New data from Tradeshift suggests a modest uptick in global trade activity during Q4 following an acceleration in new orders.

San Francisco: – New data from Tradeshift suggests a modest uptick in global trade activity during Q4 following an acceleration in new orders during the quarter.

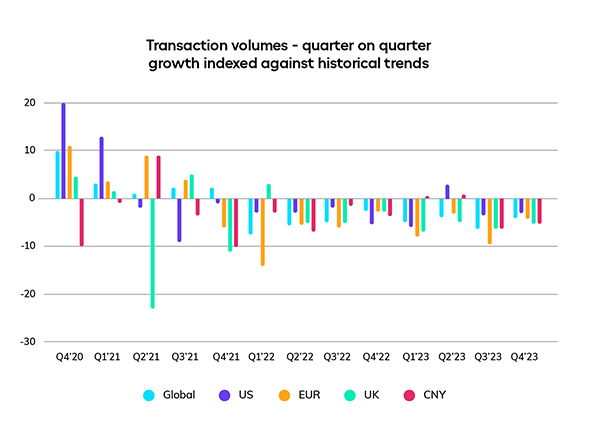

According to Tradeshift’s latest Index of Global Trade Health, global trade transaction volumes improved to 4 points below the baseline in Q4, having sunk to 6 points below anticipated levels in the previous quarter.

Tradeshift’s analysis of purchase orders and invoice traffic on its global platform reveals a remarkable increase in ordering activity during Q4. Order volumes grew 5 points above the expected range in the final quarter of 2023, recapturing some momentum following a protracted slump.

In the US, total transaction volumes stabilized at 3 points below the baseline in Q4 having softened in the previous quarter. Orders in the US rose at 6 points above the expected range in Q4, marking the most substantial acceleration in two years.

Transaction volumes across the Eurozone, which had fallen to 9 points below the anticipated level in the previous quarter, rose to 4 points below the expected level in Q3. Order volumes across the region tracked 3 points above the baseline in Q4. UK trade activity remained low compared to other markets with total transactions 5 points below the expected level. Order volumes grew at 1 point above the expected range in Q4.

“Ordering patterns give us useful clues as to how businesses are viewing demand signals for the next six months,” said James Stirk, CEO, Tradeshift. “If order volumes continue to rise in Q1, then we should start to see activity levels begin to climb in areas such as transport and logistics.”

Demand for freight capacity remained 6 points below the baseline in Q4, suggesting that the recent rise in orders observed at a macro level is not yet significant enough to alter the overall pattern of decline evident over the past eighteen months. Similarly, transactions across the manufacturing remained consistent with the previous quarter, ending the year 6 points below the anticipated level.

After a relatively solid start to the year, trade in China also stayed in contraction territory, showing only modest signs of improvement from a mid-year slump. Transaction volumes across local supply chains grew at 5 points below the baseline in Q4, compared to a 6-point deficit in the previous quarter.

“The protracted slowdown in orders we’ve seen in recent quarters has left a lot of ground to recover before demand starts to show any concrete signs of normalising,” said Stirk. “Our latest data suggests sentiment among businesses is improving, but any growth we’ve seen in Q4 is coming from a low base. While I’m cautiously optimistic, the outlook for 2024 remains heavily in the balance.”

About Tradeshift’s Index of Global Trade Health

Tradeshift’s Index of Global Trade Health analyses business-to-business transaction volumes (orders processed from buyers and invoices processed from suppliers) submitted via the Tradeshift platform to offer a perspective of how external events may be impacting business-to-business commerce in a variety of different regions and sectors across the globe.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.