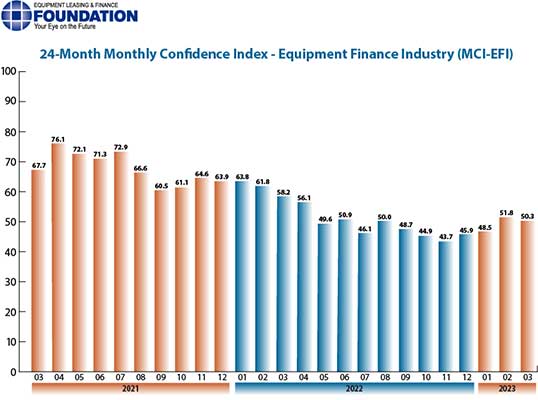

Overall, confidence in the equipment finance market is 50.3, a decrease from the February index of 51.8.

Washington, DC – The Equipment Leasing & Finance Foundation (the Foundation) releases the March 2023 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 50.3, a decrease from the February index of 51.8.

When asked about the outlook for the future, MCI-EFI survey respondent Nancy Pistorio, Foundation Chair and President, Madison Capital LLC said, “As the pandemic becomes farther in the rear view mirror, industries affected such as livery, fitness, entertainment, and hospitality are now showing strong demand for equipment.”

The overall MCI-EFI is 50.3, a decrease from the February index of 51.8.

Bank, Small Ticket

“Wintrust is well positioned to grow during this time of uncertainty given our strong balance sheet and commitment to the equipment finance space and our customers.” David Normandin, President and Chief Executive Officer, Wintrust Specialty Finance

Why an MCI-EFI?

Confidence in the U.S. economy and the capital markets is a critical driver to the equipment finance industry. Throughout history, when confidence increases, consumers and businesses are more apt to acquire more consumer goods, equipment, and durables, and invest at prevailing prices. When confidence decreases, spending and risk-taking tend to fall. Investors are said to be confident when the news about the future is good and stock prices are rising.

Who participates in the MCI-EFI?

The respondents are comprised of a wide cross-section of industry executives, including large-ticket, middle-market and small-ticket banks, independents, and captive equipment finance companies. The MCI-EFI uses the same pool of 50 organization leaders to respond monthly to ensure the survey’s integrity. Since the same organizations provide the data from month to month, the results constitute a consistent barometer of the industry’s confidence.

How is the MCI-EFI designed?

The survey consists of seven questions and an area for comments, asking the respondents’ opinions about the following:

How may I access the MCI-EFI?

Survey results are posted on the Foundation website, https://www.leasefoundation.org/industry-resources/monthly-confidence-index/, included in the Foundation Forecast eNewsletter, and included in press releases. Survey respondent demographics and additional information about the MCI are also available at the link above.

JOIN THE CONVERSATION

Twitter: https://twitter.com/LeaseFoundation

Facebook: https://www.facebook.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector—and its people—forward through industry-specific knowledge, intelligence, and programs that contribute to industry innovation, individual careers, and the overall betterment of the equipment leasing and finance industry. The Foundation is funded through charitable individual and corporate donations. Learn more at www.leasefoundation.org.

Media Contact: Charlie Visconage, cvisconage@leasefoundation.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.