Beneficial cargo owners and shippers urged to focus efforts on visibility and technology for end of year.

(RENO, NEV.) – ITS Logistics, today released the May forecast for the ITS Logistics US Port/Rail Ramp Freight Index. This month the index forecasts an improvement from severe concern to elevated concern for the Pacific Ocean Region but continued problematic empty return availability and dual transaction mandates at the terminals.

“We are still advising caution when conducting business on the west coast,” said Paul Brashier, Vice President of Drayage and Intermodal for ITS Logistics. “The International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA) have agreed to some tentative terms, including automation, but more difficult negotiable topics surrounding benefits and pay have not yet been decided.”

“In addition, empty return availability and dual transaction mandates at the terminals in L.A. and Long Beach are still proving to be problematic for the industry.”

According to the 2022 California Supply Chain Success Initiative Summary Report, the freight industry is worth $2.8 trillion for the state of California, and 735.9 billion ton-miles of cargo flow through the region. The Port of Los Angles in 2021 brought in 10,677,610 TEU followed by the Port of Long Beach bringing in 4,753,828 TEU. Despite the success that the ports have experienced over the years, currently, the risk of losing more cargo to the East Coast is steadily increasing as negotiations continue.

“Industry experts are still uneasy about doing business at these specific ports, which as we’ve seen has resulted in the East Coast Ports receiving increased cargo,” continued Brashier. “Should the trend continue long-term then there is the risk that the L.A. and Long Beach ports will gradually decline from being the number one ocean gateway. As of now, there have been no work slowdowns or red-tagging activity since April 24, so we’re hoping that business begins to pick up and negotiations reach a conclusion in the coming months.”

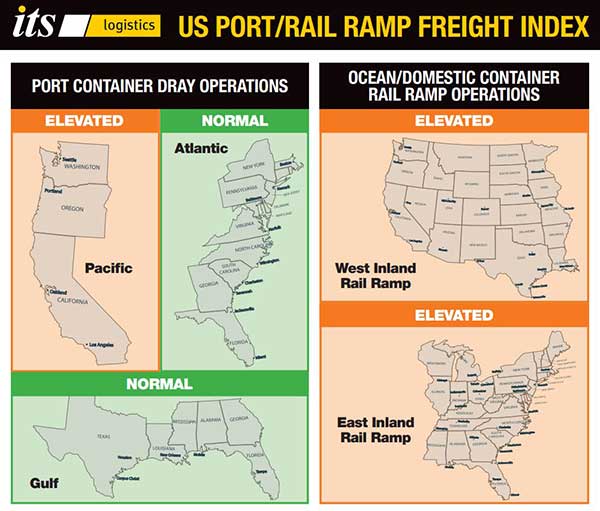

While operations remain fairly fluid at the L.A. and Long Beach ports, the ITS forecast is stable through May in that region. It is due to the current ILWU and PMA negotiations, however, that the terminal operations are elevated in the Pacific Region. On the contrary, the Gulf and Atlantic Ocean Terminal activity is still at normal operations and inbound volumes remain low as retailers and manufacturers continue to burn through high inventories.

Just last month CNBC reported that 20% of companies nonseasonal inventory was sitting in warehouses. A total of 27% of participants who contributed to the CNBC Supply Chain Survey also confirmed that they were selling products on the secondary market. This decision was being made due to inventory impacting their bottom line by remaining in warehouses with elevated storage prices. The survey too found that 50% of respondents were using ocean containers as storage for over four months.

“We are seeing various clients across industries utilize rail containers, 53-foot trailers, and ocean containers for storage because distribution centers were full,” continued Brashier. “Peak season will be here soon in Q3 and Q4 with volumes increasing more later this year. Shippers and carriers must take advantage of this lull to focus on planning. The goal should be to ensure optimal operational execution for shippers, ocean carriers, and trucking. All, if not most, of trucking procurement should be completed by the end of the month. BCO’s and shippers should focus efforts on visibility and technology to ensure smooth sailing for the last half of the year.”

ITS Logistics offers a full suite of network transportation solutions across North America and omnichannel distribution and fulfillment services to 95% of the U.S. population within two days. These services include drayage and intermodal in 22 coastal ports and 30 rail ramps, a full suite of asset and asset-lite transportation solutions, omnichannel distribution and fulfillment, and outbound small parcel.

The ITS Logistics US Port/Rail Ramp Freight Index forecasts port container and dray operations for the Pacific, Atlantic, and Gulf regions. Ocean and domestic container rail ramp operations are also highlighted in the index for both the West Inland and East Inland regions. Visit here for a full comprehensive copy of the index with expected forecasts for the US port and rail ramps.

About ITS Logistics

ITS Logistics is a premier Third-Party Logistics company that provides creative supply chain solutions with an asset-lite transportation division ranked #23 in North America, the #11 drayage and intermodal provider, a top-tier asset-based dedicated fleet, and innovative omnichannel distribution and fulfillment services. With the highest level of service, unmatched industry experience and work ethic, and a laser focus on innovation and technology–our purpose is to improve the quality of life by delivering excellence in everything we do.

Media Contact

Amber Good

LeadCoverage

amber@leadcoverage.com

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.