A lack of inland ocean chassis availability to be expected at the West and East Inland rail ramp regions.

(RENO, NEV.) – ITS Logistics, today released the January forecast for the ITS Logistics US Port/Rail Ramp Freight Index. This month the index reflects a forecast for a muted increase in inbound volumes due to Lunar New Year, with a slight increase in container volumes. There is also cause for concern with inland ocean chassis at the rail ramps, as rail operations could be impacted by a lack of ocean chassis availability.

“The Lunar New Year is once again approaching and as a result, we can expect to see a slight increase in container volumes, but it should not add any significant stress to US Port operations,” said Paul Brashier, Vice President, Drayage and Intermodal for ITS Logistics. “This time of year traditionally has an immense impact on the logistics infrastructure as China and other Southeast Asian countries temporarily shut down production facilities and operate transportation services with significantly limited personnel on hand.”

Also known as the Chinese New Year (CNY) or Spring Festival, the Lunar New Year is one of the most significant Chinese celebrations that marks the start of the year within the Chinese calendar. A seven-day public holiday in China (January 21-27, 2023), traditional activities begin as early as three weeks before the eve of the holiday and can last for two weeks past the official end date.

“This is a time when families reunite, but during the holiday almost everything shuts down which in turn creates a big disruptor for the industry,” continued Brashier. “A bottleneck can be caused due to orders flooding in before the Lunar New Year and heavy delays can be experienced with goods exported from, as well as imported into, the countries that acknowledge the holiday. Both the Atlantic and Gulf regions are expected to experience higher than normal volumes as a result.”

Despite shipping ports and airports remaining open during the Lunar New Year, they will operate at a limited capacity. As a result, the overall process of shipments being loaded and discharged may be delayed due to limited personnel and cargo deliveries. The trucking sector of the industry is expected to ramp up the transportation of containers to and from the ports, which is critical to meet deadlines for the shipping line and ports. Local factories tend to shut down production during this time for at least 2-3 weeks during the holiday period and freight rates can increase.

“Ultimately, it’s vital that companies plan early for these industry disruptions,” continued Brashier. “It’s important to communicate with your suppliers to remain aligned and also take into consideration additional manufacturing locations that can be utilized during this time.”

In addition to the disruptions being caused by the approaching Lunar New Year, there are headwinds and potential issues that could disrupt port/rail ramp operations this month.

“The ILWU and Terminals have still not come to terms on a new contract,” continued Brashier. “Rail operations could be affected by a lack of ocean chassis availability as more volumes move IPI and move via rail further inland since the resolution of rail labor disputes. The ocean chassis availability is expected to potentially impact both the West and East Inland rail ramp regions.”

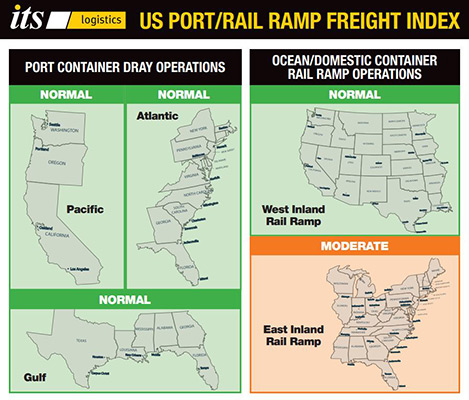

The ITS Logistics US Port/Rail Ramp Freight Index forecasts port container and dray operations for the Pacific, Atlantic, and Gulf regions. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions. Visit here for a full comprehensive copy of the index with expected forecasts for the US port and rail ramps.

ITS Logistics provides port and rail drayage services in 22 coastal ports and 30 rail ramps throughout North America.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.