Volume 28 | Issue 3

Click here to read the complete illustrated article or continue below to read the text article.

By: Harry Moser, Founder/President, Reshoring Initiative® and Kathy Nunnally, President Regions Recruiting®

Reindustrializing America is impossible without reshoring, foreign direct investment (FDI), and strong industrial policy. The Reshoring Initiative’s 2024 Annual Report reveals tremendous progress with 2024 job announcements totaling 244,000. The cumulative job announcements are over 2 million since 2010, highlighting a long-term trend toward domestic production. The 2025 outlook is potentially strong but dependent upon a stable industrial policy.

Tariff uncertainty and workforce deficiency threaten U.S. manufacturing. The recent findings from the 2025 USA Reshoring Survey, a collaboration between the Reshoring Initiative® and Regions Recruiting®, underscore a compelling truth: the skilled labor shortage is a significant barrier to foreign direct investment (FDI) and reshoring efforts. Evidence suggests that factory startup and expansion projects in the U.S. have experienced delays because of difficulties in finding skilled workers.

We encourage the Administration to utilize our data and insights to refine policies and measure their effectiveness.

Reshoring data from the Annual Report show company actions under real conditions; the survey insights reveal motivations and potential impacts across scenarios.

Based on the findings from these reports the fundamental building blocks needed for U.S. reindustrialization are: a larger, more highly skilled workforce, the use of Total Cost of Ownership (TCO) when comparing domestic to offshore sourcing, lower costs, and preparation for geopolitical risk. These are the economic essentials needed for American reindustrialization.

Let’s chart the course.

The momentum to bring manufacturing back to U.S. shores is strong. Yet, as companies commit to domestic production, a critical challenge often emerges: obtaining a skilled workforce. This isn’t merely a hurdle; it’s the bedrock upon which the success of reshoring efforts will ultimately be built.

The survey findings reveal that a highly skilled workforce is the number one enabler for companies considering reshoring. Conversely, a lack of skilled labor is a persistent deterrent.

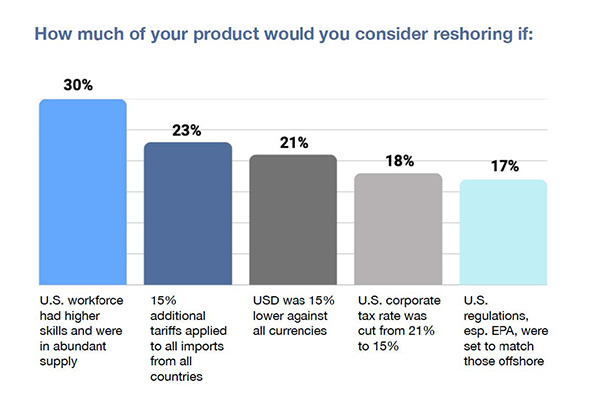

Given the resource of a skilled U.S. workforce in abundant supply, OEMs said they would reshore 30% of their products currently offshored. If 15% tariffs were applied to all imports from all countries, OEMs said they would bring back 23% of what they currently offshore. This was followed by a 15% reduction of the USD (21%), corporate tax rate cuts from 21% to 15% (18%), and U.S. regulations set to match those offshore (17%). Figure 1.

This creates a clear imperative: robust workforce development must be integrated into every reshoring strategy from inception.

Reshoring will require establishing advanced manufacturing operations that demand a workforce adept in the best production techniques of their industry, but also automation, robotics, data analytics, and other Industry 4.0 technologies. For site selectors, this translates into a sharpened focus on several key workforce-related considerations:

When companies dig into the numbers — total cost, not just price — they often realize they’re paying more than they think to stay offshore. Manufacturers often see reshoring savings in unexpected places like inventory, an average drop of 60–70% — and in one Illinois case, 94%. Reduced lead times enable companies to better align production with actual demand for lower inventory levels, less overproduction or stock-outs.

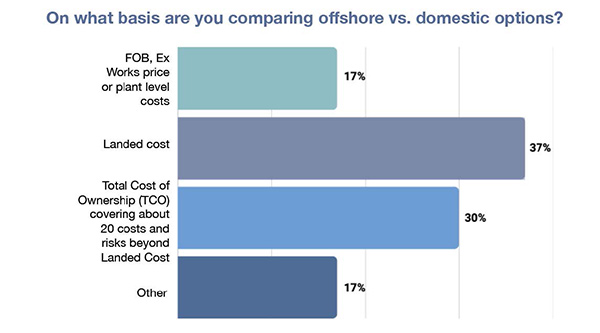

But only 30% of OEMs use Total Cost of Ownership (TCO) in comparing domestic to offshore sourcing. Seventeen percent continue to use Ex-Works or plant level costing, and 37% use Landed Cost. Seventeen percent use some other form of costing for their purchases. Frequently these methods result in a 20 to 30 percent miscalculation of actual offshoring costs. Figure 2.

Our TCO user data shows that shifting virtually all OEMs to a robust TCO system could reshore $200B of manufacturing with no government subsidies, no supply chain shock, no tariffs, no retaliation and no impact on inflation after factoring in all global risks and costs.

The Reshoring Initiative’s Total Cost of Ownership (TCO) Estimator is a free online tool that helps companies account for all relevant factors — overhead, balance sheet, risks, corporate strategy and other external and internal business considerations — to determine the true total cost of ownership.

The control and reliability derived from localization are becoming more valuable than the traditional focus on low-cost. Having engineering near manufacturing resulted in one of the highest-rated benefits of the survey. The top three reasons given to reshore were locating manufacturing near engineering (45%), the benefit of reduced freight and duty costs (45%), and avoiding geopolitical risk (38%).

Forty percent of OEMs were willing to pay 10% to 20% more for 5 weeks faster delivery. By working with domestic suppliers, manufacturers can receive inputs faster, minimizing downtime and accelerating the manufacturing process. Typical delivery time by surface freight from inland China/Asia to the Midwest is about 6 weeks. Other key takeaways and details on the 2025 Reshoring Survey results are available in the full Report.

The Reshoring Initiative 2024 Annual Report shows immense progress, but the U.S. must address workforce shortages, manufacturing cost disadvantages, and policy uncertainty to maintain this momentum.

1Q2025 data projected a potential drop to 174,000 announced jobs for the year. But as the tariffs started to firm and the economy stayed steady in 2Q2025, the projection jumped to 223,000. That figure could climb rapidly if firms gain full confidence in the permanence of new tariff and industrial policies.

Many large and substantial tentative announcements are contingent on clearer signals from the administration. The Reshoring Initiative is tracking 20-30 major billion to $10 billion announcements in a variety of industries. But when you read between the lines you learn that many companies are going to move forward only when it’s clear that the tariffs will last for an extended period of time. Manufacturers are vulnerable to policy shifts because facility investments require years of planning with investments that are difficult to reverse.

Recent disappointing jobs data and anecdotal evidence from the Federal Reserve’s recent ‘beige book’ report concur with Reshoring Initiative findings. The report, a qualitative assessment of economic conditions across twelve Federal Reserve Districts said, “Looking ahead, many contacts expected to postpone major hiring and layoff decisions until uncertainty diminished.”

Likewise, a report released in August 2025 from the Joint Economic Committee Minority warned that tariff uncertainty could derail U.S. manufacturing investment by as much as $490 billion by 2029.

The best way to promote more reshoring and protect the U.S. from increasing geopolitical risks is to implement a true national industrial policy. Such a policy should focus on leveling the cost playing field through comprehensive actions, including massive skilled workforce investments, a 20% lower USD, encouragement of the use of the total cost of ownership (TCO) metrics and the retention of immediate expensing of capital investments which the Big Beautiful Bill has accomplished.

If tariffs are used, they must be comprehensive: applied to all countries to avoid loopholes like transshipment for tariff avoidance. The Reshoring Initiative would prefer to see a more modest 10 to 15 percent tariff instituted on a long-term, e.g. 10 year basis, so that companies feel confident making investments. Instead of the complex and impermanent tariffs, we rec ommend a Value-Added Tax (VAT).

The growing demand for skilled labor remains a major constraint to scaling reindustrialization efforts. More automation, immigration of skilled workers, and recruitment and training of high school graduates will be necessary to increase output, improve competitiveness and fill the current skills gap.

The root cause of offshoring and the key barrier to reshoring, is that U.S. manufacturing cost is, on average, 10 to 50% higher than in almost all competitor countries. That price difference drives 80 to 90% of import decisions. A targeted revaluation of the U.S. dollar would improve cost competitiveness and drive both reshoring and more exports. More suggestions are available in our Competitiveness Toolkit.

We encourage companies to implement the top priorities for reindustrialization revealed by the survey — build a strong talent pipeline, use total cost of ownership, and prepare for geopolitical risk. Have you reshored a metal component or product? Apply here for the National Metalworking Reshoring Award today. Awards will be presented at FABTECH 2025 and IMTS 2026.

Click here to access the full list of Reshoring resources offered by the Reshoring Initiative. To report your reshoring successes or to get help with reshoring, contact Harry Moser, Founder and President, Reshoring Initiative, 847-867-1144.

For expert guidance and support with talent strategies to advance your business, contact Kathy Nunnally, President of Regions Recruiting®, at Office Ph. 404-636-2161. Learn more here: “Priority #1: Manufacturing Workforce Development” authored by Kathy Nunnally.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.