By Diane Tinney, Director of Product Management, Bloomberg BNA

Since 2004, U.S. manufacturers of tangible goods have leveraged the Section 199 deduction as part of their tax strategy. Like many tax laws, however, this valuable tax break comes with a complex set of rules that businesses must heed to attain maximum benefits. In addition, conflicting court rulings, an unprecedented new IRS audit approach, and the uncertainty of potential tax reform are making compliance with Section 199 even more challenging.

Here are some key points that tax and financial executives at manufacturing companies need to know when it comes to Section 199.

Congress enacted the Domestic Production Activities Deduction (DPAD), commonly known as Section 199, to give qualified manufacturers a 3% effective tax rate reduction to encourage them to create more U.S. jobs.

Generally, manufacturers are allowed a deduction equal to the lesser of:

As an example, consider a company with a taxable income of $500,000, QPAI of $300,000, and DPGR wages of $50,000. In this case, the Section 199 deduction would be $25,000 ($300,000 × 9% = $27,000, limited by $500,000 × 50% = $25,000).

Although the deduction calculation is straightforward, calculating QPAI is challenging due to its broad definition, which can include income from products Manufactured, Produced, Grown, or Extracted (MPGE) in the U.S.

In addition, to properly capture, document, and calculate QPAI, most corporate taxpayers need to modify their accounting systems. Asset-intensive industries have the additional burden of tracking and computing the depreciation portions of Cost of Goods Sold (COGS), and any impacts to direct and indirect expenses, such as repairs.

In addition to the confusion surrounding QPAI, recent court rulings have muddied the Section 199 waters further. Despite Regs. Sec. 1.199-3(e)(2) stating that repackaging is not an MPGE activity, the courts still ruled in the favor of taxpayers in the Precision Dose and Dean (Houdini) cases. In these legal proceedings, the courts rejected the IRS’ argument that labeling or repackaging does not constitute MPGE activities.

In an unprecedented move, in February 2017, the IRS announced sweeping changes to their audit approach, creating a specific “campaign” to validate the use of a Section 199 deduction by Multichannel Video-Programming Distributors (MVPDs) and broadcasters. Although the original intent of Section 199 was to provide U.S. manufacturers of tangible goods a tax incentive, some companies, such as MVPDs, and television broadcasters (those that distribute channels and subscriptions packages) are interpreting the law to their own advantage. They assert that they are producers of film, which can be defined as a tangible good and, therefore should qualify to claim this deduction. The latest audit efforts by the IRS are an attempt to reign in questionable use of the deduction.

Ironically, all the court rulings, new audit regime, and IRS guidance may be a moot point if the Republication party gets their way. Earlier this fall, the Republican leadership released its tax reform plan, “The Unified Framework for Fixing Our Broken Tax Code.” Among the many changes proposed is a 15% corporate rate reduction (down to 20% from the current 35%) and a potential elimination of the Section 199 deduction entirely. Currently, the House and Senate tax-writing committees are busily flushing out the details and weighing costs against the needs of their constituents.

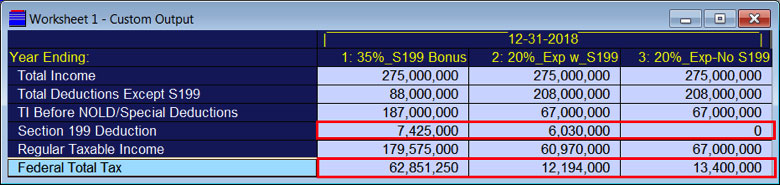

So, where does this leave manufacturers? The answer depends on the objective at hand. Manufacturers currently looking to maximize Section 199 under the current law can use the tips included in this article. For progressive manufacturers looking to plan ahead, the answer lies in strategic planning that encompasses past, current, and future tax laws. These organizations are using advanced modeling techniques to compare and contrast the use of Section 199 in various scenarios as outlined in the side bar. They can even model out the impact of potential tax reform. The result is the ability to make optimal tax strategy decisions on the fly no matter what the future holds for Section 199.

Be sure to leverage advanced modeling techniques (as shown above) to compare and contrast the use of Section 199 with or without bonus depreciation, and analyze impacts of tax reform such as the proposed reduction from a 35% to a 20% corporate tax rate.

About Diane Tinney, CPA

About Diane Tinney, CPA

Diane Tinney is the Director of Product Management for Bloomberg BNA’s software products, responsible for developing and implementing corporate tax and accounting solutions. Prior to joining Bloomberg BNA, Diane founded several startups, managed a global corporate tax product development team, and worked at a Big 4 CPA firm in State/SALT and international national tax practices.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.