Asset-intensive manufacturers must accurately track assets & liabilities to take advantage of the CARES Act & reduce material weaknesses.

By Ellen Barker, CPA, Subject Matter Expert at Bloomberg Tax & Accounting

Just as tax departments were starting to adapt to the changes spurred by the global pandemic, the accounting landscape is once again transforming. With the promise of a viable vaccine from Pfizer announced in early November, accounting executives are once again faced with potential change. The so called “new normal” may soon be a thing of the past, and the hope of returning to business as usual in the near future is a possibility. However, even if the pandemic comes to an end, the 2020 CARES Act is still in effect, and that means that its impact on tax and accounting, and in particular, on a manufacturer’s financial reporting (at least for 2020) is imminent.

Having significant fixed assets is characteristic of a manufacturer, so they are likely to have a large number of NOLs or other tax attributes on their balance sheets. This means that manufacturers are generally more sensitive to economic downturns or sudden changes to how deferred tax assets and liabilities are computed, such as what happened with the passing of the CARES Act. As any accounting executive can attest to, with rapid change, comes the risk for material weaknesses. As a result, asset-intensive manufacturers need to accurately track revalued tax assets and liabilities to not only take advantage of the stimulus being offered, but to also mitigate the risk of material weaknesses or controls issues.

A typical manufacturer has significant deferred tax liabilities resulting from differences in depreciation between generally accepted accounting principles (GAAP) and income tax reporting methods. Consider this common scenario:

Manufacturer ABC has federal tax depreciation of $350 million and GAAP depreciation of $250 million. The difference in depreciation is $100 million. Assuming the tax rate is 21%, the difference in tax is $21 million (21% x $100 million).

At first glance, simple enough. But under the lens of Section 2307 of the 2020 CARES Act, this common scenario is no longer straightforward. Section 2307 includes a technical correction to the depreciation treatment of qualified improvement property (QIP). The technical correction assigns a 15-year instead of 39-year recovery period to QIP placed in service after December 31, 2017, making QIP eligible for bonus depreciation.

Assuming Manufacturer ABC has $195 million of QIP.

| Post-CARES Act QIP Depreciation: | $195,000,000 (100% of $195 million) |

| Pre-CARES Act QIP Depreciation: | $5,000,000 ($195 million/39 years) |

| Depreciation Increase: | $190,000,000 |

Because of the QIP technical correction, Manufacturer ABC’s $21 million deferred tax liability (DTL) would need to increase to $60.9 million, resulting in a $39.9 million balance sheet increase, and a $39.9 million earnings decrease (i.e. $190 million x 21%). Inadvertently missing this income statement and balance sheet correction is just one example of the many potential issues that arise when rapid tax law changes are made.

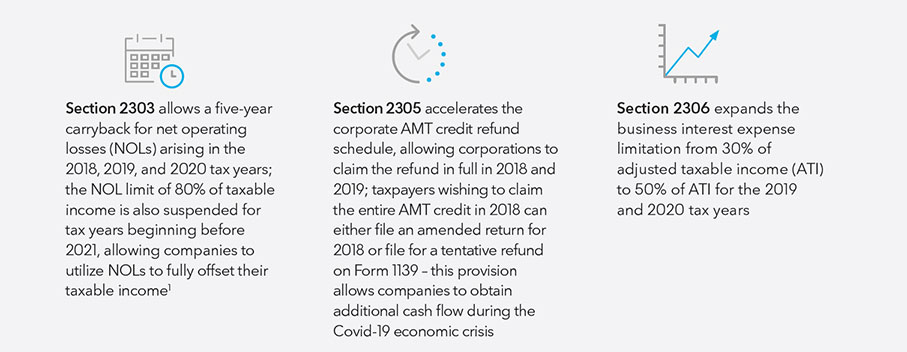

Other business tax provisions from the 2020 CARES Act

State taxation is yet another area that must be taken into consideration. Because states vary on whether they conform to federal tax laws, large variances in state taxable income is common. If not calculated accurately, these variances can create another material vulnerability. When it comes to accurately calculating state income, the problem is two-fold. First, keeping up with each state’s response to tax reform, such as the 2020 CARES Act, is a huge undertaking, but achievable with enough manpower and/or the availability of third-party tax research. The second and arguably bigger issue is the implementation of tax changes at scale. Most finance departments have inherited systems that were not designed to handle rapid tax and regulation changes like we have witnessed in the past few years. This is why spreadsheets — despite the well-known risks such as calculation and human errors — are still widely used by tax and accounting executives.

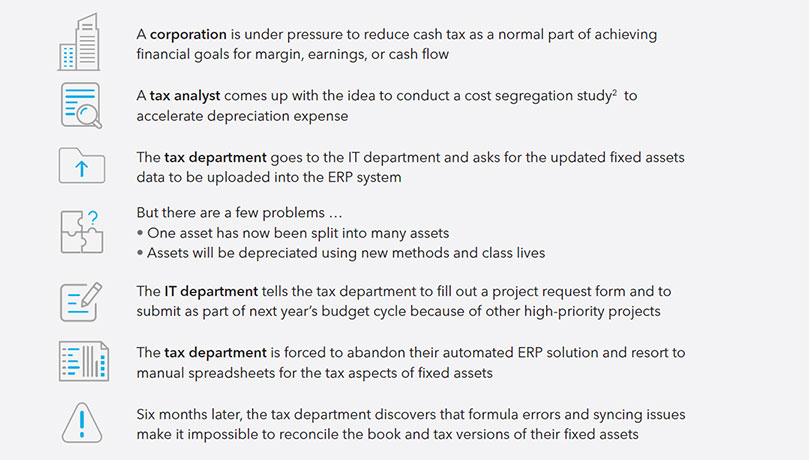

Just like in medicine, treating the symptom without addressing the root cause is likely a fruitless effort. To remedy the material weaknesses ailment, the prudent first step should be to determine how the material weakness came into existence in the first place. Consider this real-life example of how a material weakness can easily come to fruition.

The failure to understand operational limitations of existing accounting systems & available IT resources can lead to material weaknesses.

The following checklist can help tax departments recognize some of the warning signs that could lead to material weaknesses in financial reporting. Answering “Yes” to any of the questions on the checklist, means your company might be at risk for material weaknesses in financial reporting.

❑ Do you depend on systems that are not tax-sensitive?

❑ Do you depend on your IT department to implement tax law changes?

❑ Do you have trouble getting the IT department to prioritize your projects?

❑ Do your projects fail to get completed on time?

❑ Do you lack the support of executives and other leadership?

❑ Is a plan for technical corrections nonexistent?

❑ Do you forget to outline assumptions made during the provision period?

❑ Does IT have difficulty understanding how to code tax calculations?

❑ Are you missing a process to address retroactive changes?

❑ Does tax reform materially change your tax position?

❑ Are you already working around limitations in your operations?

❑ Are you already doing tasks and calculations manually?

❑ Do you have too many spreadsheet models?

❑ Is your data untrustworthy?

❑ Do you have staff, time, cost, or other resource constraints?

Early and ongoing communication with your IT department and software vendors about upcoming projects, such as implementing CARES Act tax law changes, is a simple, yet effective way to reduce material weakness risk. This is especially important if your project includes software code changes. While this may sound rudimentary, it is surprising how often accounting and tax teams neglect to involve IT until the eleventh hour.

To accurately forecast the project timeframe, ask your IT team and partners if your systems automatically update new tax laws and are tax sensitive. If your systems lack these critical features and it is not feasible to switch over to a more robust accounting system, expect the project to take longer than originally anticipated as there will be more manual processes involved. In addition, consider hiring a tax technology expert (either in-house or outsourced) to ensure the latest tax law changes are reflected in your tax planning efforts. Issues that could lead to material weaknesses should be elevated to the top of the priority list and given the appropriate visibility. Be diligent in getting the entire team involved, from tax advisers to IT vendors to internal IT and, of course, your key tax and accounting staff.

Whether we are near the end of the pandemic or not, the 2020 CARES Act is poised to significantly impact your tax and accounting software systems, processes, and financial reporting. If history is meant to repeat itself, then the future holds even more swift and significant tax law changes. To defend the integrity of your company’s financial reporting now and in the future, the best defense is a strong offense in the form of agile operational processes and systems that can withstand whatever new tax regulations are thrown our way.

Ellen Barker is a Subject Matter Expert for Bloomberg Tax & Accounting. She is responsible for researching and designing tax and accounting requirements for Bloomberg Tax & Accounting Fixed Assets. Prior to Bloomberg Tax & Accounting, Ellen was a Senior Tax Associate in Dixon Hughes Goodman LLP’s Metro DC market.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.