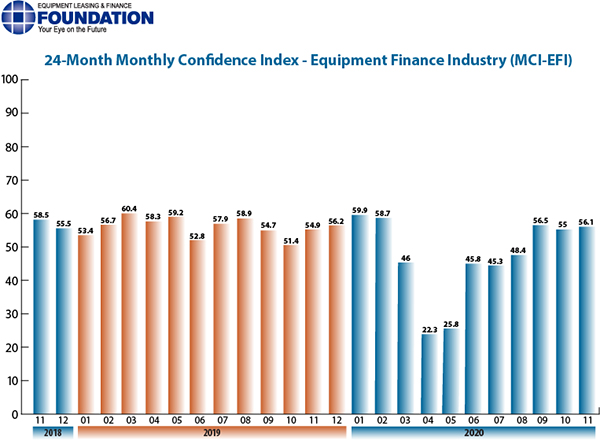

The overall Monthly Confidence Index in November is 56.1, an increase from the October index of 55.0.

Washington, DC – The Equipment Leasing & Finance Foundation (the Foundation) releases the November 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 56.1, an increase from the October index of 55.0.

The Foundation also releases highlights of the COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry. 55 survey responses were collected from November 2-13 on a range of topics, including payments deferrals, defaults, and staff analysis. 54% of companies expect that the default rate will be greater in 2020 than in 2019, down from 56% in October; 35% expect it to be the same, unchanged from last month; and 11% expect it to be lower compared to 9% last month. Only 4% of lenders reported having more than 10% of their portfolio now under deferral, down from 7% of lenders last month. The largest percentage of respondents (69%) have 0.01-4.99% of dollars outstanding currently under payment deferral in their owned portfolio. Comments from survey respondents follow MCI-EFI survey comments below, and additional survey results and analysis are available at https://www.leasefoundation.org/industry-resources/covid-impact-survey/.

[Note: Some MCI and COVID-19 Impact survey questionnaires and comments were submitted before Election Day results were publicized.]

When asked about the outlook for the future, MCI-EFI survey respondent Michael Romanowski, President, Farm Credit Leasing, said, “All eyes are on the election. Depending on what shakes out with the political environment will impact businesses’ longer-term plans for investment. The present environment is on shaky ground and fiscal stimulus is needed to stop the tremors.”

The overall MCI-EFI is 56.1, an increase from the October index of 55.0.

Bank, Small Ticket

“Following the distraction of the election, business will get re-focused on winning with whatever the new rules of engagement are and will continue to find ways to win.” David Normandin, CLFP, President and CEO, Wintrust Specialty Finance

Independent, Middle Ticket

“We believe better health outcomes related to the pandemic (therapeutics, forthcoming vaccine) coupled with more government stimulus will allow business formation and capital expenditures to return to a more normal pace.” Bruce J. Winter, President, FSG Capital, Inc.

Bank, Small Ticket

“Over the near term we expect continued volatility due to the election and impact of the continued COVID pandemic until such time as a vaccine is developed and accepted. Mid- and long-term we expect continued growth due to the resilient nature of the U.S. economy and our industry.” Kirk Phillips, President & CEO, Wintrust Commercial Finance

Independent, Middle Ticket

“Our portfolio is comprised of all investment grade credits so we have not seen any defaults due to COVID-19 impact. We have not received any requests by our customers for deferral of rents.” Aylin Cankardes, President, Rockwell Financial Group.

“The short-term effect will depend on the outcome of the election for my company as we are 100% oil and gas.” Tracy Trimble, President, US Global Asset Investments, LLC

To participate in the COVID-19 Impact Survey of the Equipment Finance Industry: The Foundation invites all regular ELFA member companies to participate each month. Survey responses are limited to one per company. If you did not receive a survey and would like to participate, please contact Stephanie Fisher, sfisher@leasefoundation.org, by November 30 to determine eligibility for inclusion in the December survey.

ABOUT THE MCI

Why an MCI-EFI?

Confidence in the U.S. economy and the capital markets is a critical driver to the equipment finance industry. Throughout history, when confidence increases, consumers and businesses are more apt to acquire more consumer goods, equipment, and durables, and invest at prevailing prices. When confidence decreases, spending and risk-taking tend to fall. Investors are said to be confident when the news about the future is good and stock prices are rising.

Who participates in the MCI-EFI?

The respondents are comprised of a wide cross-section of industry executives, including large-ticket, middle-market and small-ticket banks, independents, and captive equipment finance companies. The MCI-EFI uses the same pool of 50 organization leaders to respond monthly to ensure the survey’s integrity. Since the same organizations provide the data from month to month, the results constitute a consistent barometer of the industry’s confidence.

How is the MCI-EFI designed?

The survey consists of seven questions and an area for comments, asking the respondents’ opinions about the following:

How may I access the MCI-EFI?

Survey results are posted on the Foundation website, https://www.leasefoundation.org/industry-resources/monthly-confidence-index/, included in the Foundation Forecast eNewsletter, and included in press releases. Survey respondent demographics and additional information about the MCI are also available at the link above.

JOIN THE CONVERSATION

Twitter: https://twitter.com/LeaseFoundation

Facebook: https://www.facebook.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Instagram: https://www.instagram.com/leasefoundation/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector—and its people—forward through industry-specific knowledge, intelligence, and programs that contribute to industry innovation, individual careers, and the overall betterment of the equipment leasing and finance industry. The Foundation is funded through charitable individual and corporate donations. Learn more at www.leasefoundation.org.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.