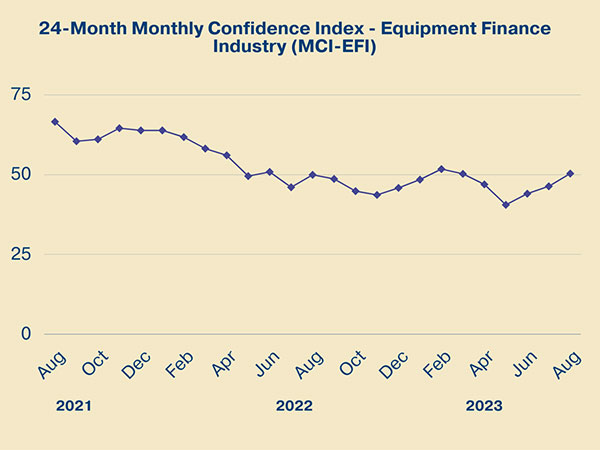

The overall MCI-EFI is 50.4, an increase from the July index of 46.4.

Washington, DC – The Equipment Leasing & Finance Foundation (the Foundation) releases the August 2023 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 50.4, an increase from the July index of 46.4.

When asked about the outlook for the future, MCI-EFI survey respondent Dave Fate, CEO, Stonebriar Commercial Finance, said, “In spite of significant turmoil in the U.S. banking sector, including multiple downgrades and warnings from the rating agencies, as well as unprecedented interest rate increases over the past year, the equipment leasing and finance industry continues to persevere. Secured equipment loans and leases continue to outperform every other asset class. I would expect our industry to continue to deploy much-needed capital—which serves as a catalyst for the U.S. economy—across a diverse set of industries across the credit spectrum. Stonebriar continues to thrive in this environment with year-to-date originations through July 31 of $1.26 billion, up 28% year over year.”

The overall MCI-EFI is 50.4, an increase from the July index of 46.4.

Bank, Small Ticket

“Hanmi’s Leasing Department continues to see steady demand for its funding services and as rates have started to stabilize, pricing has become less of an issue. We are fortunate to have long standing partners that are loyal and experienced originators. Increased delinquency and default rates from recent historic lows have our attention as potential concerns and we continue to monitor our portfolio closely.” Mike Coon, CLFP, First Vice President – Portfolio Manager. Hanmi Bank

Independent, Middle Ticket

“In the past three years, our industry was directly affected by three major issues: Covid, the unprecedented speed and size of Fed rate hikes, and the unexpected fallout from deposit stickiness in the banking industry. After each occurrence, the confidence index for our industry dropped and then after a few months started to recover. What this tells us is that we aren’t immune to these strong forces, but after they happen our industry reacts and finds a way to deal with them. This past resilience and agility are what give me confidence in the near-term future of our industry. There remain macro forces out there that we cannot control which could potentially impact every industry. These include an escalation of the war in Ukraine, further aggressive rate moves by the Fed, and the potential crisis involving loan refinancing for commercial office buildings. All of these are big unknowns, but if the past is a guidepost for the future, our industry will find a way to succeed.” Mike Rooney, Chief Executive Officer, Verdant Commercial Capital LLC

ABOUT THE MCI

Why an MCI-EFI?

Confidence in the U.S. economy and the capital markets is a critical driver to the equipment finance industry. Throughout history, when confidence increases, consumers and businesses are more apt to acquire more consumer goods, equipment, and durables, and invest at prevailing prices. When confidence decreases, spending and risk-taking tend to fall. Investors are said to be confident when the news about the future is good and stock prices are rising.

Who participates in the MCI-EFI?

The respondents are comprised of a wide cross-section of industry executives, including large-ticket, middle-market and small-ticket banks, independents, and captive equipment finance companies. The MCI-EFI uses the same pool of 50 organization leaders to respond monthly to ensure the survey’s integrity. Since the same organizations provide the data from month to month, the results constitute a consistent barometer of the industry’s confidence.

How is the MCI-EFI designed?

The survey consists of seven questions and an area for comments, asking the respondents’ opinions about the following:

How may I access the MCI-EFI?

Survey results are posted on the Foundation website, https://www.leasefoundation.org/industry-resources/monthly-confidence-index/, included in the Foundation Forecast eNewsletter, and included in press releases. Survey respondent demographics and additional information about the MCI are also available at the link above.

JOIN THE CONVERSATION

Twitter: https://twitter.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector—and its people—forward through industry-specific knowledge, intelligence, and programs that contribute to industry innovation, individual careers, and the overall betterment of the equipment leasing and finance industry. The Foundation is funded through charitable individual and corporate donations. Learn more at www.leasefoundation.org.

Media Contact: Charlie Visconage, cvisconage@leasefoundation.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.