Taxpaying property owners can unlock cash flows sooner through cost segregation studies, an overlooked tool within real estate accounting.

In today’s volatile market, many property owners are wishing they’d known about cost segregation sooner. It’s a useful tool that should be considered whenever an individual or company purchases, constructs, expands or renovates any type of real estate property, from manufacturing warehouses to shopping malls. If you have a trusted advisory partner that can perform these studies effectively, they can help you get the most value out of your property as a taxpayer.

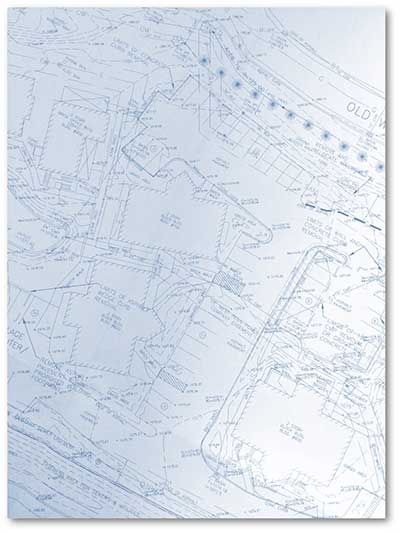

Cost segregation studies help property owners and general taxpayers to “identify portions of real property that are separate tangible personal properties subject to shorter depreciable recovery periods,” according to the IRS. In simpler terms, cost segregation studies are the best way to reduce your taxable income and increase cash flows by identifying components of a project that are eligible for faster tax depreciation. It separates your property into individual components instead of a singular unit and identifies what areas of a project are eligible for faster depreciation such as HVAC systems, roofing, plumbing, etc.

Here are three pieces of advice for those who are on the fence about utilizing a cost segregation study, or who may not know where to begin.

Choose a partner with an engineering background. Cost segregation is more of an engineering function than an accounting function, and this is proving to be true as the pool of companies offering cost segregation services has become more saturated. The IRS is starting to weigh the validity of firms that utilize an engineering approach over those that take an accounting approach, as it takes true engineering knowledge of building components to segregate the asset correctly.

A firm may claim to abide by IRS guidelines, but it takes specialized experience to accurately understand this. Any study done without this substantial background knowledge could potentially be thrown out or leave money on the table.

It’s not too late to claim your money. If you have constructed or purchased a facility in the past ten years and have not performed a cost segregation study yet, you can still reap the benefits today. “Look back” cost segregation studies can recapture these tax depreciations from previous years, without the need to dig up prior tax returns.

It is most beneficial to have a study done at the time of the purchase, build or remodeling, though, as larger projects can lead to additional tax benefits. The IRS also suggests that all properties that change ownership should have a new study done, even if one was recently completed.

Cost segregation is a powerful tool in reducing taxes and producing additional cash flow in the early years of property ownership. It is an even more powerful tool when taking into account bonus depreciation, which is being phased out slowly over the next four years. Some properties qualify for bonus depreciation, which is an additional five-year depreciation and allows these property owners to deduct a specified percentage (usually 30%, 50% or 100%) in the same year the property is placed in service, according to the IRS. Customers should take advantage of this extra benefit on top of cost segregation while it is still around, as beginning this year it will start to see a 20% reduction.

As we continue to navigate a world where our economy has blanketed us with a seemingly permanent sense of uncertainty, it’s not only useful but in some cases imperative, to understand the value of cost segregation studies. The benefits of these studies can reduce operating costs for your property, leading to more efficiency with property management.

Bottom line — if you are thinking about utilizing a cost segregation study, make sure to find a partner you trust, with significant experience carrying out these practices. The rewards may be even greater than you think.

Antonio Fratangelo currently serves as principal at HPM, helping to lead the firm’s audit & contract services division. He has spent his entire 22-year career specializing in project management, engineering, auditing and consulting roles in the construction industry.

From tradition to transformation Sequoia Brass & Copper has stood for excellence in American manufacturing. In this episode, we sit down with Kim MacFarlane, President of Sequoia Brass & Copper, to hear the inspiring story of a family-owned company founded by her father, built on craftsmanship, trust, and a relentless commitment to quality. Kim shares how she’s guided the company through the challenges of modern industry while honoring its heritage, and how the next chapter will be carried forward by her son Kyle. This is more than a story of brass and copper; it’s about resilience, innovation, and the enduring strength of family legacy. If you’ve ever wondered how tradition can meet the demands of today’s industry hit play and be inspired.