By Chris Gerda

Many manufacturing organizations have been the victim of financial crime, and it often comes in the form of an attack from a sophisticated cyber fraudster or malicious supplier or employee. These fraudsters are technologically savvy and agile, making it difficult to establish a strong risk mitigation strategy for payments security around new vendor onboarding and change management.

The statistics surrounding fraud tell a compelling story about its scope. According to Strategic Treasurer, a full 79% of organizations were the victims of payment fraud in the past year, and 56% of corporates experienced fraud or data theft in that span. A lack of secure processes for payments is a trouble spot across all industries, but fraudsters often target manufacturers precisely because their activities involve high volumes of large, complex payments. Given that fraud incidents carry massive financial and reputational losses, many businesses are locked into a no-win situation unless they can drastically improve security.

This landscape is harder to navigate for businesses with complex supply chains, and if you’re reading this, that likely includes yours.

How can manufacturing organizations juggle the difficult fraud landscape against the needs of their customers and suppliers without making major sacrifices along the way? One critical strategy is streamlining, automating and securing key accounts payable functions. That results in a host of benefits in addition to greatly reducing the risk of fraud, such as greater efficiency, reduced costs, and increased AP staff productivity.

There are a number of accounts payable technology solutions available to manufacturing organizations, which often layer in security-focused features and services that go above and beyond what might be native in your ERP, banking technology, and existing business processes. The costs associated with implementing an AP automation solution are offset by long-term savings realized and mitigated risk of financial and reputational damages that result from fraud. Ensuring suppliers stay happy with a shift to automated, electronic payments is important, and boasting better security is just one more selling point for your critical business partners.

To help your organization drastically reduce its risk of suffering a payment fraud loss, let’s look at the critical security measures that should be a part of your accounts payable automation strategy.

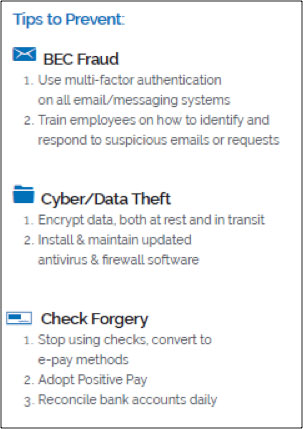

Here are tips for proven strategies that prevent BEC Fraud, Cyber and Data Theft, and Check Forgery – where does your organization stand?

Preventing Outside Threats: You need to know who you’re paying, and your suppliers need to know their payments aren’t being misdirected. Supplier onboarding using digital identity verification methods via technology partners and their in-house experts ensure that supplier funds can’t be misdirected by an imposter pretending to be your supplier, a member of your AP team, or even your CEO. Verifying email domains, digging into IP addresses, and validating phone numbers are just some of the ways digital verifications provides critical protections that are staples of efficient and effective vendor onboarding in today’s world.

Preventing Account Changes: Imposters are enough trouble, but the other most impactful fraud scenario for any manufacturer has to be a fraudster socially engineering the change of account information due to Business Email Account Compromise. Ensuring that only credentialed AP team members have access to accounts, maintaining a strong internal cybersecurity posture of never changing account information without a dual control while using digital verification methods, and adopting payment monitoring technology are all factors to mitigate this damaging risk.

Reducing the Risk of Check Fraud: Checks will continue to be a very fraud-prone payment type, and many manufacturers are still wholly or primarily reliant on them as a method for paying suppliers.

You don’t have to move away from checks entirely tomorrow, but checks are not the payment methods that will be driving business relationships of the future. Electronic payments can improve security while also supporting convenience and speed. Technologies like Positive Pay absolutely do make checks safer, but in a way that can be compared to putting Kevlar on a horse and buggy. The problem is that not only are ACH and card secure, but they’re also much faster, help to increase account reconciliation timeframes, and generally increase overall AP efficiency.

Securing Critical Bank Data: By working with a technology partner to hold and vet sensitive supplier bank account information, your organization can remove the risk of a breach from play. Holding on to supplier account information is a liability and carries potential for fraud and damaged relationships with key vendors, offloading that task to a partner who specializes in it can be a lifesaver.

Building Better Analytics: Ultimately, better insight into your payments and where you’re experiencing fraud attempts and reconciliation problems can help you make better business decisions. Whether you’re bolting on reporting to existing accounting systems or getting insights from a trusted partner, you’ll want access to dashboards that give you an at-a-glance look into the associated risk of your suppliers and transactions. This is especially crucial to fight fraud, as you’ll be able to catch payment red flags before funds leave the door.

With the evolving payment fraud landscape, the payments that make your supply chains possible have never been more important to secure. Fortunately, technology is available to help your business make payment security upgrades that protect and strengthen relationships with your customers and your suppliers.

Chris Gerda

Chris Gerda serves as the head of risk and fraud prevention overseeing the Paymode-X B2B payment network for Bottomline Technologies. He is responsible for overall anti-fraud strategy and technology initiatives to maintain the security of $200 billion in payments within the 400,000+ network membership base.

Prior to joining Bottomline, Chris served as the Bank Secrecy Act Manager at Pershing LLC, the largest Broker-Dealer Clearing Firm in the United States. He has managed investigations of complex financial crime schemes and money laundering internationally and previously served in a senior investigative role in Anti-Money Laundering at the Bank of New York Mellon. Chris is a former police officer and is a United States Army Veteran. He holds a B.S. in Criminal Justice from Plymouth State University and a M.S. in Fraud and Forensics from Carlow University.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.