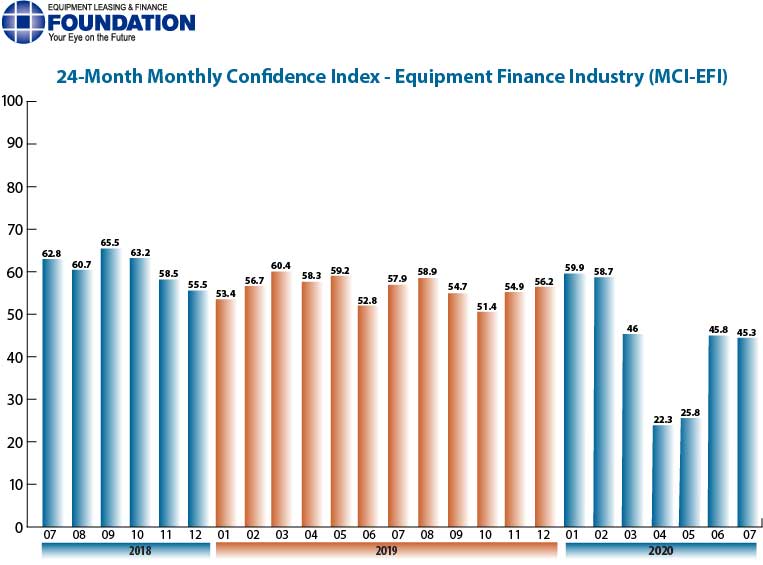

Confidence in the equipment finance market is 45.3, steady with the June index of 45.8.

Washington, DC, July 16, 2020 – The Equipment Leasing & Finance Foundation (the Foundation) releases the July 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 45.3, steady with the June index of 45.8.

The Foundation also releases highlights of the COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry. From 77 survey responses collected from July 1-11, results show that 95% of equipment finance companies have offered payment deferrals. 77% of companies expect that the default rate will be greater in 2020 than in 2019. A majority (83%) of companies have not furloughed or laid off employees. Comments from survey respondents follow MCI-EFI survey comments below, and additional survey results are available at https://www.leasefoundation.org/industry-resources/covid-impact-survey/.

When asked about the outlook for the future, MCI-EFI survey respondent Michael Romanowski, President, Farm Credit Leasing, said, “We continue to find solutions for our customers as they traverse through the COVID crisis. In some cases, we are providing leasing solutions to customers who have not considered leasing in the past. We expect these new relationships to continue to grow even after the pandemic has moved on.”

The overall MCI-EFI is 45.3, steady with the June index of 45.8.

Bank, Small Ticket

“Business volume is strong and we are maintaining portfolio performance. Yields are better and COVID affected accounts continue to fall.” David Normandin, CLFP, President and CEO, Wintrust Specialty Finance

Independent, Small Ticket

“There’s little cause for optimism. I’m very concerned that continued coronavirus infections will cause rolling closures across the country.” Quentin Cote, CLFP, President, Mintaka Financial, LLC

Independent, Middle Ticket

“We are starting to see some spending, possibly pent-up demand, with businesses that had put acquisitions on hold at the onset of COVID-19. Stronger borrowers are looking to take advantage of the situation and tuck in, or otherwise acquire weaker competitors.” Bruce J. Winter, President, FSG Capital, Inc.

Captive, Small Ticket

“The gamble of deferring payments will either pay off or not in the next three months as we see how many of the deferred customers survive. We, a truck manufacturer captive, are more involved in ‘final mile’ delivery, and we see the next one to three years as being steady. Past that it is a guessing game. Everything depends on curbing the pandemic.” Jim DeFrank, Executive Vice President and Chief Operating Officer, Isuzu Finance of America, Inc.

Independent, Middle Ticket

“The short term will be challenging for many. By year end, I believe you will see a number of firms exit the business. However, adversity for some also provides opportunity for others. This is a resilient and innovative industry which will manage through these unprecedented times and endure over the long term.” Nancy Pistorio, CLFP, President, Madison Capital LLC

Independent, Middle Ticket

“Short term we are extremely focused on helping our clients navigate through the COVID-19 pandemic, and internally focused on leveraging technology to ensure we continue to deliver outstanding service to our clients. Many of our competitors have either ceased originating or scaled back their originations, which has resulted in new opportunities for our firm. Medium- to long-term we are focused on recruiting new talent, along with ‘A Players’ to ensure we are well positioned to meet our aggressive growth objectives.” Samuel Smith, President, Customers Commercial Finance, LLC

To participate in the COVID-19 Impact Survey of the Equipment Finance Industry: The Foundation invites all regular ELFA member companies to participate each month. Survey responses are limited to one per company. If you did not receive a survey and would like to participate, please contact Stephanie Fisher, sfisher@leasefoundation.org, by July 31 to determine eligibility for inclusion in the August survey.

ABOUT THE MCI

Why an MCI-EFI?

Confidence in the U.S. economy and the capital markets is a critical driver to the equipment finance industry. Throughout history, when confidence increases, consumers and businesses are more apt to acquire more consumer goods, equipment, and durables, and invest at prevailing prices. When confidence decreases, spending and risk-taking tend to fall. Investors are said to be confident when the news about the future is good and stock prices are rising.

Who participates in the MCI-EFI?

The respondents are comprised of a wide cross-section of industry executives, including large-ticket, middle-market and small-ticket banks, independents and captive equipment finance companies. The MCI-EFI uses the same pool of 50 organization leaders to respond monthly to ensure the survey’s integrity. Since the same organizations provide the data from month to month, the results constitute a consistent barometer of the industry’s confidence.

How is the MCI-EFI designed?

The survey consists of seven questions and an area for comments, asking the respondents’ opinions about the following:

How may I access the MCI-EFI?

Survey results are posted on the Foundation website, https://www.leasefoundation.org/industry-resources/monthly-confidence-index/, included in the Foundation Forecast eNewsletter, and included in press releases. Survey respondent demographics and additional information about the MCI are also available at the link above.

JOIN THE CONVERSATION

Twitter: https://twitter.com/LeaseFoundation

Facebook: https://www.facebook.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Instagram: https://www.instagram.com/leasefoundation/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector and its people forward through industry-specific knowledge, intelligence, and academic outreach programs that contribute to industry innovation, individual careers, and the overall betterment of the $900 billion equipment leasing and finance industry. The Foundation is funded through individual and corporate donations. Learn more at www.leasefoundation.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.