What you need to know when appealing commercial property taxes.

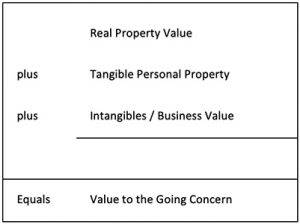

Real Property Value plus Tangible Personal Property plus Intangibles/Business Value equals Value to the Going Concern.

By Kent Hileman

Complex properties are unique and complex, and often the Assessor’s Office can get it wrong. There is typically a significant amount of real estate in the form of land, buildings, and site improvements. But some complex property types, like a hospital campus, encompass a large amount of value in equipment and intangibles as well. Equipment within a hospital often consists of MRI’s, CT’s, X-Rays, ventilators, surgical equipment, some of which costs millions of dollars per piece of equipment, all the way down to computers, desks, chairs, tables, and other more common tangible personal property. All combined, the tangible personal property value can be significant, as can the intangible value. Intangibles within a hospital or other healthcare related business (such as a Skilled Nursing Facility – SNF) can consist of electronic records and software, service agreements, physician agreements, assembled workforce, noncompete agreements, franchise agreements, licensed beds, and more.

Generally speaking, the value of a complex property can be summed up as follows:

The above formula is the same for other complex properties, such as hotels, Regional Shopping Malls, and more. As a result, to help minimize property tax on the real property component alone, you need an expert in pulling out those intangible components, as well as the tangible personal property. Property Valuation Services has experts to remove those values.

In the appraisal of commercial real estate, there are three common approaches to value. They are:

Cost Approach – this approach considers the value of the land, plus the replacement cost of the depreciable assets, less depreciation. All forms of depreciation should be removed from the Replacement Cost New of the improvements to derive the market value of the subject property. Those forms of depreciation include curable and incurable physical depreciation, curable and incurable functional obsolescence, and external (economic) obsolescence.

Market Approach – the direct sales comparison approach uses the market to estimate value by comparing the subject to similar properties that have recently sold. When comparing the sold properties to the subject being appraised, the person conducting the approach must consider similarities and differences that affect value.

Income Approach – this approach is based upon the premise that the value of a property can be estimated by the worth of its net operating income stream (NOI). The NOI is then capitalized by an appropriate rate to turn the income generated by the property into value.

For property tax appeals, you need an expert in all three approaches, don’t stick with someone that is only familiar with the income approach or sales, there could always be a different way to save you money. There could also be the equity method, comparing your property’s assessment to those around you / similar to your property in States which allow that argument, like Texas and Georgia.

You need an expert familiar with the whole valuation process, as well as separating the tangible personal property and intangible values from the real estate value for complex properties, as that is often where the Assessor can get it wrong. If you have a complex property, make sure you are hiring an expert that is familiar in removing those components.

Kent A. Hileman

About Kent Hileman, MAI, ASA, CMI

Kent Hileman is an owner of PVS and has been with the company since 2000. He has been involved in the appraisal or value analysis of over 400 hospitals plus thousands of medical office buildings, psychiatric and rehab hospitals, surgery centers, and more. He has also appraised or analyzed other complex commercial property types such as hotels, motels, golf courses, industrial, warehouse, office, funeral homes, car washes, office buildings, and more. He holds the highest designations as it relates to appraisal/valuation, MAI from the Appraisal Institute, ASA in real property from the American Society of Appraisers, ASA in appraisal review and management from the American Society of Appraisers, and CMI from the Institute for Professionals in Taxation. He is licensed in a multitude of states for both appraisal and property tax consulting. Kent has experience presenting / testifying at various levels of appeal throughout the Country, from informal to State to assisting at the Court level. He was a member of the 2011 IPT Symposium Committee and presented during the hotel / healthcare breakout session on various topics and issues surrounding the valuation of these complex properties as it relates to property tax.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.