How to maintain the upcycle in commercial aerospace in 2026.

By John Schmidt and Jeff Wheless, Accenture

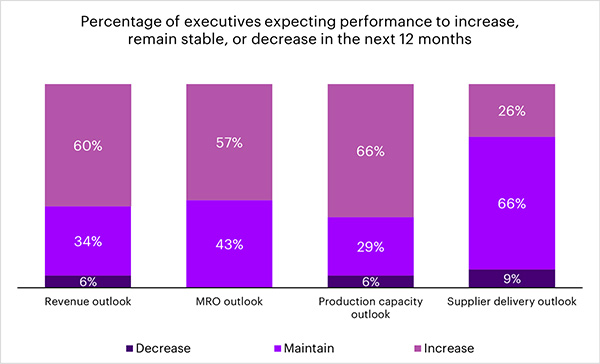

The commercial aerospace industry is entering a new era – one defined not just by growth, but by the ability to sustain it. According to our latest research, the sector is set for 12% revenue growth by the end of 2025. As production levels normalize, growth is expected to temper to a more sustainable 5% in 2026. Optimism and confidence are returning, with 92% of executives expecting supplier deliveries to meet or exceed targets in the next 12 months. For the first time in years, all nine indicators in our biannual commercial insights report are positive. The key challenge now is how to sustain this positive upcycle in the year ahead.

Confidence in aircraft deliveries is running high. For the second half of 2025, almost all executives expect deliveries to match or exceed 2024 levels. This growth reflects the resolved labor disputes, increased production rates and a stabilizing supply chain. The rebound has filtered through to suppliers, who benefited from aftermarket tailwinds, reporting strong commercial revenue increases of 11-22%. They are now emerging from the worst of their supply chain pressures and aligning themselves with OEM production schedules. Safran expects a 15–20% increase in LEAP engine deliveries in 2025, Rolls-Royce is expanding its overhaul capacity in Asia, while GE is upgrading its engine assembly lines in the US and Europe.

Passenger demand, measured in Revenue Passenger Kilometers (RPK), is expected to grow 5.8% in 2025 – driven mostly by Asia-Pacific. Airlines are reshaping their fleet strategies as demand continues to outpace new aircraft supply – but are also putting more demand on maintenance, repair and overhaul (MRO) services. Over the long horizon, 57% of executives forecast higher MRO spending in the next 12 months, which rises to 77% in 24 months. In response, leading providers are scaling capacity by adopting innovative ways to mitigate the impact of parts shortage while navigating labor and supply chain bottlenecks. Strong financial results and continued M&A momentum support this outlook.

However, beneath these headline numbers, the industry faces a complex web of risks. Supply chain fragility, volatile material costs and geopolitical instability make recovery uneven across the globe. To navigate these complexities, aerospace companies must balance short-term fixes with long-term resilience. Here are recommendations for the commercial aerospace industry to embrace in 2026:

Persistent geopolitical tensions and shifting trade policies continue to drive shortages of raw materials and parts, pushing up costs and compressing margins—54% of executives anticipate further price increases in the coming year. To sustain growth amid this volatility, companies must strengthen near-term responsiveness while building the foundations for longer-term flexibility.

In the short term, companies should prioritize control tower capabilities for real-time supply chain visibility and adopt flexible pricing strategies to navigate cost and policy uncertainty. Over the medium horizon, they can enhance agility by establishing regional manufacturing hubs and inventory buffers for critical parts. Airbus’s expansion of its Mobile, Alabama facility, home to A220 and A320neo production lines, demonstrates how regional hubs can improve responsiveness and mitigate cross-border risk.

Over the long term, the goal extends beyond flexibility to true structural resilience—designing aerospace operations beyond supply chains and operations that anticipate and absorb disruption by design. This means re-architecting around digital intelligence, distributed networks, and predictive insight. Through digital twins and AI-enabled modeling, companies can simulate risks, test contingencies, and continuously optimize performance—transforming resilience from a reactive process into an inherent capability.

Boeing’s model-based digital thread built on model-based system engineering (MBSE) principles, exemplifies this shift. It integrates AI, real-time sensor data, and simulation to deliver predictive insights from fleet level down to individual aircraft. Rolls-Royce’s partnership with Trax links its Blue Data Thread digital twin to the eMRO system, enabling real-time data exchange that extends engine on-wing performance and optimizes maintenance planning.

Co-innovative partnerships are emerging as a cornerstone strategy for companies navigating today’s volatile trade dynamics. Our research shows they rank high as a short-term action to mitigate immediate disruptions and as a long-term approach to build resilience. Rather than relying on transactional relationships, businesses are shifting toward collaborative ecosystems that make resilience a shared capability. By leveraging digital platforms, companies can strengthen coordination, accelerate innovation and ensure adaptability – critical for sustaining competitiveness in the long run.

GE Aerospace’s FLIGHT DECK, the company’s proprietary lean operating model, exemplifies this approach. Since becoming an independent business, GE Aerospace has embedded more than 550 supply-chain professionals and engineers across its top suppliers to jointly improve quality and delivery. The impact is visible: in 2025 Q2, output from priority suppliers rose 10%, and the overall supply chain achieved over 95% of committed deliveries.

The outlook for 2026 points to steady momentum. For an industry navigating fragile supply chains and shifting geopolitics, the challenge does not lie in delivering on immediate targets but embedding greater resilience into the system. What matters now is less the pace of recovery than the choices leaders make to shape a more durable and flexible industry.

About the Authors:

John Schmidt is Accenture’s aerospace and defense global industry lead. With deep industry expertise, John has helped major OEMs and Tier-1 suppliers drive strategy, improve operations and boost shareholder value. John’s experience extends beyond aerospace and defense to sectors including consumer electronics and health sciences. Based in Chicago, John serves on the Aerospace Industry Association’s Board of Governors.

Jeff Wheless leads Accenture’s global research for the industrial sector. His team provides intelligence, thought leadership and market insights for aerospace and defense, automotive, industrial, transport and logistics, and Industry X markets. He’s based in Phoenix, Arizona.

Read more from John Schmidt:

Stories to watch: Paris Air Show 2025 – Aerospace Manufacturing and Design

Research Report: Securing future growth for commercial aerospace amid volatility

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.