The top five legal trends powering the automotive industry into 2022.

Looking back to 2021, the automotive industry experienced successes, such as the upsurge of electric and autonomous vehicle development, and challenges, such as the global supply chain fiasco. The successes and challenges will impact legal trends. Looking forward to 2022, the top five legal trends driving the automotive industry are below.

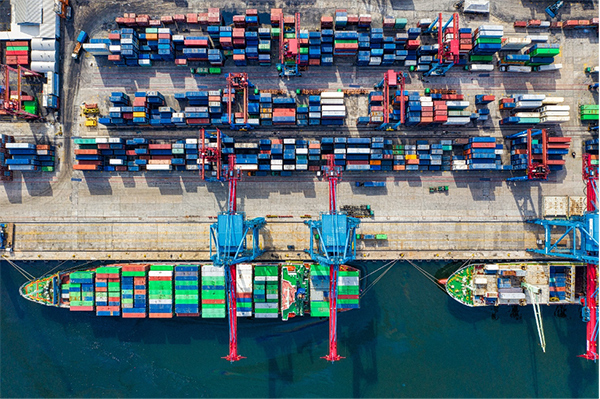

The shortage of semiconductor chips is not expected to be resolved in 2022, while demand is skyrocketing. Raw material and labor shortages continue to be in play, and pricing for raw materials, like resin and steel, is fluctuating. As a result, experts opine that supply chain disruption will continue to be a critical challenge for the automotive industry in 2022, resulting in periodic production shut downs.

This supply chain disruption will affect transactions, lawsuits, and everything in between. Many suppliers will demand new supply contracts—without fixed pricing—but instead with pricing tied public indices. Customers and suppliers also continue to wrangle over responsibility for expenses incurred during the pandemic (e.g., higher labor, shipment and raw material costs) and damages caused by production interruptions. For the most part, companies kept these disagreements out of the courts in 2020 and 2021. In 2022, this likely will change. Supply chain lawsuits are expected. Finally, financial distress is expected, particularly for some smaller suppliers. Companies that relied upon pandemic government stimulus programs to stay afloat in 2020 and 2021 may not be able to weather the storm in 2022, leading to restructurings, bankruptcies, and accommodation agreements.

Antitrust issues expected to impact the automotive industry in 2022 include an increasingly aggressive approach to merger control and collusion impacting labor markets by the U.S. Antitrust enforcement agencies, the Federal Trade Commission (FTC) and Antitrust Division of the Department of Justice (Antitrust Division).

First, expect change with merger enforcement. The FTC and the Antitrust Division announced on January 18, 2022, that they will be reviewing the Horizontal Merger Guidelines, in effect since 2010. The agencies are considering whether an adverse impact on labor markets (reducing jobs and/or lowering compensation) should be considered when measuring the potential anticompetitive impact of mergers and, relatedly, whether the agencies should continue to credit a reduction of FTEs as a procompetitive merger-specific efficiency. The FTC also recently rescinded the Vertical Merger Guidelines, which provided guidance on how the FTC evaluates mergers between parties at different levels of the distribution chain. The Assistant Attorney General in charge of the Antitrust Division hinted that the Antitrust Division may follow suit, commenting that the current vertical guidelines overstate certain efficiencies and fail to account for certain types of harms, including harm to labor markets, and are actively under review by the DOJ.

Second, be on alert for no-poaching and wage fixing claims. In 2016, the agencies issued guidelines for HR professionals on how to avoid potential violations of antitrust laws related to the use of no-poach agreements (i.e., agreements by employers not to solicit and/or hire each other’s employees) to and wage-fixing agreements. The guidelines noted that the Antitrust Division would consider criminal charges for companies that engaged in these types agreements. The Antitrust Division made good on this promise by filing several cases charging companies and certain employees with conspiring to fix wages and/or enter into no-poach agreements in 2020. These cases are still pending, and more filings are expected. Additionally, a number of putative civil class action cases have challenged these types of agreements.

Automotive and other industries had a record number of mergers and acquisitions in 2021, totaling over two billion U.S. dollars, in value, for the global automotive industry in the fourth quarter of 2021 alone. The industry is set to experience yet another impressive year of mergers, joint ventures and other combinations, fueled by venture financing and other options. The Bipartisan Infrastructure Law, which immediately spurred investments in 2021, likely will spur deal activity in the automotive space in 2022 as well. Finally, deal work, consolidations and other sales are expected to increase in the context of troubled supplier workouts or sales.

As automakers move toward electric and autonomous vehicles, cybersecurity has become a top legal concern. Companies are familiar with the regulations applicable to vehicle safety; but dealing with cybersecurity requires ongoing technical and legal due diligence.

One of the first standards to address vehicle cybersecurity, ISO/SAE 21434:2021 Road Vehicles – Cybersecurity Engineering, officially was released in its latest version on August 31, 2021. This standard specifies engineering requirements for cybersecurity risk management applicable to all phases, from concept, to production, to decommissioning. These systems must provide robust protection from evolving threats. It is expected that ISO/SAE 21434 will become a baseline standard (effectively mandatory) for the automotive industry in the United States soon. Further, starting in July 2022, automakers must comply with the UN R155 automotive cybersecurity regulation for new vehicle launches in Europe, Japan and Korea, with other regions expected to follow. ISO/SAE 21434 incorporates R155 requirements, making it more likely that R155 will become part of the United States cybersecurity landscape as well.

On top of complying with the cybersecurity standards, automakers and suppliers need to ensure that they are prepared to respond—and respond quickly—to any cyberattack. In addition to technical know-how, this requires up-do-date knowledge of applicable statutory reporting requirements, which may from country to country, and to some extent, from state to state in the United States.

To address these new cybersecurity risks, standards, and reporting requirements, companies in the automotive industry are focused on risk-allocation terms in contracts, clarifying which company may be responsible for damages should there be a cyberattack. Companies also are hiring law firms to assist with planning and table top exercises (simulated cyberattacks) to ensure that all constituents, from legal to I.T., are prepared to respond quickly and properly to an incident.

One of the major legal questions steering into 2022 is whether litigation will increase in light of the movement to the electric-autonomous mobility space, particularly as electric vehicle sales trend sharply upward. To date, the answer appears to be “no”, but this could change as more consumers purchase these new vehicles.

The most common product liability allegations seen in this space involve battery fires. Even though they attract a media attention, battery fires in electric vehicles are still a very small percentage of the vehicle fires reported in the United States (5,000-10,000 per year). That being said, there have been a number of well-published recent electric vehicle recalls, which may spark litigation in 2022. Recalls also may lead to lawsuits between the automaker and the component supplier over which entity should be responsible for recall costs. Finally, NHTSA—which thus far has stayed in an “investigation” lane, is expected to issue new requirements directly applicable to electric and autonomous technologies, although whether this will occur in 2022 is not certain. Such new standards may provide a basis for additional product liability litigation, class actions and potential recalls. In short, electric and autonomous vehicle litigation has not substantially increased, but is being followed closely by all participants in the automotive industry.

As the world enters 2022, it is difficult to anticipate what other challenges the continuing pandemic may bring to the automotive industry. The legal industry is prepared, staying on the forefront of regulations, standards, best practices and litigation, to help drive the industry to successful year.

Laura C. Baucus is the Director of Dykema’s Automotive Industry group and the founder of the firm’s Supply Chain practice. Laura advises global clients in the automotive, aerospace, and other manufacturing, industries on supply chain disputes and transactions. She also represents clients in complex contract litigation, B2B warranty disputes, and consumer financial services litigation. Laura can be reached at lbaucus@dykema.com or 248-203-0796.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.