New tax reforms reshape U.S. manufacturing strategy, unlocking investment and innovation opportunities.

By Derek Burgess

H.R. 1 introduces sweeping tax reforms poised to reshape U.S. manufacturing. With pro-growth provisions now in effect, the legislation is expected to drive long-term industry transformation.

The bill cements a suite of pro-manufacturing tax reforms that industry leaders have long championed, including:

While these provisions are designed to supercharge investment, innovation, and global competitiveness, there are some significant impacts across other areas. Clean energy manufacturing will be impacted by certain policy rollbacks on advanced manufacturing credits, clean electricity (particularly for wind and solar), hydrogen, and EV originally provided under the Inflation Reduction Act (IRA) of 2022.

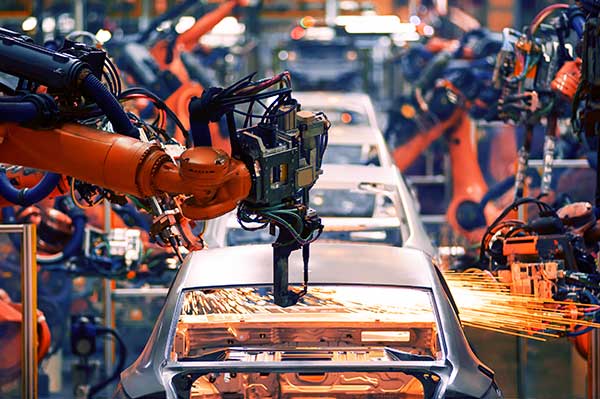

Manufacturers can now fully deduct the cost of eligible equipment, machinery, and construction of new facilities in the first year. This change improves cash flow—especially beneficial for capital-intensive sectors such as automotive, aerospace, and heavy industry. The immediate deduction of costs associated with capital equipment purchases is a game changer, potentially boosting investment capacity. The newly introduced production property rule provides full expensing for U.S. nonresidential real property used as an integral part of qualified production activity.

Furthermore, by extending 100% bonus depreciation originally enacted through the Tax Cuts and Jobs Act, the bill aims to encourage manufacturers to invest in the tools necessary for enhancing productivity, which is expected to boost the competitiveness of U.S. manufacturers and impact crucial decisions on where to establish operations.

Another pivotal aspect of the bill is the restoration of immediate U.S. R&D expensing, which is expected to reignite innovation, particularly in high-cost sectors such as pharmaceuticals, aerospace, automotive, and technology. Previously, these costs had to be amortized over five years. This reinstatement is crucial for fueling U.S. innovation, as it improves first-year cash flow and increases after-tax returns on investment—key factors influencing when and where companies decide to invest.

Interest deductions are currently limited to earnings before interest and taxes, which is less favorable for capital-intensive industries. H.R. 1 restores the more favorable EBITDA standard, allowing deductions before depreciation and amortization. This can broaden access to financing and potentially strengthen the business case for new construction projects. However, the law also introduces certain adjustments that could offset some of these benefits, making it important for companies to evaluate the net impact. For manufacturers pursuing automation or expansion projects financed with debt, the revised rules may significantly improve the financial viability of those initiatives.

As manufacturers delve into the complexities of the nearly 900-page bill, they are addressing questions about specific tax provisions, effective dates, and the phase-in and phase-out timelines. Supply chain resilience remains a high priority for manufacturers, and the international tax changes make evaluation especially critical. Given the intricacies involved, companies should consider modeling a range of scenarios to improve cash flow and enhance tax efficiency. This approach should help them navigate the new landscape more effectively, as well as support better outcomes for their organizations.

The passing of H.R. 1 has sparked optimism among manufacturers, opening new pathways for growth and strategic alignment. Companies looking to execute mergers and acquisitions should develop a clear narrative around how they plan to leverage these tax incentives to drive future growth. Executives should evaluate their own readiness for acquisition by assessing their financial health and operational capabilities to capitalize on the opportunities presented by the new legislation. This includes conducting thorough due diligence to identify potential synergies with target companies, particularly in areas where tax incentives can enhance profitability.

Moreover, companies should consider how these tax changes might affect their valuation and the overall landscape of potential acquisitions. The ability to immediately expense capital investments and R&D costs can significantly enhance cash flow, making firms more attractive to investors.

H.R. 1 has created much-needed certainty for manufacturers, which has been a barrier to making substantial investments in U.S. facilities. Analysis from Ernst & Young LLP (EY US) for the National Association of Manufacturers projected that failure to extend these provisions could have resulted in 5.9 million lost jobs, $540 billion in lost wages, and a $1.1 trillion GDP reduction.

With many tax provisions set to expire, the clarity provided by the bill will enable manufacturers to make informed decisions about where to invest and what to invest in. Yet uncertainty remains for some sectors. Several clean energy investments are scaled back, and automotive commitments in battery production that rely on stable tax incentives may be affected. The early repeal of the demand-side tax credits for wind and solar is a negative signal to invest in the manufacturing of equipment and components for these sectors. Clean-tech investment has surged in the U.S. following the passage of the IRA—momentum now facing uncertainty under the new law.

While there are trade-offs, the overall outlook is one of momentum and opportunity, encouraging companies to present a clear narrative around leveraging these tax incentives for future growth.

At the same time, congressional leaders are preparing a second reconciliation bill—potentially a sequel to H.R. 1. A new working group, led by the House Republican Study Committee, is exploring additional tax and health provisions that didn’t make it into the first package. These could include technical corrections, tax extenders such as the Work Opportunity Tax Credit, and retirement-related measures.

For manufacturers, this signals that the policy landscape remains in motion. Now is the time for continued advocacy around what didn’t make it into H.R. 1. Strategic planning should account for not only what’s in H.R. 1 but also what might be coming next.

About the Author:

Derek Burgess is a tax partner with Ernst & Young LLP, as well as the EY Global and Americas Tax Industry Leader for Industrials & Energy and the EY Americas Tax Sector Leader for Aerospace, Defense & Mobility. In his client service roles, he supports multinational companies in global transactions, transformations, business strategy, and large international planning projects, including restructurings, supply chain management, and OECD BEPS initiatives. Derek serves as the Tax Account Leader on some of the organization’s largest and most complex clients. Derek has a BBA in Accounting and Master in Taxation from Grand Valley State University. He is also a CPA in Michigan, member of the American Institute of CPAs and member of the Michigan Association of CPAs.

The views reflected in this article are the views of the author and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.