The trend on service-driven business models has been accelerating industrial manufacturers for years addressing profitability and growth.

By Brian R. May, Accenture

Key to reaching it will lie in the ability of industrial companies to pivot in a way that balances the core and new service management offerings for their customers, according to Accenture research.

Accenture recently surveyed 748 industrial executives in 14 countries, including the U.S., after observing that industrial customers are more interested in purchasing outcomes than buying products. In addition, they find greater value in services and support. More than 60 percent of respondents also said their service business accelerated during the pandemic, an indicator that a robust services business can help industrial companies weather rough storms.

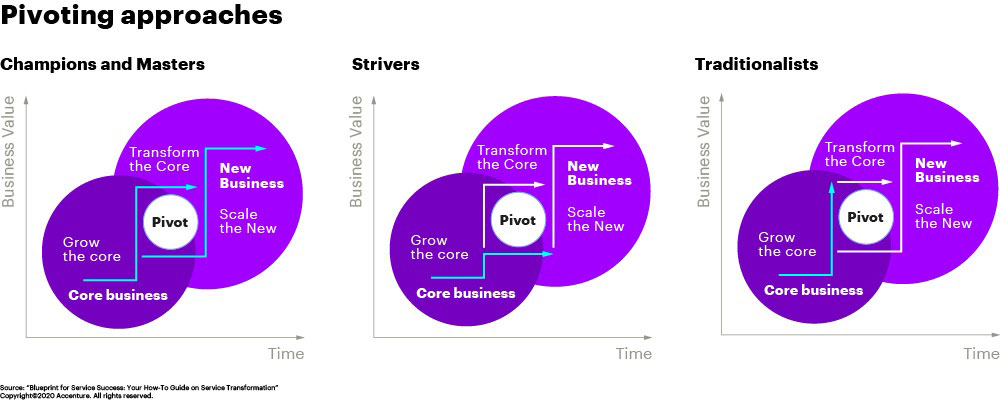

Such findings reinforce the fact that industrial companies need to continue developing and wisely pivoting toward more business and digitally enabled services. To understand how some industrials are executing successful pivots, the research examined four categories of service players according to different service management maturity levels. These categories include champions, masters, strivers, and traditionalists.

Masters provide a prime example of successfully pivoting toward additional services by growing their core services while developing and scaling new ones to achieve stable, robust service profitability. Of all the categories, they have the highest proportion of annual recurring revenue out of total service revenue – making services a driver for business stability. Champions have efficiently configured new services for their customers and are also providing product as a service (P-a-a-S), where pricing is based on pay-per-use or pay-per-outcome. They also offer robust core services.

But, with success there can also be challenges. For example, 57 percent of industrial equipment respondents said their organization is finding it difficult to pivot due to a lack of strong service delivery capabilities. Most respondents also indicated challenges finding the right collaboration model in a complex ecosystem of technology providers, service providers and independently owned distributors. Many also struggle with the consistent investment focus required to create a world class services business. There is an answer, however.

There are four actions industrial companies can take to successfully grow core services while pivoting to new ones to achieve a viable industrial service transformation. Organizations should:

Services are increasingly generating an even greater proportion of overall revenue to drive stable growth. We believe that services will contribute as much as 60 percent of overall revenue for industrial companies in the next five to 10 years. Those that can master their service business will greatly increase their chances for future success.

Brian R. May, brian.r.may@accenture.com, is a managing director and the global lead for Accenture’s Industrial industry group in North America. Brian advises and works with C-level executives in order to support industrial clients while paving their way through digitization and automation following the overarching goal to reshape and transform their business, keep them competitive in their respective areas, and create sustainable growth.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.