The Top 10 Equipment Acquisition Trends are intended to help businesses make their strategic equipment acquisition plans.

Washington, DC — The Equipment Leasing and Finance Association (ELFA) which represents the nearly $1 trillion equipment finance sector, today revealed its Top 10 Equipment Acquisition Trends for 2022. Real private investment by U.S. businesses in equipment and software is forecast to be almost $2 trillion in 2022, with a substantial amount of that investment activity financed, so these trends impact a significant portion of the U.S. economy.

ELFA President and CEO Ralph Petta said, “The pandemic is the underlying theme throughout the trends this year as equipment acquisition continues to drive supply chains across all U.S. manufacturing and service sectors. Nearly eight in 10 of U.S. businesses use equipment leasing and financing to acquire the productive assets they need to operate and grow. We are pleased to provide the Top 10 Equipment Acquisition Trends to help businesses make their strategic equipment acquisition plans, especially since there are significant opportunities for businesses to benefit from expected economic growth this year.”

ELFA distilled recent research and data, including the Equipment Leasing & Finance Foundation’s 2022 Equipment Leasing & Finance U.S. Economic Outlook, industry participants’ expertise and member input from ELFA meetings in compiling the trends.

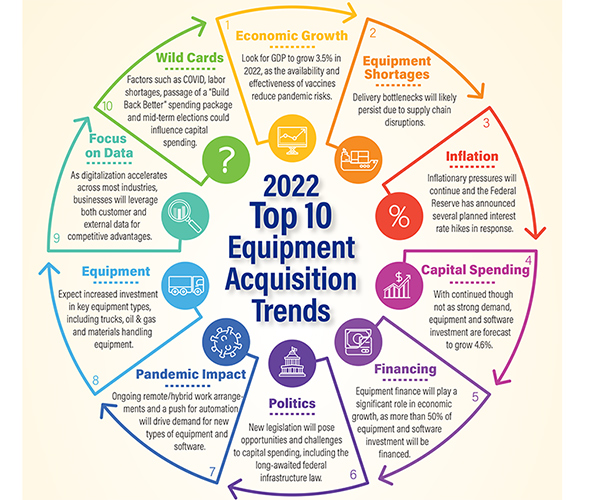

ELFA forecasts the following Top 10 Equipment Acquisition Trends for 2022:

For an infographic and video highlighting the Top 10 Equipment Acquisition Trends for 2022, please visit ELFA’s Equipment Finance Advantage website for end-users at https://www.equipmentfinanceadvantage.org/toolkit/10trends.cfm.

More Information

ELFA’s EquipmentFinanceAdvantage.org informational website is designed for businesses that want to learn more about how they can incorporate equipment financing into their business strategies.

For forecast data regarding equipment investment and capital spending in the United States, see the Equipment Leasing & Finance Foundation’s 2022 Equipment Leasing & Finance U.S. Economic Outlook at www.leasefoundation.org/industry-resources/u-s-economic-outlook/.

About ELFA

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the nearly $1 trillion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 580 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. ELFA has been equipping business for success for more than 60 years. For more information, please visit www.elfaonline.org.

Follow ELFA:

Twitter: @ELFAonline

LinkedIn: www.linkedin.com/groups?gid=89692

Facebook: www.facebook.com/ELFApage

ELFA is the premier source for statistics and analyses concerning the equipment finance sector. Please visit www.elfaonline.org/Data/ for additional information.

Media/Press Contact: Amy Vogt, Vice President, Communications and Marketing, ELFA, 202-238-3438 or avogt@elfaonline.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.