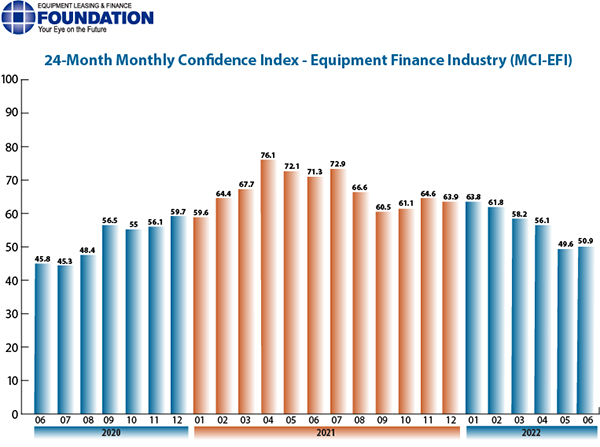

Confidence in the equipment finance market is 50.9, steady with the May index of 49.6.

Washington, DC – The Equipment Leasing & Finance Foundation (the Foundation) releases the June 2022 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 50.9, steady with the May index of 49.6.

When asked about the outlook for the future, MCI-EFI survey respondent Glenn Davis, President, RESIDCO, said, “Interest rates are a major concern. Uncertainties related to Fed action or inaction, as well as the continuing war in Ukraine will weigh heavily on the economy.”

The overall MCI-EFI is 50.9, steady with the May index of 49.6.

Bank, Small Ticket

“The equipment leasing and finance business adapts to change and finds ways to win in difficult environments. The rising rate environment is a healthy change from the past decade and creates the opportunity to build margin back into business models and strengthen the community.” David Normandin, CLFP, President and CEO, Wintrust Specialty Finance

Independent, Small Ticket

“When the supply chain is repaired, and should demand evaporate, we will have a bigger issue than we do today.” James D. Jenks, CEO, Global Finance and Leasing Services, LLC

Bank, Middle Ticket

“Supply chain issues continue to linger, especially with light duty trucks. We continue to see interest from our customers with large expansion projects to lock in rates while they remain at historically low levels.” Michael Romanowski, President, Farm Credit Leasing

Why an MCI-EFI?

Confidence in the U.S. economy and the capital markets is a critical driver to the equipment finance industry. Throughout history, when confidence increases, consumers and businesses are more apt to acquire more consumer goods, equipment, and durables, and invest at prevailing prices. When confidence decreases, spending and risk-taking tend to fall. Investors are said to be confident when the news about the future is good and stock prices are rising.

Who participates in the MCI-EFI?

The respondents are comprised of a wide cross-section of industry executives, including large-ticket, middle-market and small-ticket banks, independents, and captive equipment finance companies. The MCI-EFI uses the same pool of 50 organization leaders to respond monthly to ensure the survey’s integrity. Since the same organizations provide the data from month to month, the results constitute a consistent barometer of the industry’s confidence.

How is the MCI-EFI designed?

The survey consists of seven questions and an area for comments, asking the respondents’ opinions about the following:

Survey results are posted on the Foundation website, https://www.leasefoundation.org/industry-resources/monthly-confidence-index/, included in the Foundation Forecast eNewsletter, and included in press releases. Survey respondent demographics and additional information about the MCI are also available at the link above.

JOIN THE CONVERSATION

Twitter: https://twitter.com/LeaseFoundation

Facebook: https://www.facebook.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector—and its people—forward through industry-specific knowledge, intelligence, and programs that contribute to industry innovation, individual careers, and the overall betterment of the equipment leasing and finance industry. The Foundation is funded through charitable individual and corporate donations. Learn more at www.leasefoundation.org.

Media Contact: Charlie Visconage, cvisconage@leasefoundation.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.