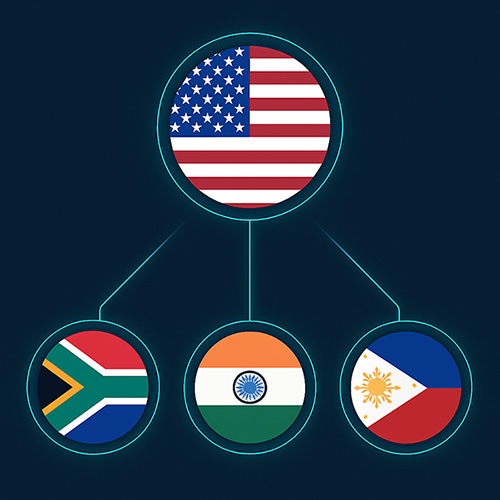

US brands face a critical CX choice. South Africa, India and the Philippines each offer unique strengths, risks and rewards.

By Ruben Moggee, CEO of Nutun International

Offshore CX used to be all about price, seeking the lowest hourly rate and cutting costs fast. However, there has been a shift and the stakes have changed. India, the Philippines and South Africa are now in competition, with each bringing more than just savings to the table. These countries are offering scale, quality and proven CX delivery, having built deep talent pools.

India led the way in the 1980s with South Africa and the Philippines joining the race in the 1990s. These days they are now trusted partners for premium services, offering strong cultural alignment and scalability to operational costs and should be on every US business radar.

These days customer loyalty is harder to earn and easier to lose. The wrong CX partner does more than damage your service, it chips away at your brand. Your offshore location is no longer a back-office decision, it speaks volumes about what your business really stands for.

Today, CX leaders in the US are asking more strategic questions: Where will my customers have the best experience? Which market aligns with my operating hours and culture? Which location delivers savings and value?

To help answer that, the Customer Value Index (CVI) – a composite score out of 100 – offers a clear benchmark for comparing the CX performance of each region.. The CVI blends operational performance with CX outcomes across 10 critical business dimensions..

The results reveal three very different propositions: South Africa ranks highest with a score of 92, followed by India at 83 and the Philippines at 78.

When it comes to domain expertise, each market brings something different to the table. South Africa’s technology and back-office capabilities are categorized as Moderate-High. The region offers high-quality, niche and regulated services in CX analytics, fintech, legal and healthcare, with high automation back-office integration, and robust front-to-back lifecycle coverage. Domain expertise includes travel, financial services, healthcare, utilities, telcos, and retail.

The Philippines is renowned for expert delivery in e-commerce, healthcare, financial services, and telcos. India, meanwhile, offers industry-leading outsourced services in technology support, financial services, healthcare, and telco domains, with strengths in Robotic Process Automation (RPA) and chatbots.

Language and cultural fluency can make or break a customer interaction. South Africa stands out with 5 to 6.5 million native English speakers and ranks 11th in English proficiency, according to the EPF English Proficiency Index.

The Philippines, with fewer than 50,000 native English speakers, ranks 22nd but is globally recognized for its neutral American-style English. India, while home to one of the world’s largest English-speaking populations, with 250,000 to 350,000 native English speakers, ranks 69th.

While language proficiency is high, especially in technical and back-office domains, accent neutrality and cultural nuance can vary, often requiring training or technology-assisted neutralization.

But it is not about language – it is about people. South African agents have a high cultural affinity with the US, and the region is ranked the best offshore CX delivery destination for North America. Agents consistently demonstrate confidence, empathy, and contextual awareness, and are often ranked the friendliest.

According to the Fortune 50 client program, South Africa reports Net Promoter Scores (NPS) between 40 and 60 and an average Customer Satisfaction (CSAT) rate of 85% – the highest among the three regions. The country also boasts the lowest annual attrition rate at 20 to 30%, supported by government-backed BPO skills development via various private-public industry initiatives.

The Philippines has an adaptable but US-leaning workforce, with an NPS of 40 and 80% CSAT. However, it has the highest annual attrition rate (35 to 50%). India and the US have cultural ties, but accent and idiomatic gaps affect CX. NPS varies widely, with a CSAT average of 77%. India’s annual agent attrition rate is 30 to 40%.

Large-scale workforce upskilling programs exist in both India and the Philippines but vary by region and often struggle to address quality-of-life issues prevalent in these countries.

In terms of offshore operational capacity, South Africa ranked highest according to CVI (27), with strong quality and blended channels (voice, email, chat, and social) offering strong alignment with premium and regulated service models. The workforce is skilled in high-complexity and niche services, offering flexibility in scaling programs, especially US-aligned services. The country’s talent pool is growing but is limited compared to India and the Philippines.

While technically strong, India requires greater empathy training to meet US CX expectations, earning a CVI score of 25. A large, flexible workforce and existing infrastructure support broad-scale programs quickly and efficiently.

With a CVI score of 21, the Philippines offers solid traditional capabilities ideal for high-volume models, but digital capabilities are still maturing. Digital transformation hinges heavily on provider investments, where well-established large-scale models offer rapid deployment, supported by a large labor force and pool of talent that enables rapid volume ramp-ups. Voice remains the primary channel.

Infrastructure strength, climate stability, and workforce resilience all play a critical role in long-term CX delivery – yet they’re often overlooked. The CVI scores these factors too, revealing clear differences in risk and reliability across the three markets.

South Africa scores highest for overall stability, resilience and attrition rates with a CVI of 17.5 due to its strong business continuity measures, including planned power management (known as load-shedding), established infrastructure, and low climate risk.

By contrast, climate vulnerability to extreme weather events in the Philippines counts against the nation, adding operational risks – the country ranked first in this risk category. Long commute times affect agent well-being, which may contribute to high attrition rates in the country. The net effect is a CVI score of 12.5.

India ranked third in climate risk, according to the 2024 World Risk Index. While tier one cities offer greater resilience, power outages and connectivity issues plague outer regions. However, severe congestion in the major centers means commute times of over 60 minutes on average, which causes stress.

This risk profile plays directly into cost-to-value. At a $12 to $16 fully loaded rate, including all core delivery-critical components, shrinkage cover, breaks, set-up costs, training, recruitment and reporting, South Africa charges the highest rates but offers the best cost-to-value due to low attrition rates, strong infrastructure, and US alignment.

While slightly cheaper, the $11 to $15 rate in the Philippines excludes almost all delivery-critical components and comes with high attrition rates and climate risks. With the lowest rate ($8 to $11), India’s fully loaded offering is compelling, but requires extensive add-ons to meet the same service scope offered in South Africa.

After weighing performance, people, risk and cost, one truth stands out. No single offshore hub works for every business. The best choice depends on whether scale, savings, quality or customer connection matter most.

South Africa offers strong alignment with US needs. Neutral English accents, cultural closeness and skilled agents make it the leader for complex, regulated CX. The Philippines is a proven partner for high-volume voice support, though infrastructure limits remain. India delivers scale, technical depth and efficiency in IT-enabled and back-office functions, but voice-based CX for US brands often requires extra oversight.

Choosing where to offshore is no longer a numbers game. The right location is the one that strengthens customer loyalty and supports the brand for the long term.

About the Author:

Ruben Moggee joined Nutun as International CEO, bringing extensive experience in driving turnaround and growth for businesses worldwide. With a focus on stakeholder engagement, strategy implementation, and market expansion, He prioritizes people development and enhancing customer experiences and interactions. Ruben is genuinely passionate about the BPO sector and its capacity to uplift communities. His leadership journey includes roles as CEO at Digicall Group and OKS, where he managed large teams and led acquisitions in South Africa, Australia, and the UK. His background as a former partner at KPMG has equipped him with a strong foundation in navigating complex business environments.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.