Effective April 1, many employers will be required to provide paid, job-protected leave for employee absences related to COVID-19.

By Amy Jordan Wilkes

The Families First Coronavirus Response Act goes into effect April 1, 2020 for many employers and, for the first time under federal law, will require paid, job-protected leave for employee absences related to the COVID-19 pandemic. The Act will remain in effect until December 31, 2020. While the Act may seem straightforward, there are many potential pitfalls waiting to trap unwary employers. All employers should review the Act’s requirements carefully to ensure they act in compliance with the law and provide eligible employees with the now federally mandated paid leave.

The Families First Coronavirus Response Act (the “Act”) generally applies to employers who have less than 500 full-time and part-time employees, and requires that these covered employers provide two types of paid leave to employees. Although many employers are understandably concerned about their ability to provide paid leave to employees during uncertain economic times, employers will be reimbursed dollar-for-dollar for both types of leave through a refundable tax credit.

Covered employers must provide all employees up to 80 hours of paid sick time at the employee’s regular rate of pay when the employee is unable to work (including working remotely from home) because the employee:

(1) is subject to a quarantine order related to COVID-19;

(2) has been advised by a health care provider to self-quarantine due to COVID-19;

(3) is experiencing symptoms of COVID-19 and seeking a medical diagnosis;

(4) is caring for an individual subject to a quarantine order or who has been advised to self-quarantine by a health care provider;

(5) is caring for the employee’s child under 18 if school or daycare has been closed due to COVID-19; or,

(6) is experiencing any other “substantially similar condition” as specified by federal authorities.

When an employee takes paid sick leave under the Act, the employee is required to provide documentation supporting the need for leave.

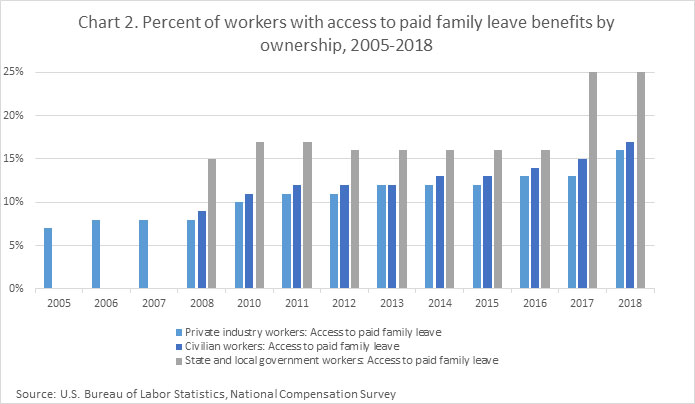

For the first time under federal law, paid, job-protected leave will be required for employee absences related to the COVID-19 pandemic. Graph source: Bureau of Labor Statistics https://www.bls.gov/ncs/ebs/factsheet/family-leave-benefits-fact-sheet.htm

The Act also amends the Family Medical Leave Act and requires covered employers to provide up to 12 weeks of paid family leave when an employee is unable to work because the employee must care for a child under 18 whose school or daycare is closed for reasons related to COVID-19.

The family leave portions of the Act only apply to employees who have been employed for at least 30 calendar days. With certain exceptions for small employers who have less than 25 employees, employees who take paid family leave under the Act have a right to reinstatement following leave. When the need for family leave is foreseeable, employees should provide notice of the leave to the employer as soon as practicable. And, just as with sick leave, when an employee takes family leave the employee is required to provide documentation supporting the need for leave. Small businesses with less than 50 employees may qualify for an exemption from the requirement to provide leave due to school or childcare closings if the leave requirements would jeopardize the viability of the business.

Employees who are unable to work and take paid sick leave may be entitled to compensation at 2/3 of their regular rate of pay, or the applicable minimum wage, whichever is higher, up to a maximum of $511 per day, or $5,110 total over the entire paid sick leave period. These benefits apply to employees who:

(1) are subject to a quarantine order related to COVID-19;

(2) have been advised by a health care provider to self-quarantine due to COVID-19; or,

(3) are experiencing symptoms of COVID-19 and are seeking medical diagnosis.

Employees who are unable to work and take paid family leave may be entitled to compensation at 2/3 of their regular rate of pay, or the applicable minimum wage, whichever is higher, up to a maximum of $200 per day, or $2,000 total to care for individual who must quarantine or is experiencing a “substantially-similar” condition, or $12,000 total to care for a child whose school or daycare is closed for the 12-week period. These benefits apply to employees who are:

(1) caring for an individual subject to a quarantine order related to COVID-19 or who has been advised by a health care provider to self-quarantine due to COVID-19;

(2) caring for their child whose school or daycare is closed due to COVID-19; or,

(3) experiencing any other substantially-similar condition.

Employees taking family leave may take paid sick leave for the first ten days of the leave period, or they may substitute any accrued vacation leave, personal leave, or sick leave.

As with most other federal employment laws, covered employers are required to provide employees with a notice describing the Act’s requirements, which employers may do electronically. The Act also prohibits employers from retaliating against employees who take paid sick or family leave or who otherwise engage in protected activity under the Act.

Employers who violate the Act are subject to penalties including fines and imprisonment as well as damages, including attorney’s fees. Recognizing the uncertainties and difficulties facing businesses during this period of national emergency, the Department of Labor will observe a temporary period of non-enforcement of the Act for the period March 18, 2020 through April 17, 2020, provided the employer has made reasonable, good faith efforts to comply.

Since the Act was passed, employers have raised numerous questions regarding compliance, including how to count employees working for different entities toward the coverage threshold, whether sick leave or family leave may be taken intermittently, how to properly calculate the employee’s regular rate of pay, and what happens if a business furloughs employees or shuts down. Although the Department of Labor has issued guidance on some of these issues and will be issuing formal regulations in April, employers should contact legal counsel with specific questions regarding compliance with the Act.

Amy Jordan Wilkes

Amy Jordan Wilkes is a partner at Burr & Forman (Birmingham, Ala.), where she regularly counsels employers with respect to all types of human resource issues. She may be reached at awilkes@burr.com.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.