The second quarter was off to a strong start with April MLFI results showing solid performance all around.

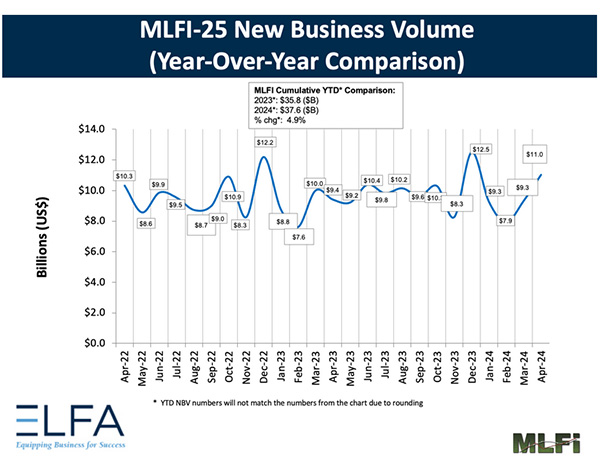

Washington, DC—The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for April was $11 billion, up 17% year-over-year from new business volume in April 2023. Volume was up 18% from $9.3 billion in March. Year-to-date, cumulative new business volume was up 4.9% compared to 2023.

Receivables over 30 days were 2%, down from 2.1% the previous month and up from 1.8% in the same period in 2023. Charge-offs were 0.4%, down from 0.5% the previous month and up from 0.3% in the year-earlier period.

Credit approvals totaled 75%, down from 77% in March. Total headcount for equipment finance companies was up 1.3% year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in May is 50.7, a decrease from the April index of 52.9.

ELFA President and CEO Leigh Lytle said, “The second quarter was off to a strong start with April MLFI results showing solid performance all around. The equipment finance industry continues to demonstrate its resilience despite informal polling of ELFA members that shows interest rates, tighter credit and inflation to a lesser degree are all impacting their businesses. Originations had double-digit growth both year over year and month to month, and credit quality is heading in a positive direction with charge-offs and delinquencies both ticking down last month. All are indicators that bear continued watching in the coming months.”

Brian Holland, President and CEO, Fleet Advantage, LLC, said, “We’re seeing a noticeable and continued uptick in business volume continuing in April, the third straight month of business growth. Even with this noteworthy trend, businesses remain focused on prudence with their operations and bottom-line discipline given the still-uncertain direction of the overall economy for the remainder of 2024. Given this environment, we’re focused on helping the transportation sector strengthen their financial bottom lines through holistic asset management strategies that allow them to optimize their equipment life cycles and take a proactive approach to their procurement initiatives in the coming years.”

About ELFA’s MLFI-25

The MLFI-25 is the only near-real-time index that reflects capex, or the volume of commercial equipment financed in the U.S. The MLFI-25 is released globally at 8 a.m. Eastern time from Washington, D.C., each month on the day before the U.S. Department of Commerce releases the durable goods report. The MLFI-25 is a financial indicator that complements the durable goods report and other economic indexes, including the Institute for Supply Management Index, which reports economic activity in the manufacturing sector. Together with the MLFI-25 these reports provide a complete view of the status of productive assets in the U.S. economy: equipment produced, acquired and financed.

The MLFI-25 is a time series that reflects two years of business activity for the 25 companies currently participating in the survey. The latest MLFI-25, including methodology and participants, is available at www.elfaonline.org/knowledge-hub/mlfi.

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the $1 trillion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 580 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. ELFA has been equipping business for success for more than 60 years. For more information, please visit www.elfaonline.org.

Follow ELFA:

X: @ELFAonline

LinkedIn: https://www.linkedin.com/groups/89692/

Media/Press Contact: Amy Vogt, Vice President, Communications and Marketing, ELFA, avogt@elfaonline.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.