March 2024 U.S. cutting tool consumption totaled $212.4 million, down 1.1% from February’s $214.6 million, according to USCTI and AMT.

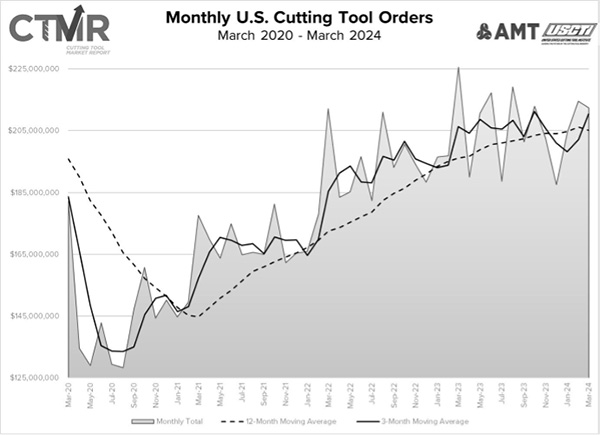

McLean, Va. — March 2024 U.S. cutting tool consumption totaled $212.4 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was down 1.1% from February’s $214.6 million and down 5.8% when compared with the $225.6 million reported for March 2023. With a year-to-date total of $631.5 million, 2024 is up 2% when compared to the same time period in 2023.

“Despite the troubles at Boeing, cutting tool shipments to aerospace and defense-related manufacturing remain quite strong,” declared Jack Burley, chairman of AMT’s Cutting Tool Product Group. “First quarter data indicates that consumption of cutting tools and tooling remains on pace with current industrial production at a modest level. This may be an indicator of somewhat sluggish activity.

“New projects are available in most industries, but many customers are reluctant to move forward, possibly because they are worried about inflation and election results. Despite the downward trend in new machine tool orders, I find it very interesting that cutting tools and related accessories to keep shops running are still performing reasonably well.”

Steve Stokey, executive vice president and owner of Allied Machine and Engineering, agreed that inflation remained an industry concern.

“The first quarter of 2024 is up slightly over the first quarter of 2023, but the long-run trend has turned negative for the first time since March 2021, when the industry began to recover from the COVID-19 downturn,” Stokey said. “Stubbornly high inflation appears to be a drag on the industry as the number of units shipped has shown a more sluggish trend than the value of shipments. The remainder of the year could end flat or slightly down from 2023 if these patterns continue.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

AMT – The Association For Manufacturing Technology represents and promotes U.S.-based manufacturing technology and its members – those who design, build, sell, and service the continuously evolving technology that lies at the heart of manufacturing. Founded in 1902 and based in Virginia, the association specializes in providing targeted business assistance, extensive global support, and business intelligence systems and analysis. AMT is the voice that communicates the importance of policies and programs that encourage research and innovation, and the development of educational initiatives to create tomorrow’s Smartforce. AMT owns and manages IMTS – The International Manufacturing Technology Show, which is the premier manufacturing technology event in North America.

The United States Cutting Tool Institute (USCTI) was formed in 1988 and resulted from a merger of the two national associations representing the cutting tool manufacturing industry. USCTI works to represent, promote, and expand the U.S. cutting tool industry and to promote the benefits of buying American-made cutting tools manufactured by its members. The Institute recently expanded its by-laws to include any North American manufacturer and/or re-manufacturer of cutting tools, as well as post-fabrication tool surface treatment providers. Members, which number over 80, belong to seven product divisions: Carbide Tooling, Drill & Reamer, Milling Cutter, PCD & PCBN, Tap & Die, Tool Holder and All Other Tooling. A wide range of activities includes a comprehensive statistics program, human resources surveys and forums, development of product specifications and standards, and semi-annual meetings to share ideas and receive information on key industry trends

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.