Seven ways disruptive technologies are changing the manufacturing sector.

Jim Morrish, Founding Partner

Nikita Singh, Lead Analyst

Joydeep Bhattacharyya, Content Editor

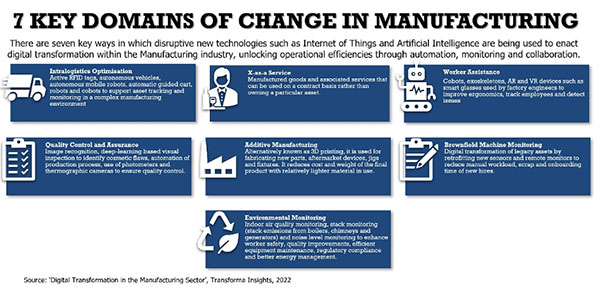

The manufacturing sector and associated fields have been through a substantial shift in recent years, and particularly through the application of some of the critical new emerging technologies, many of which have been combined under the ‘Industry 4.0’ banner. In the report titled ‘Digital Transformation in the Manufacturing Sector’, technology industry analyst firm Transforma Insights has highlighted seven significant transformations occurring in the manufacturing industry, facilitated by disruptive technologies like the Internet of Things (IoT), Human Machine Interface, and Artificial Intelligence. This article provides an analysis of each of these domains, exploring the tangible effects resulting from their implementation in real-world scenarios.

Intralogistics optimisation encompasses multiple dimensions including inventory and warehouse management, transportation optimisation, workflow optimisation, asset tracking and monitoring, and autonomous vehicles. In short, it accounts for all the logistic processes between the delivery of raw materials to the creation of the products.

Intralogistics Optimisation is further segmented into three areas: Inventory and Warehouse Management, Autonomous Vehicles and Workflow Optimisation.

Inventory and Warehouse Management refers to storage and stock keeping, starting from tracking the material in the initial phase of the production process until the final output, which allows for optimisation of the inbound supply chain. For instance, Volkswagen Group investing USD1 billion in electric mobility and digitalisation across its assembly plants in North America, with the aim to increase its productivity by 30% by 2025.

Autonomous Vehicles (vehicles that can sense their surrounding and operate without human intervention, using a combination of sensors, cameras, radars, and AI. Automated Guided Vehicles (AGVs) can reduce the necessary widths of pathways within a storage facility allowing such facilities to be up to 30% smaller. Around 9% of manufacturers used semi-autonomous or autonomous vehicles within their operations in 2018, and between 2019 and 2022, the number was expected to double. BMW Group has tested different autonomous vehicles for six months across the majority of its manufacturing facilities and estimates that AVs can reduce production costs by 5% per vehicle.

Finally, Workflow Optimisation, which includes optimising internal company processes or repeated operational tasks through automation, allowing manufacturers to keep up with the need for both personalised products and changing market demand while enhancing their manufacturing agility. For instance, • , Audi uses RFID tags which accompany each vehicle throughout their production cycle. These tags allow for easy access to vehicle information.

Servitisation or X-as-a-Service refers to the provision of assets that have traditionally been sold in return for a single upfront fee instead of being offered as a service in return for an ongoing revenue stream. Servitisation can be applied to many manufactured goods and associated services, ranging from cars and printers at the consumer end of the market to large-scale wind turbines and heavy mining equipment. The concept is particularly applicable to high-value equipment with relatively light usage (such as sophisticated medical equipment).

X-as-a-Service relieves end-users from owning and maintaining a hardware asset, saving them from capital purchase, and opening new markets for asset vendors. They also establish new ongoing relationships between equipment vendors and equipment users, provide equipment vendors with better insights into customer usage and better position them for up-sell opportunities. These solutions better enable field servicing and adherence to maintenance schedules, end-user compliance with device operating parameters and guidelines, and feedback.

A prime example of this approach is Rolls Royce’s CorporateCare Enhanced service for its Pearl 15 jet engine is a cost-per-flight-hour service which includes scheduled maintenance, unscheduled maintenance, nacelle repair and maintenance, and engine health monitoring, loaner engines during maintenance shop visits, and engine spare parts.

Collaborative robots, or cobots, are assisting devices that help workers in reducing their workload, minimising errors, and automating repetitive tasks, resulting in increased efficiency. The manufacturing sector uses collaborative robots to address challenges such as rising labour shortages, repetitive task environments, and jobs that require fast-paced work.

Cobots accounted for 3% of all industrial robot sales in 2017 and are expected to increase to 34% by 2025. They are particularly used in the automotive sector. For instance, Kay Manufacturing uses cobots for visual inspection of automotive parts and its rotating arm allows an attached camera to spot any defects. Hyundai uses exoskeletons, worn by industrial workers, that provide much-enhanced endurance and strength while working in the manufacturing facility. Ford uses cobots to help lift heavy car parts, thereby protecting the health of their employees and increasing production efficiency.

Historically, manufacturing companies employed trained quality assurance specialists to verify the integrity of finished goods, but rising IoT and Industry 4.0 initiatives, automated QC and QA solutions are increasingly used in a manufacturing context. Manufacturing companies are now using digitally transformed quality control and quality assurance solutions to enhance business efficiency through real-time monitoring, process automation, and data analytics.

For instance, BMW uses automated image recognition for quality checks and inspections, and to eliminate pseudo-defects, while Airbus introduced an automated, drone-based aircraft inspection system that accelerates and facilitates visual inspections. Shelton, an automotive fabric producer deployed a surface inspection system called ‘Web Spector’ and increased its capacity by undertaking inspections in a tenth of the time required by humans, increasing throughput per person in the packing department by 50%, lower error rates, and save millions of pounds (sterling) per year in customer claims.

Additive Manufacturing (often used interchangeably with 3D printing) is used to fabricate a three-dimensional object by adding layer-upon-layer of material and fusing them together. AM can reduce cost, the quantity of raw materials used, the weight of the products, and increase productivity. For example, Boeing used 3D printing to create structural titanium parts and saved approximately USD2-3 million in titanium cost per plane.

Lamborghini uses AM for prototyping and tooling, Bugatti pursues hybrid functional assembly based on 3D printed hollow parts and other car parts, Porsche uses the 3D printing process to manufacture individual parts for classic cars, and Audi has developed spare-part and serial part production using AM30.

The most significant usage of AM lies in the aerospace and defence industry. For instance, more than 70,000 3D-printed production parts have been launched through Boeing’s commercial and defence programs. In 2018, Boeing fabricated over 7,500 tools using additive techniques and as of Q4 2019, the firm had already exceeded 14,000 tools.

Brownfield machine monitoring refers to the monitoring of existing (legacy) equipment. Since many manufacturers do not want to modify existing, well-functioning legacy assets to deploy new technology-based solutions, brownfield machine monitoring can enhance such assets by implementing new sensors on old machines. Some of the sensors and monitors Brownfield Machine Monitoring systems use are audio sensors, vibration sensors, optical sensors, plug-in electricity monitors, and remote valve monitors.

According to the US Bureau of Economic Analysis, the average age of industrial assets in the United States was about 23 years in 2015. Examples of brownfield monitoring deployments include Siemens Guadalajara deployment of MindSphere to create a dashboard to monitor the consumption of energy resources like electricity and gas in real-time, and consequently improved its efficiency by 20% and performance maintenance by 5%. In another case, Sugar Creek Brewing Company, USA, retrofitted its bottling line with IIoT technology to reduce revenue loss of USD30,000 a month (from the foam created by uncontrolled beer movement), and in 2019 alone, the firm saved USD120,000.

In the manufacturing sector, environment monitoring ensures that the environment in a manufacturing premises is pollutant-free and safe for workers. It includes indoor air quality monitoring, stack monitoring (stack emissions from boilers, chimneys, and generators) and noise level monitoring. Other benefits of such solutions are enhanced worker safety, product quality improvements, more efficient equipment maintenance, regulatory compliance, and better energy management.

According to the International Labour Organization, work-related illnesses and diseases result in USD3 trillion of global economic losses each year. The US Bureau of Labor Statistics claims that in 2019, the country had 421,400 non-fatal injuries and illnesses, with direct expenses of up to USD35,000 and indirect costs of around USD150,000 for each accident.

Examples of deployments involving environment monitoring include Masan Group’s deployment of a deodorant system from Oizom at its Vietnam food processing facility, which has eliminated the need for manual check-ups at every interval, further helping the company by saving employees’ time, effort, and manpower. In another example, Upplands Motor Stockholm AB deployed AQMesh pods to compare air quality outside and inside the showroom, and its indoor unit showed elevated levels of NO and CO, compared to the outside unit.

About the report

The report ‘Digital Transformation in the Manufacturing Sector’ examines digital transformation in the Manufacturing sector as enabled by the key technology groups that are the focus of Transforma Insights’ research. These technology groups include: 3D Printing & Additive Manufacturing, Artificial Intelligence, Autonomous Robotic Systems, Edge Computing, Human Machine Interface, Internet of Things (IoT), and Product Lifecycle Management.

Accordingly, the aim of this document is not to chart the future direction of the manufacturing industry, but to highlight key areas of change enabled by new and emerging technologies. The bulk of the report is concerned with discussion of these key areas of change, including an overview of each area, together with analysis of the business impact, and the complexity, timings and risk associated with each area. We also identify key enabling technologies for each area (from the list above) and provide summary details of illustrative case studies that are available in Transforma Insights Best Practice & Vendor Selection database.

The purpose of the report is two-fold. Firstly, from the perspective of a practitioner in the manufacturing industry, the document highlights new and emerging aspects of change that can be expected to impact the industry in the next few years. Secondly, from the perspective of potential vendors to the manufacturing industry, it highlights key emerging areas of opportunity to sell new products, services, and solutions to the manufacturing industry. Our analysis of the key technologies that enable each of the identified areas of digital transformation will help vendors of horizontal (technology-specific) capabilities to identify the contexts in which they may be able to secure new business from the Manufacturing sector.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.