Volume 22 | Issue 3

Click here to read the complete illustrated article as originally published or continue below to read the text article.

A famous legend describes an emperor who asked an inventor to name his reward for bringing an innovation to the kingdom. The keen inventor asked the emperor for payment in the humble grain of rice, paying the inventor with the results from taking a single grain of rice that would be doubled on each square over a 64-square chessboard. In the end, the final squares had exponential mountains of rice. Today’s velocity of technology advancement, especially for the manufacturing industry, is no different—it’s exponential.

Take this analogy of a chessboard and apply it to how quickly the industry needs to absorb the technology that continues to proliferate. The squares on the chessboard can be timed to the beginning of the technology revolution, using Moore’s Law as a measuring stick. It means that, if we start calculating from 1965 when Moore’s Law was created, in 2019 we are in the “second half of the chessboard”, with advancements in technology coming at an unprecedented pace. In such a scenario, manufacturers need to be smart not only in what technologies they choose to adopt, but how to use them to drive innovations within their companies and in their products and offerings. How can they achieve this?

Innovation is a multifaceted topic, and a versatile one at that. Larry Keeley, an innovation strategist at Deloitte Doblin, defines innovation simply as “the creation of a viable new offering.” It can mean many things—it can be directed toward meeting a customer need; it should sustain itself and return value to the company; it is new to a market or industry; and it should extend beyond products to ways of doing business and even new forms of engagement with customers. It takes a nuanced approach to understand what innovation—with all its complexities—exactly means in the industrial manufacturing industry.

The complexities of designing, producing, and delivering products to market in industrial manufacturing gives rise to two areas of innovation that we recently explored through a scan of data from filings and citations from the US Patent and Trademark Office (USPTO). Our scan of patents registered between 2006 and 2017 for a representative group of 43 Fortune 100 industrial companies identified that manufacturers are making innovations both for the products they sell to customers, but also for the processes used to manufacture those products. In fact, process-based patents were 43 percent more frequent than product-focused patents in 2018. This makes sense, as asset-intensive industrial companies have long focused on reducing operating costs through greater efficiencies and process improvements.

Next, we identified patterns within this subset of the US patent space that are related to the linkage of what we identify as exponential technologies (see sidebar for list). Deloitte has been tracking the adoption of these 13 technologies in manufacturing for several years.

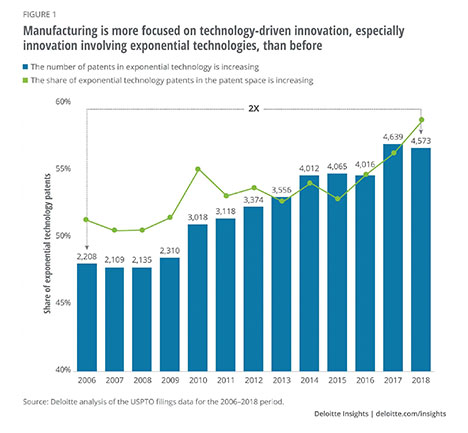

Our scan of the US patent universe for industrial manufacturers reveals that patents in exponential technologies have consistently represented the majority share of overall patents filed. In fact, during 2006–2017, such patents almost doubled and their concentration within the overall patent space also increased (figure 1). This is especially true in the past four years, as industrial manufacturers have applied these technologies along their digital maturity journey. Indeed, combining several advanced technologies has been an approach that many manufacturers are taking, and our patent data scan validates this trend.

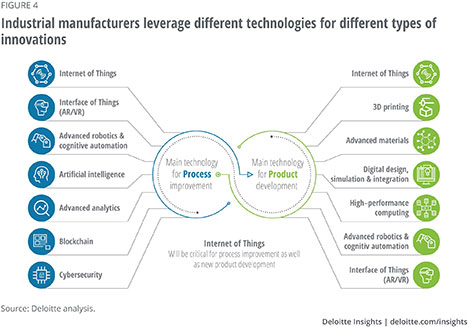

It should come as no surprise that the biggest concentration of activity centers around IoT. Enterprise-level IoT implementations have the capability to optimize almost any processes and controls across production and operations – or to become part of the products themselves. Realizing this, manufacturers are developing IoT solutions combining other technologies to exploit their full benefits. This holds especially true when you think of the role that IoT plays in integrating devices and machines with data analytics to surface actionable insights. IoT emerges as the center of exponential technology concentration and is likely to be a pivotal element in creating both connected products and connected processes.

What’s interesting to note is the different combinations of these exponential technologies for product vs. process-led innovations. In Figure 2, you can see that Interface of Things, advanced robotics and cognitive automation, artificial intelligence, and advanced analytics are the focus areas – as a higher number of patents are granted in these technologies. (Note: Interface of things includes virtual reality, augmented reality, mixed reality, wearables, and gesture recognition technology.)

These innovations have likely helped industrial manufacturers stimulate their digital twin of the factory efforts, backed with high-end analysis and automation. Even blockchain- and cybersecurity- related patents are more prevalent for process innovation, highlighting the trend toward making operations more robust and secure.

On the product development side, industrial manufacturers are applying technologies such as 3D printing, advanced materials, digital design, simulation and integration, and high-performance computing. Some of the primary process technologies (advanced robotics and cognitive automation and Interface of Things, etc.) do not appear prominently in product development. This could change as R&D teams share process-related innovations with product designers, leading to the development of new products and services that satisfy unmet customer needs and experiences.

As industrial manufacturers continue to adopt the technologies of the fourth industrial revolution, there are several actions to consider based on the insights from this study. Start by evaluating the concentration of patent activity in your organization related to exponential technologies. Is it greater than 50 percent? The share of exponential technologies in the US patent space seems to be increasing for industrial companies (59 percent in 2018), signaling the continued adoption of digital to transform business.

Another activity would be to explore the division of patent-driven research at your organization that is focused toward product innovation versus process innovation. Our study showed an increasing gap between the patents related to process innovations and products (43 percent in 2018). Are you linking process innovations with product development? This is expected to be increasingly important as industrial companies advance along the digital maturity curve. Performing an evaluation of your R&D efforts as they relate to patent filings could uncover some new ways to approach innovation.

Editor’s note: This article is an excerpt summary of Deloitte’s report series, “Tracing innovation through exponential technologies: Lessons from the US industrial patent data” To read the full report series, visit www2.deloitte.com/insights.

Paul Wellener

PAUL WELLENER

Paul is a vice chairman, Deloitte LLP, and the leader of the US Industrial Products & Construction practice with Deloitte Consulting LLP. He has over 30 years’ experience in the industrial products and automotive sectors and has focused on helping organizations address major transformations —globalization, exponential technologies, the skills gap, and the evolution of Industry 4.0. He is based in Cleveland, Ohio.

JOE ZALE

JOE ZALE

Joe is a principal, Deloitte LLP, and a Marketplace lead in the US Industrial Products & Construction practice with Deloitte Consulting LLP. He also leads the Strategy & Analytics and Strategy, Transformation & Innovation efforts in the practice’s Energy, Resources & Industrials segment. Joe has worked with clients across a variety of industries, including automotive, consumer and industrial products, medical products, and pharmaceuticals. He is based in Stamford, Connecticut.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.