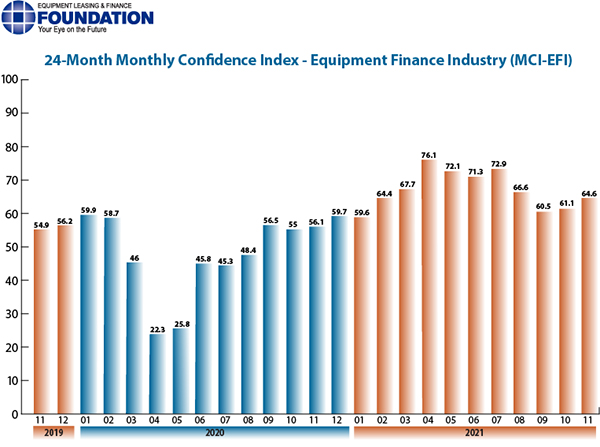

Confidence in the equipment finance market is 64.6, an increase from the October index of 61.1.

Washington, DC – The Equipment Leasing & Finance Foundation (the Foundation) releases the November 2021 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 64.6, an increase from the October index of 61.1.

When asked about the outlook for the future, MCI-EFI survey respondent Dave Fate, Chief Executive Officer, Stonebriar Commercial Finance, said, “While I believe the equipment leasing and finance Industry will always perform well through various cycles, the last few months have shown a number of interesting data points. Strong corporate earnings continue to drive the equity markets. The current rise in Inflation rates is alarming and seems like it will be with us for a while. Continued issues with the lack of skilled and non-skilled labor are the number one concern of most of our customers. Supply chain issues are causing real disruption and seem to have no viable plan to alleviate them. The rest of Q4 and into Q1 will be very interesting as we navigate through year-end closing in our industry and the Christmas holiday season.”

The overall MCI-EFI is 64.6, an increase from the October index of 61.1.

Bank, Middle Ticket

“We continue to see interest in capital expansion for the sectors we serve, especially with middle market customers. Supply chain issues continue to be a headwind to the implementation of capital investment.” Michael Romanowski, President, Farm Credit Leasing

Independent, Middle Ticket

“Business owners are feeling much more confident and are moving forward with capital acquisitions, some that had been delayed because of the pandemic. Pending no flare up of COVID-19 infections in the coming months, we expect smooth sailing for the next several quarters.” Bruce J. Winter, President, FSG Capital, Inc.

ABOUT THE MCI

Why an MCI-EFI?

Confidence in the U.S. economy and the capital markets is a critical driver to the equipment finance industry. Throughout history, when confidence increases, consumers and businesses are more apt to acquire more consumer goods, equipment, and durables, and invest at prevailing prices. When confidence decreases, spending and risk-taking tend to fall. Investors are said to be confident when the news about the future is good and stock prices are rising.

Who participates in the MCI-EFI?

The respondents are comprised of a wide cross-section of industry executives, including large-ticket, middle-market and small-ticket banks, independents, and captive equipment finance companies. The MCI-EFI uses the same pool of 50 organization leaders to respond monthly to ensure the survey’s integrity. Since the same organizations provide the data from month to month, the results constitute a consistent barometer of the industry’s confidence.

How is the MCI-EFI designed?

The survey consists of seven questions and an area for comments, asking the respondents’ opinions about the following:

How may I access the MCI-EFI?

Survey results are posted on the Foundation website, https://www.leasefoundation.org/industry-resources/monthly-confidence-index/, included in the Foundation Forecast eNewsletter, and included in press releases. Survey respondent demographics and additional information about the MCI are also available at the link above.

JOIN THE CONVERSATION

Twitter: https://twitter.com/LeaseFoundation

Facebook: https://www.facebook.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector—and its people—forward through industry-specific knowledge, intelligence, and programs that contribute to industry innovation, individual careers, and the overall betterment of the equipment leasing and finance industry. The Foundation is funded through charitable individual and corporate donations. Learn more at www.leasefoundation.org.

Media Contact: Charlie Visconage, cvisconage@leasefoundation.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.