Geopolitical shifts and tariffs are redefining global supply chain strategies across the tech and semiconductor sectors.

By Mita Gupta, EVP and Business Unit Head, WNS Procurement

Today’s supply chains aren’t just being reshaped – they’re being strategically rewired. Unlike the reactive redesigns prompted by COVID-19, this new wave of change is policy-driven, and rooted in geopolitical calculus. While the US and China reached an agreement last week to suspend reciprocal tariffs for 90 days to help reach a broader trade deal – lowering tariffs from 145% to 30% on US tariffs, and from 125% to 10% on China’s – the broader implications of years of economic escalation are still unfolding.

Trump-era semiconductor tariffs, recently formalized into a blanket 25% rate – even on previously exempt components – continue to send shockwaves through global tech ecosystems. These levies, initially aimed at protecting American manufacturing and curbing adversarial trade practices, have introduced immense complexity, disrupted global sourcing norms, and raised costs across critical industries like automotive, aerospace, and healthcare.

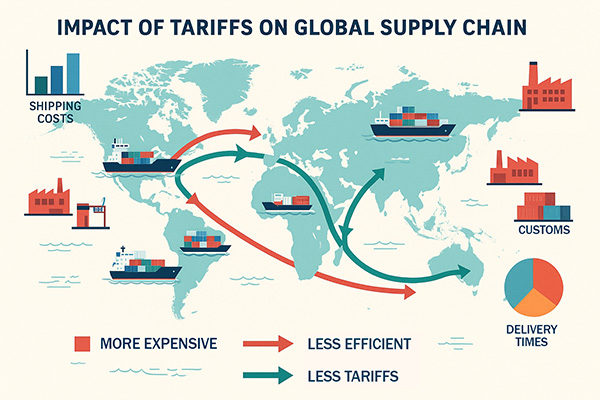

What began as a targeted tariff skirmish has evolved into a seismic reconfiguration of global supply chains, especially in technology. Companies are reengineering production networks not just to optimize cost or resilience, but to comply with rapidly shifting trade rules and geopolitical risk zones.

The recent US-China agreement to suspend or cancel certain tariffs marks a temporary cooling of tensions, but uncertainty lingers. Even with partial rollback, tariff rates remain significantly higher than pre-trade war norms. And while China has reversed non-tariff restrictions, such as curbs on rare earth exports, the US is reportedly considering plans to put several Chinese chipmaking companies on an export blacklist – signaling that tariffs remain a political tool.

This climate has accelerated China’s pursuit of semiconductor self-reliance, while the US, EU, and Japan pour billions into domestic chipmaking. Meanwhile, Taiwanese multinational chipmaker TSMC’s $100 billion investment into a US expansion, including plans for three new fabrication plants, two advanced packaging facilities and a major R&D team center, marks the largest single foreign direct investment in US history. Yet, with tariffs now overriding exemptions, even compliant imports face duties due to bureaucratic gaps caused by lack of clear policies, triggering confusion and delayed refunds.

Semiconductors, AI accelerators, GPUs, and networking gear now sit at the frontlines of trade disputes. These components power everything from smartphones to smart grids. But because their supply chains are globally distributed, often spanning five or more countries, tariffs have added cost and uncertainty at nearly every stage.

For industries like automotive, medical, and defence, the anticipated fallout is real. Tariffs can drive up input costs, delay procurement, and disrupt budget cycles. There are reports of data center operators and device makers increasingly stockpiling chips and shifting final assembly to the US or tariff-exempt regions to qualify for “Made in USA” advantages.

Some companies are implementing dual-track manufacturing strategies – maintaining parallel sourcing in both high-tariff and low-tariff regions. Others are exploiting legal backdoors: rerouting products through countries like the UK, where minor assembly or labeling tweaks allow reclassification and reduced duties.

The political volatility of global trade has elevated nearshoring and friendshoring from risk-mitigation tactics to strategic imperatives. With the US signaling that trade policy will continue to serve national security and industrial objectives, businesses are shifting supply bases locally or to countries with more stable or aligned trade relationships.

India, Vietnam, Mexico, and Malaysia are becoming go-to nodes for electronics and high-tech manufacturing. India, for example, now assembles nearly 20% of the world’s iPhones. These moves reflect a broader decoupling trend-not only from China, but from any single-source dependency.

But this shift isn’t without friction. Fragmented networks, longer qualification cycles, and rising labor and compliance costs make execution complex. For companies considering homeshoring to the United States, up-front capital and long-term operating costs for front-end capacity such as advanced logic fabs, as well as materials, packaging, and other segments, are inherently higher relative to other regions. Yet, procurement leaders recognize the upside: strategic agility, shorter lead times, and reduced exposure to tariffs that can swing wildly in a matter of weeks in the current environment.

Procurement teams are turning to Gen AI-powered platforms and tools to stay ahead. With tariffs now layered with exemptions, refund directives, and country-of-origin complexities, real-time intelligence is no longer optional.

The most resilient organizations are leveraging these tools to transform how they manage complexity and cost volatility:

At WNS Procurement, we’ve seen the applications firsthand. Our Amplifi PRO platform, with modules like ERIM (Event Risk Impact Mitigation), enables teams to simulate disruptions, assess regulatory fallout, and pivot supply lines-all in real time.

In the fast-moving technology industry, where geopolitical volatility, supply chain shocks, and regulatory shifts can upend operations overnight, traditional risk strategies like static dashboards or annual reviews are critically outdated. For procurement professionals in the technology sector, lead times are long and supplier ecosystems span the globe, so staying ahead means adopting a new mindset: from reactive risk mitigation to proactive value creation.

Forward-thinking organizations are building resilient procurement functions by embedding always-on, predictive risk frameworks that integrate deeply with business strategy. These frameworks go beyond supplier scorecards, incorporating dynamic data feeds, Gen AI-powered risk sensing, and early-warning systems that flag disruptions across upstream and downstream nodes.

Specific approaches gaining traction include:

As new deals, retaliatory tariffs, and uncertain implementation policies continue to unfold, procurement teams must:

The U.S.–China tariff developments underscore an essential truth: procurement can no longer simply operate as a tactical back-office function, it needs to step up to building a presence as a strategic force shaping resilience, innovation, and growth.

As companies rewire their global operations around policy risk and national security imperatives, those with real-time insight and rapid execution will lead.

About the Author:

Mita Gupta is the EVP and Business Unit Head of WNS Procurement. She is responsible for the business unit’s strategy, growth initiatives and financial performance. Mita has decades of experience launching and scaling businesses within B2B services and technology domains. She has driven the rapid expansion of some of the most successful companies in the procurement and supply chain sectors across dozens of countries in North America, EMEA and APAC. Before WNS, Mita donned multiple global and leadership roles in Cprime, a portfolio company of Goldman Sachs and Everstone Capital; Globality, an AI-powered B2B autonomous sourcing platform; GEP Worldwide and Kearney.

Read more from the author:

Six Ways to Navigate Supply Chain Volatility Amid Geopolitical Shifts | Supply Chain Brain, March 27, 2025

Q&A with Mita Gupta, EVP at WNS Procurement | Procurement Magazine, March 21, 2025

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.