Tariffs may change, but supply chain disruption won’t stop. Manufacturers can use data to stay agile, compliant, and revenue-ready.

By Ankur Gupta, Senior Director of Product Management for Model N High Tech Products

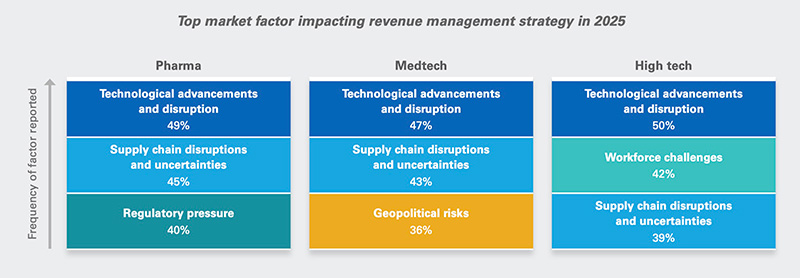

Tariffs, export controls and geopolitical tensions are creating turmoil in already complex high-tech supply chains. However, the tech industry’s rigid, sprawling networks make the industry no stranger to disruption. Even minor problems create major ripples. While the current political situation is somewhat unprecedented, manufacturers constantly deal with uncertainty. So it’s no surprise that Model N’s 2025 State of Revenue Report found supply chain issues are a top factor impacting high-tech revenue management for the fourth year in a row.

In the volatile high-tech manufacturing space, companies can’t just hope they’ll survive the inevitable disruptions and market shifts. They must develop agility to maintain profitability.

Operational flexibility comes from high-quality, real-time data combined with strong analytics and AI. This data infrastructure supports supply chain transparency, flexible contracts and dynamic pricing strategies, which enable companies to optimize revenue and navigate inevitable market turbulence.

Agility doesn’t come from collecting data but rather from the ability to interpret it. Effective analysis and AI use require timely, accurate data, a challenge many manufacturers struggle with. The Model N report found more than 90% of surveyed executives have concerns about the quality of their revenue data. They listed incomplete, inaccurate and outdated information as their top issues.

Data errors can lead to revenue leakage. For example, outdated information may put a customer in the wrong tier, triggering a rebate they don’t qualify for. If the data is incorrect, even the most advanced automation tools will produce misleading results.

Overcoming data challenges requires integration, standardization, enrichment and governance. Manufacturers must connect disparate data sources to aggregate and store the information in a central location. Automated data collection ensures timeliness and accuracy.

Traditional data warehouses are not adequate for the volume and variety of revenue management information. Transitioning to a data lake allows companies to store both structured and unstructured data, providing the foundation for advanced analytics.

Next, manufacturers must implement canonical data models to standardize data across systems. For example, a customer attributes might be different in the ERP than in the CRM, making account reconciliation difficult. A canonical model would define a single, standardized customer object and establish clear mappings with various systems and third-party data sources. The harmonization makes analysis easier because data fields carry the same meaning across systems.

Once they’ve standardized the data, manufacturers can apply AI to clean, enrich and validate the information. AI-powered tools identify gaps, flag mismatches and auto-fill missing information, improving the reliability of operational and analytical systems. For example, GenAI can extract product attributes from sales channel data to build a more complete and accurate product catalog.

These processes turn data from a hodgepodge into coherent insight. This improves day-to-day operations (like pricing and billing) while also enabling analytics, automation and AI-driven insights for business agility.

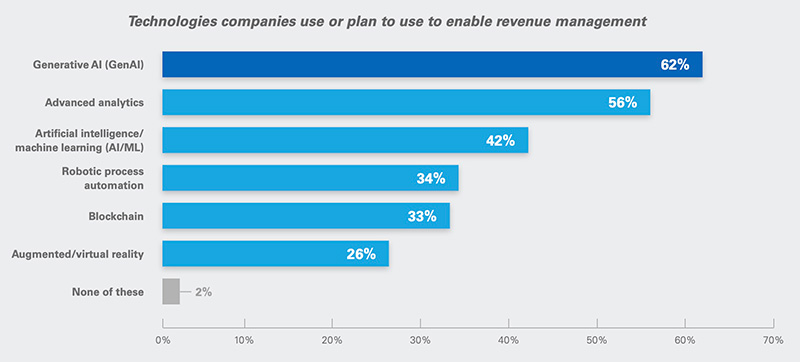

Technology has demonstrated its value for revenue management. More than 90% of business leaders in the Model N survey reported a measurable impact on revenue outcomes from their technology innovation and investments. Nearly all (98%) use or plan to implement new technology in their revenue processes.

With quality data and AI-powered tools, manufacturers can achieve several key goals.

The geopolitical situation requires supply chain transparency. Tariffs are just one challenge. Companies must also navigate export controls, denied-entity lists and retaliatory actions from multiple governments. While efforts to onshore semiconductor manufacturing may reduce some risk, true resilience comes from supply chain transparency aided by good quality data.

Regulations change quickly. If companies can’t immediately track the source and end destination of materials and products, they risk violations. Real-time data enables ongoing visibility so manufacturers can identify new and potential areas of noncompliance and gray market activity. Standardized and enriched sales data combined with geopolitical intelligence and restricted entity lists make it possible to spot red flags that otherwise might go unnoticed.

Beyond compliance, transparency also uncovers supply chain vulnerabilities, such as overreliance on a particular supplier or geographical region. With this information, manufacturers can proactively adjust supply chain strategy to avoid higher costs, material disruptions, and sales losses, and to protect against future risks.

Fluctuating trade policies can impact costs and net revenue. And in the current climate, those changes happen very frequently. Manufacturers can’t rely on stagnant pricing approaches.

AI and analytics enable manufacturers to optimize pricing strategies based on market events. These tools use real-time data on sales, contracts, channel performance, material costs, supply chain movement, regulations and market trends to create highly specific customer segments and calculate the best price and incentive structure for each.

Scenario modeling further strengthens pricing agility by giving manufacturers a way to simulate how future trade actions, cost fluctuations or policy changes could impact their contract performance and revenue. By projecting different conditions, such as a sudden raw material price spike or an export ban, companies can anticipate revenue and sales impacts. As conditions shift, these insights inform real-time pricing adjustments, helping manufacturers preserve margins and capitalize on market opportunities.

Multi-year, fixed-price contracts weren’t built for the current level of volatility. Manufacturers relying on these structures face significant revenue risks. They are locked into their contracted rates, regardless of how much production expenses or market demand increase.

Switching to contingency-based contracts benefits manufacturers and their partners. These models incorporate performance incentives and pricing adjustments tied to market changes, regulatory shifts, supply chain variations and customer demand. This approach reduces chipmakers’ financial exposure and shares market volatility risks with their customers.

AI-powered platforms enable contract negotiation to ensure the right price and rebates are incorporated, allowing companies to manage these more complex contract structures.

No one can control — or even predict — the next manufacturing industry disruption. Today’s trade challenges will resolve, only to be replaced with different issues. That’s why building the right data infrastructure is imperative. With high-quality data and the right analytics capabilities, companies gain the agility to respond to any change with speed and confidence.

About the Author

Ankur Gupta is Senior Director of Product Management for Model N High Tech products. Ankur is a seasoned product management leader, with 20 years of experience driving the growth of enterprise SaaS-based Revenue Management products at Model N (10 years) and Cloud Management product suite at Oracle (6 years). In his current role at Model N, he focuses on strategy, planning and execution of the High-Tech product line.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.