Global supply chains were left to count the cost of a post-pandemic inventory glut at the start of 2023, according to data from Tradeshift.

Global retail supply chains were left to count the cost of a post-pandemic inventory glut at the start of 2023, according to the latest Index of Global Trade Health from Tradeshift. Trade activity across the sector dropped 12 points below the expected range in Q1, a two-year low. Demand for transport and logistics capacity also remained low, at 9 points below the baseline, amid signs of a broader economic slowdown.

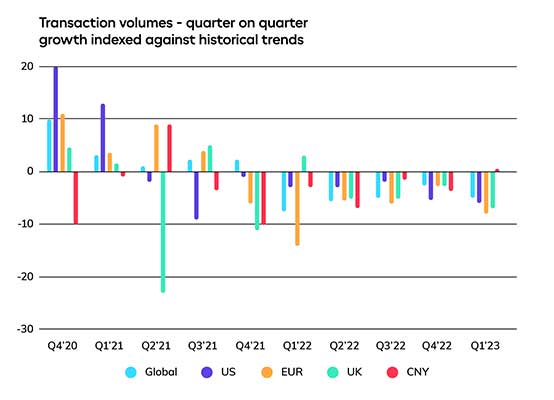

Global slowdown hits supplier cash flow: Total transaction volumes across all sectors fell to 5 points below the expected range, marking the fifth consecutive quarter that global trade activity has remained in contraction territory. New invoices from suppliers fell sharply in Q1 off the back of a steep decline in order volumes over the previous two quarters.

“Large buyers are coming out of a nasty bullwhip cycle”, said Christian Lanng, CEO at Tradeshift. “We’ve seen orders fall consistently over the past six months as organizations attempt to rebalance inventory levels. Order volumes picked up momentum in Q1, but in the short term, we’ll see a liquidity gap opening up that will hit supplier cash reserves. With the cost of borrowing rising, businesses are looking at ways to monetize new orders and turn them into cash faster. We’ve seen a spike in demand for services such as invoice financing.”

Brighter outlook for the US: US trade activity mirrored the global pattern. Transaction volumes tracked 6 points below the expected range, primarily due to a steep decline in supplier invoices. A solid recovery in ordering activity during the quarter hinted at a brighter outlook in the months ahead. Order volumes in the US finished Q1 at a year high.

China’s factories spring into action: Transaction volumes in China climbed back into the expected range in Q1 for the first time in 21 months following December’s lifting of strict Covid prevention measures. However, supply chain operators will be nervous about the broader global slowdown. Furthermore, China’s dominance of global manufacturing supply chains also faces erosion from accelerating diversification efforts among Western companies. Tradeshift’s latest Index shows trade activity in Vietnam rising five times faster than the global average over the past year. Activity levels in Mexico rose six times faster than the worldwide average during the same period.

Eurozone and UK get a reality check: After a strong Q4, trade activity across the Eurozone fell again in Q1, dropping to 8 points below the expected range. Supply chains across the UK also had a more challenging start to 2023. Transaction volumes dipped to 7 points below the expected level. UK trade activity could also face a tough six months ahead, with order volume growth crashing to 10 points below the baseline in Q1.

“The UK is attempting to implement supply chain reconfiguration at massive scale, but they’re doing this on top of processes and infrastructure that simply aren’t built for change,” said Lanng. “As businesses evaluate their reconfiguration strategies, they would do well to look at the systems and processes they have in place to identify, vet and onboard new suppliers. Procurement teams using 20th-century models and technologies will struggle to deliver the ingredients businesses need to remain agile.”

About Tradeshift’s Index of Global Trade Health

Tradeshift’s Index of Global Trade Health analyses business-to-business transaction volumes (orders processed from buyers and invoices processed from suppliers) submitted via the Tradeshift platform to offer a perspective of how external events may be impacting business-to-business commerce in a variety of different regions and sectors across the globe.

About Tradeshift

Tradeshift is the cloud-based business commerce platform that transforms the way B2B buyers and sellers connect, transact and trade. We’re a leader in e-invoicing and AP automation, offering tools for compliant e-invoicing in 50+ countries, including China. We’re also an innovator in B2B marketplaces and embedded fintech services that bring value, opportunity and growth to any business that joins the network. Tradeshift’s vision is to connect every company in the world, creating economic opportunity for all. Today, the Tradeshift platform is home to a rapidly growing community of buyers and sellers operating in more than 190 countries. Find out more at: www.Tradeshift.com

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.