Volume 10 | Issue 4

At first, you may wonder what air compressors and auto parts have in common and why a company like Schulz would split itself into these two completely different divisions. The answer is that both businesses rely on casting iron, process in which Schulz has excelled since the early 1960s as a small foundry. In those days, the company made all sorts of cast iron products, from grates to tableware. But in 1972, Schulz started making air compressors and within 10 years the company dominated the Brazilian market and began its expansion to the rest of Latin America.

The company’s metal works were also applied to the auto business and Schulz began making cast metal auto parts in the 1970s. Today, Schulz is one of Brazil’s major auto parts makers and registered a growth rate of 83 percent over the past two years, mostly due to its auto parts division. The division, which is now responsible for the majority of the company’s revenues, grew out of a series of major investments that increased production capacity in casting metals, mounting sub-systems, and finishing of auto parts, an all-in-one solution that gave the company’s products excellent quality assurance ratings in a market that has been demanding increased performance and better prices from its OEMs.

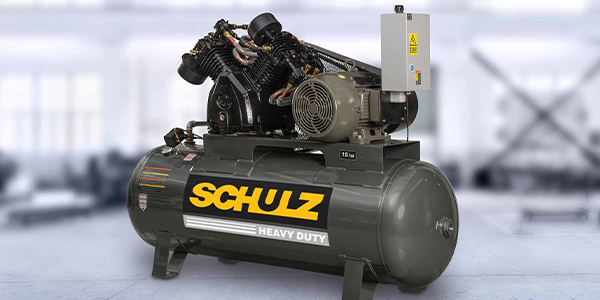

In its compressors division, Schulz has kept its dominance through constant investments into research and development, a strategy that gave the company innovative products released on a regular basis. The company also maintains a diverse and segmented marketing strategy, adjusting its approach to fit the particulars of each major region, both at home and abroad.

Brazilian Air Compressor Market Leader

Schulz began producing air compressors in 1972 with two different models. Thirteen years later, the company was already the leader in air compressors throughout Latin America and today has 70 percent of the Brazilian market share, exports to 70 countries and has a distribution center in Atlanta, Ga.

The company’s newest line of rotary screw compressors, called 3000 series, was designed specifically for the American industrial market. “In air compressors, we are fairly spread out, but mostly in the Americas. We have a strong presence in the Middle East and South Africa, too. About 30 percent of our sales in this division come from exports and we expect about 30 percent growth in this area over the next few years,” remarks Carlos Rotella, Managing Director at Schulz.

Today, the company has a complete range of compressors, including piston, diaphragm, and rotary screw models. Furthermore, Schulz makes pneumatic tools, condensation separators and drills. Part of the company’s competitive strategy is the fact that it develops pneumatic products for every possible application, from hobby and consumer models for cars and bicycles to semi-industrial models for small business to heavy duty industrial lines. Schulz has a specific line for dental applications and not to be left out of the newest craze in beach fashion, the company’s new Summer Jet compressor is made specifically for tanning salons, for the application of tanning liquids.

Schulz’s engineering team creates new products from market studies. “Strategic planning is the responsibility of the marketing department,” explains Rotella. “We have intense R&D and we modify our plans every two years, based on market studies. We collect market data and our team acts on this information to launch new products. We invest a lot in structured marketing.” Schulz also has an extensive sales and service network with more than 400 service centers throughout Latin America.

But competition continues to test the company’s metal. “We are seeing a lot of inexpensive, low-quality products coming from Asia now and they are competing in great quantities,” comments Rotella. “It has become a commodity business and the Chinese have competitive prices. The great advantage that Schulz has is our innovation; we use our know-how to develop products with greater cost-benefit. It’s necessary to show our clients the benefits of our products in relation to our competitors. Only this way the purchase decision will be made based on factors other than price alone.” The strengthening of Brazil’s currency makes competing in the United States and Europe more difficult and has two opposite sides for the Brazilian economy: good for importing machines and equipment; bad for competitive pricing in the global market.

Going Ahead with Auto Parts

Originally a small foundry, Schulz entered the automotive parts business in 1980 with cast metal parts for chassis and suspension systems. Schulz also supplies wheel hubs, break components and parts for engines and transmissions for heavy commercial vehicles, agricultural machineries and construction equipment – all parts that require high quality metals and methods. “The great challenge in entering this market was to get quality products; the market does not accept poor quality. You have to deliver a perfect part and then follow up soon afterwards with a better one,” explains Rotella. So the company focused on competing with products that require the highest quality; products that few companies can produce well. “We only work with parts that are not considered commodities, parts that are difficult to produce and are generally purchased only from very trustworthy companies. What was an obstacle for many companies was an opportunity for us.” Recently, Schulz received “Volvo Supplier Award” recognition by the Swedish Group for the Top 8 Suppliers worldwide, out of more than 1,600 global companies. This award confirms Schulz’s compromise with its customer’s satisfaction.

Today, the automotive division is responsible for 60 percent of the company’s revenues, having passed the compressors division in the past decade. As Brazil’s auto market continues to grow, opportunities for high-quality cast products increased. Schulz now has major contracts with Daimler-Chrysler, Scania and Volvo. A major part of this business is for the domestic market, but about 30 percent is for exports to Europe (20 percent) and the United States (10 percent).

Another thing that happened over the past decade is that the auto business in Brazil opened itself to foreign investment and many Brazilian sub-systems manufacturers were acquired and merged into larger groups. “Most of the principal metal works companies and foundries in Brazil were acquired by investment groups. Now Brazil occupies the seventh position in the world in metal processing.” As the Brazilian market becomes more sophisticated from these mergers and acquisitions, competition gets tougher. “Eventually, groups from China and India will enter in our market and we’ll have to increase productivity and have a well established partnership with our main customers.” Schulz, already investing in its own productivity and know-how, uses its all-in-one operation to get an edge on the competition. The company integrates its melting and casting capabilities with painting, mounting and product development technologies to offer turnkey solutions at competitive prices. “Our focus is on project planning; good planning means good productivity and less time executing,” asserts Rotella.

The plan must be working. Schulz has registered nearly 83 percent growth over the past two years. Since 1993, the company has increased its participation in this market, and has made massive investments more than doubling its production capacity to better serve its customers. In 2000, the company acquired a modern painting system to complete the turnkey operation. In 2002, Schulz expanded its casting capacity from 20,000 to 40,000 metric tons per year. However that expansion was not the end. Always looking ahead, in 2005 the company started a new investment plan.

All-In-One Production

Schulz employs more than 1,950 workers in its plant located in the south of Brazil. With more than three-quarters of a million square feet and plenty of space to grow, Schulz can produce around 400,000 compressors per year in its current facilities. That includes a capacity of 80,000 metric tons of cast iron per year. More than $ 26 million investments are in course to reach 100,000 metric tons capacity. “We began this expansion effort a year ago and we’re investing in several areas – machines, building space, new people and training. We have all functions in one site, from the foundry to painting, unlike other companies that outsource the different steps of the process.”

Rotella credits most of the company’s competitive success, both in compressors and in auto parts, to its technical expertise and its ability to make quick decisions and improve the factory with

speed and agility. “In compressors we use an optimized production method, with the flexibility to make lots of different kinds of products,” he explains. “The more we produce for different

markets, the more difficult we are to be knocked out of the market. We try to take up all the space and this is the greatest effort we are applying”.

Schulz adopts production methods from Japanese industrial leaders, including a Lean Production System. “The initial results of this production enhancement have been improving work force engagement and decreasing process losses. We’ll see major improvement in daily productivity by the end of this year. We intend to intensify our efforts looking for optimized production.” Schulz also adopts an “Integrated Management Style” that encourages diverse areas of participation in the company’s strategic decisions, through multidisciplinary committees.

Schulz is clearly setting itself up to compete in Brazil’s booming market and in the global arena with Lean Production System, added value products, competitive prices and integrated Industrial approach.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.