Monthly Leasing and Finance Index new business volume in May was down 26 percent year over year.

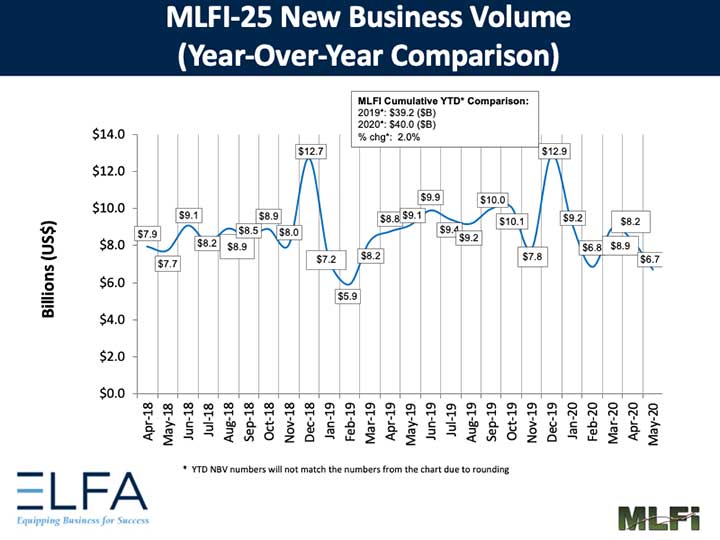

Washington, DC, June 25, 2020—The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector, showed their overall new business volume for May was $6.7 billion, down 26 percent year-over-year from new business volume in May 2019. Volume was down 18 percent month-to-month from $8.2 billion in April. Year-to-date, cumulative new business volume was up 2 percent compared to 2019.

Receivables over 30 days were 4.30 percent, up from 3.00 percent the previous month and up from 1.70 percent the same period in 2019. Charge-offs were 0.61 percent, down from 0.80 percent the previous month, and up from 0.46 percent in the year-earlier period.

Credit approvals totaled 68.1 percent, down from 71.7 percent in April. Total headcount for equipment finance companies was down 2.2 percent year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) rose to 45.8 in June, up from 25.8 in May.

ELFA President and CEO Ralph Petta said, “The downturn in the economy precipitated by the COVID-19 pandemic crisis is responsible for new business softening in the equipment finance space during the month of May. This is evident in market segments serving customers in the construction, hotel, tourism, leisure and food service industries, in particular. Of note is separate Equipment Leasing & Finance Foundation survey data that show a willingness on the part of ELFA members to provide much-needed assistance to their customers by agreeing to restructure payment streams and extend deferral relief. This is a testament to an industry that time and again demonstrates flexibility and resolve by adapting in a positive way to sometimes disruptive and changing economic conditions.”

Aylin Cankardes, President, Rockwell Financial Group, said, “The U.S. equipment finance market continues to see challenges with lower growth and delayed receivables due to the COVID-19 pandemic. Businesses have put a portion of their capital acquisitions on hold while realigning resources for their customers and employees. We are starting to see a gradual boost from the fiscal and monetary stimulus efforts but it continues to be uneven across industry sectors. On a bright note, our customers are getting a better grip on the disruption by balancing between resiliency and efficiency. As states continue to reopen it should help stabilize activity in the coming months.”

The MLFI-25 is the only index that reflects capex, or the volume of commercial equipment financed in the U.S. The MLFI-25 is released globally at 8 a.m. Eastern time from Washington, D.C., each month on the day before the U.S. Department of Commerce releases the durable goods report. The MLFI-25 is a financial indicator that complements the durable goods report and other economic indexes, including the Institute for Supply Management Index, which reports economic activity in the manufacturing sector. Together with the MLFI-25 these reports provide a complete view of the status of productive assets in the U.S. economy: equipment produced, acquired and financed.

The MLFI-25 is a time series that reflects two years of business activity for the 25 companies currently participating in the survey. The latest MLFI-25, including methodology and participants, is available at www.elfaonline.org/Data/MLFI/.

ELFA produces the MLFI-25 survey to help member organizations achieve competitive advantage by providing them with leading-edge research and benchmarking information to support strategic business decision making.

The MLFI-25 is a barometer of the trends in U.S. capital equipment investment. Five components are included in the survey: new business volume (originations), aging of receivables, charge-offs, credit approval ratios, (approved vs. submitted) and headcount for the equipment finance business.

The MLFI-25 measures monthly commercial equipment lease and loan activity as reported by participating ELFA member equipment finance companies representing a cross section of the equipment finance sector, including small ticket, middle-market, large ticket, bank, captive and independent leasing and finance companies. Based on hard survey data, the responses mirror the economic activity of the broader equipment finance sector and current business conditions nationally.

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the nearly $1 trillion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 575 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. For more information, please visit www.elfaonline.org.

Follow ELFA:

Twitter: @ELFAonline

LinkedIn: www.linkedin.com/groups?gid=89692

Facebook: www.facebook.com/ELFApage

ELFA is the premier source for statistics and analyses concerning the equipment finance sector. Please visit www.elfaonline.org/Data/ for additional information.

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector and its people forward through industry-specific knowledge, intelligence, and academic outreach programs that contribute to industry innovation, individual careers, and the overall betterment of the $900 billion equipment leasing and finance industry. The Foundation is funded through individual and corporate donations. Learn more at www.leasefoundation.org

Media/Press Contact: Amy Vogt, Vice President, Communications and Marketing, ELFA, 202-238-3438 or avogt@elfaonline.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.