By Kimberly Knickle, Research Vice President, IDC Manufacturing Insights

Manufacturers of every size and shape are changing rapidly because of new digital technologies, with some of the greatest impact today coming from cloud, mobile, big data and analytics, internet of things (IoT), and robotics. Manufacturers also have high expectations for the business value of technologies that are in earlier stages of adoption, such as artificial intelligence (AI) and machine learning, 3D printing, augmented reality/virtual reality (AR/VR), and even blockchain. This digital transformation (DX) is well under way, with manufacturers feeling the impact in all parts of the organization.

The stakes are incredibly high. Basically, manufacturers must either become adept at digital transformation or struggle to survive. In 2017, global organizations will spend $1.2 trillion on digital transformation (DX), with discrete and process manufacturers contributing almost 30% of this spending. Forward progress is underway, and the investments are yielding tangible results. Manufacturers have made significant progress since we last benchmarked them in 2015 — increasing the percentage of manufacturers in the two most advanced stages (managed and optimized) of our IDC MaturityScape for Digital Transformation, from 20.5% to 30.9%.

Historically, we’ve measured the health of the manufacturing industry based on productivity, but because of the pressure to digitally transform, we now look for innovation in business models and business processes as an indication of who will succeed in the coming years. It definitely isn’t enough to have technology for technology’s sake; manufacturers that can speed their adoption of digital capabilities in order to create business value will be the leaders of their industry. The results of DX are in the thinking supply chain, product and service innovation, smart manufacturing and Industry 4.0, and more.

Over the next few years, we believe some of the most notable changes in the industry will be:

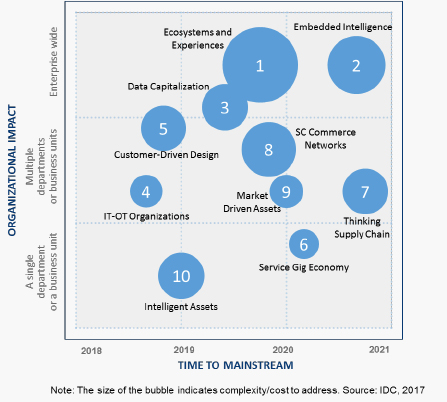

As a result, key themes woven into our worldwide manufacturing top 10 predictions for 2018 include the focus on ecosystems and experiences, greater intelligence in operational assets and processes, data capitalization, the convergence of information technology (IT) and operations, and rethinking work. Most of our predictions refer to a continuum of change and digital transformation (DX) within the wider ecosystem of the manufacturing industry and global economy.

While the predictions offered here largely focus on the near- to midterm (2018–2021), the impact of many of these will be felt for years to come. Our worldwide manufacturing 2018 predictions are:

While the predictions offered here largely focus on the near- to midterm (2018–2021), the impact of many of these will be felt for years to come. Our worldwide manufacturing 2018 predictions are:

For each of these predictions, we suggest that manufacturers think about the impact on their IT organizations and on the larger business as well. An increasing share of IT spending and IT project management is coming from outside the IT organization. Yet eventually those IT investments must tie into the existing IT portfolio and enterprise architecture in a cohesive way, not to mention the fact that the IT organization may take on managing any IT assets that are acquired even through the line of business. For example with IoT projects, we know that only 40% of IoT projects are driven from IT and 55% are funded exclusively by business (based on the worldwide manufacturing results from IDC’s Global IoT Decision Maker Survey, 2017).

And across the predictions as a whole, we recommend that manufacturers take the following approaches to ensure they are maximizing the value they derive from both current and future technology investments:

While the predictions offered here largely focus on the near- to midterm (2018–2021), the impact of many of these will be felt for years to come, and we’re looking forward to what 2018 will bring to the manufacturing industry.

About Kimberly Knickle:

About Kimberly Knickle:

As a research vice president in IDC Manufacturing Insights, Kimberly Knickle is responsible for research and analysis of business and IT issues for manufacturers. She leads the IT Priorities & Strategies program, which focuses on hot topics and technologies that are changing the way manufacturers buy and use IT, such as digital transformation, big data and analytics, cloud, IoT, mobility, and 3D printing. The program also includes research based on IDC survey data related to manufacturers’ IT investment priorities and plans. Knickle also contributes to the Product Innovation, Service Innovation, and Connected Products research.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.