Q3 is expected to see a boost in deal-activity with supply chain challenges and geopolitical and regulatory shifts as key factors.

With Covid-19 and the economic uncertainty following it, businesses faced a significant dip in earnings due to delays in supply chain. The interruptions resulted from the closure of factories and borders, coupled with labor shortages across the globe. Post-pandemic, the economy continues to recover from the downturn. Besides the supply-chain issues, businesses are coping with inflation, higher interest rates and volatile capital markets. These factors initially slowed down dealmaking globally, but the M&A market seems to be picking up. Recently, Norton Rose Fulbright collaborated with Mergermarket to survey executives from market players across the globe, focusing on the current trends in the M&A market and what the future holds. The report titled “Global M&A Trends and Risks” covers the insights from the survey.

More companies are revamping their operations to effectively withstand supply chain disruptions, as discussed in this Industry Today article. To have more control over their production and service chain, companies are motivated to acquire suppliers in different stages of their production. This type of vertical integration, which is becoming more common, minimizes the need for third-party providers and the risk of supply disruptions. As discussed in the Global M&A Trends and Risks report, it is a significant driver of current M&A activity worldwide.

Businesses are digitizing their products and services. The pursuit to invest in emerging technologies and digitally transform business operations is driving deal flow in different sectors, including in the logistics and supply chain areas.

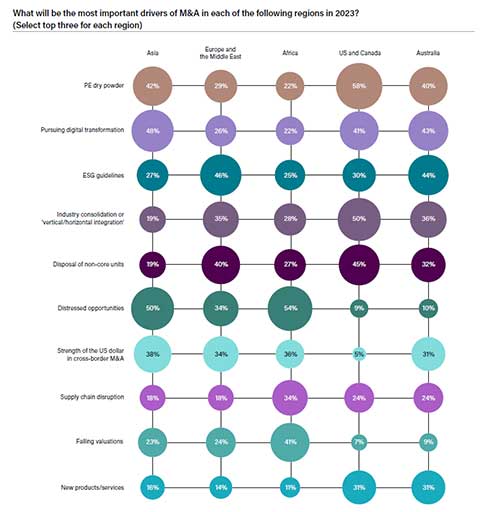

Businesses are also becoming cognizant of their compliance with environmental, social, and corporate governance (ESG). With its growing influence in M&A decisions, ESG remains a major driving force for the market, particularly in Australia, Europe, and Middle East. The Global M&A Trends and Risks report notes that about 44 percent of respondents (for Australia) and 46 percent (Europe and the Middle East) identified ESG as the single most important factor driving M&A in those regions.

While businesses are addressing their operational shortcomings through acquisitions and digital transformation, financial buyers are similarly seeking opportunities to secure businesses with reliable logistics and supply processes. While the market continues to be fragile, it has seen private equity buyers strengthening their portfolio in these sectors.

For companies that do not forecast vertical integration or digital transformation anytime soon, onshoring has become a feasible way to restore certainty in their supply chain. These companies are engaging domestic suppliers and distributors to avoid the current uncertainty with outsourcing.

Due to the current trade barriers and protectionist measures involving some of the biggest economies, operational costs have increased, and business margins have lowered. Buyers are hesitant to pursue acquisitions of companies affected by these measures.

Besides the trade barriers, the Russia-Ukraine war and the world-wide retaliatory measures have added to the trade barriers. They have further heightened the risk to supply chains and stifled cross-border M&A, especially in Europe. There are also local political risks to dealmaking that loom in certain regions. Approximately 64 percent respondents in the Global M&A Trends and Risks report note that these risks are the biggest hurdle to M&A activity in Asia and Africa for 2023.

It comes as no surprise that the higher interest rates have raised borrowing costs. It has made things difficult for businesses looking for acquisitions, including those pursuing vertical acquisitions. Overall, the pace of the M&A landscape in most markets has slowed down. In stark contrast, respondents have experienced financing becoming somewhat easier in Asia. About 60% respondents have this prediction, as per the Global M&A Trends and Risks report.

Despite the hurdles, financial sponsors are helping keep the M&A market buoyant, deploying their post-pandemic, unallocated capital in strategic investment. 89 percent of the respondents to the Global M&A Trends and Risks report survey noted using cash reserves to finance deals globally. For US and Canada, the prevalence of private equity dry powder came out as the most important factor driving M&A.

For the foreseeable future, companies will be tapping into acquisitions to build or grow supply chain network. While it will take time for the M&A market to see movement at a level that we are familiar with, dealmakers are optimistic for a more stable geopolitical environment, which will be promising for the overall M&A market.

About the Author:

Aara Tomar provides corporate advice to business owners and entities in mergers and acquisitions and private equity transactions.

Ayşe Yüksel Mahfoud is Norton Rose Fulbright’s Global Head of Corporate, M&A and Securities.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.