Megaprojects are notorious for cost and schedule overruns but a new, practical approach is helping to minimize risk and keep projects on track.

By Sam Linder

Large, capital-intensive projects have suffered from perennial underperformance and overruns—especially in industries such as energy, chemicals, and technology. Layer in today’s geopolitical tensions and market uncertainty, and it’s becoming ever-more important to keep megaprojects on track while determining—objectively—whether they remain viable or not.

Getting it wrong in today’s economic climate can be calamitous. McKinsey’s analysis of more than 300 capital projects valued at $1 billion or more found that the average cost overrun was $1.28 billion. Cost overruns relative to initial budget were 79 percent, on average, with average schedule delays of around 18 months.

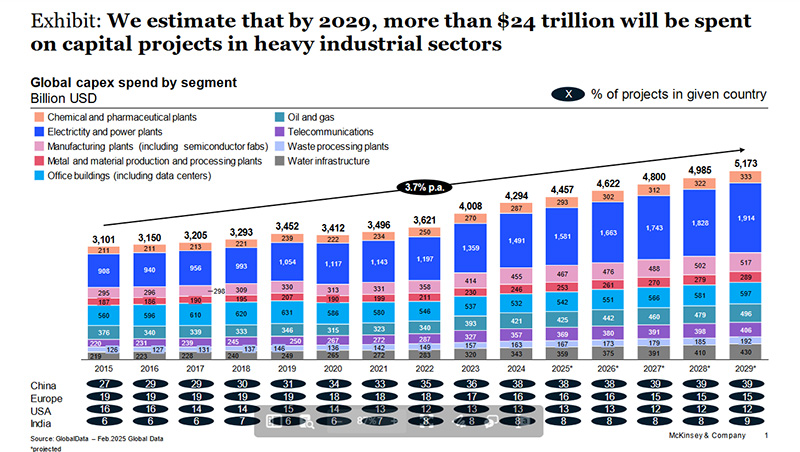

With an estimated $24 trillion in capital ready for deployment over the next five years across global projects of all sizes1, urgent solutions are needed. Some organizations are obtaining better results from their megaprojects by moving away from peer-review panels or “kill authority” investment committees that were designed to solve this very problem.

These organizations have opted instead for a new, pragmatic middle-ground alternative—an independent project challenge team—to help minimize downsides, stay on track, and ensure viability. The approach provides a “happy medium” between the two approaches, tapping the benefits of both while minimizing their respective downsides.

An independent project challenge team enables subject-matter experts to peer review the readiness of a project early on by assessing key assumptions, while financial and commercial experts evaluate the economic viability.

These teams provide an internal perspective on aspects such as technical maturity and risk exposure in a more realistic and unbiased way, while also having greater authority when making recommendations on scope, returns assumptions, costs, commercial viability, scheduling, and overall competitiveness.

Five elements sit at the heart of an independent project challenge team. Together, they can not only enhance the outcomes of complex megaprojects, but also help executives ensure continued alignment with evolving strategic priorities:

Counter unintentional biases: From the start, an independent project challenge team has a mandate to address the unintentional internal biases that project teams are often vulnerable to.

Gain outside perspectives: The team is more “independent” and can get input from experts outside the organization, for example, from industry associations and research centers.

Have an investor mindset: Cross-functional representation on the team provides a holistic view and the ability to stress-test a project’s competitiveness.

Create an in-depth fact base: Independent project challenge teams can access both internal and external data to generate alternative scenarios.

Establish a balanced approach to authority: Such teams can submit sound evaluations to company leadership, enabling them to make decisions that align the project with the organization’s strategic priorities.

Independent project challenge teams are already making a material difference to megaproject developments across different sectors.

One global energy company adopted the approach to address underperformance that saw it losing more than half the potential of its megaprojects, leading to significant additional cost. A business unit-led approach and internal biases had resulted in a lack of in-depth reality checks, reinforcing group consensus and preventing corrective action.

After an extensive review process, the organization created an integrated, independent challenge team with a mandate to include external expert perspectives in the project review process. The team identified a potential $250 million reduction in the engineering scope of a $1.5 billion offshore energy project, making it viable even in a very low pricing scenario.

Another company set up an independent project challenge team to evaluate a technology project that could create $5 billion in future value but involved multiple jurisdictions, complex tax and financial implications and no precedent for price modelling. Without sound market intelligence, the organization opted for highly conservative assumptions, which strained the project’s progress.

An independent project challenge team was able to demonstrate substantial market potential and competitiveness, finding that previous assumptions were far too negative and the project in fact had substantially higher market potential than projected. The team identified opportunities to develop a faster, lower-cost project plan, with adequate risk guardrails. A case was made to move quickly with the project to secure future competitive advantage.

Despite decades of underperformance, common approaches to stress-testing and managing megaprojects have not improved the delivery of large capital projects. With trillions of dollars globally lined up for large capital projects, now may be the time for a fresh approach.

Large projects are risky, but a systematic, unbiased approach can create a lasting competitive advantage. In a market with growing demand, an independent lens helps identify and mitigate risks early, optimize costs, and keep projects on track.

Sam Linder is Partner at McKinsey & Company.

1 GlobalData – Feb 2025 Global Data

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.