How the U.S. can reshape the power grid with alternative battery installations.

In 2022, the U.S. installed more battery storage than ever before, adding significant capacity to the power grid. According to the U.S. Energy Information Administration, the U.S. installed 4 gigawatts of battery capacity this past year, nearly matching the 4.7 gigawatts in all the previous years combined.

The urge of this movement to reshape the U.S.’ regional power grids mainly pertains to the growing demand and strength for solar. With electricity prices falling during the day when solar is producing and surging in the evening when solar falls off, leaves batteries to profit. Texas and California, have been leading the way in the movement of reshaping the power grid for the past years, as they are notably the two largest solar markets in the U.S. California credits this new wave of battery installations for sparing the state from additional electrical blackouts last summer, when it was experiencing major state-wide heat waves. Texas stepped up battery installations due to its recent blackouts from extremely cold temperatures it experienced over the last few years.

The current decade has been referred to by industry experts as “the decade of energy storage” and now, three years in, it is expected to grow even more. As energy storage is critical to integrating large amounts of wind and solar power into the grid, governments have set aggressive targets for renewable penetration that will only be possible with a significant investment in energy storage.

While the demand for energy storage is accelerating, the pace of the growth is hard to predict due to supply chain issues pertaining to lithium-ion batteries and manufacturers trying to keep up with the increasing demand. Due to shortages in key raw materials – such as lithium, which currently dominates the industry as these batteries have a very high energy density, voltage capacity and charge storage – these supply chain issues will slow down energy storage deployment and delay the transition to carbon-free electricity. Therefore, we should look for a swap-in replacement for lithium-ion batteries, such as alternatives like sodium-ion batteries, calcium-ion batteries and zinc-ion batteries.

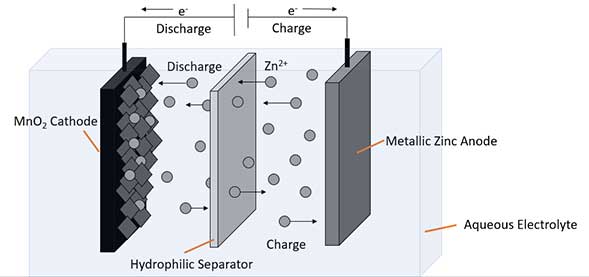

For example, zinc-ion batteries use the same fundamental design as lithium-ion to store charge but without the additional risks. Zinc is far heavier than lithium, making zinc-ion batteries too heavy for EVs, but otherwise offer the same power and service life as lithium-ion. This means they are just as well-suited for energy storage. These adoptions of new battery technologies offer the ESS industry a unique opportunity to develop a supply chain that is free from any competition with automakers in the already crowded EV industry that is reliant on scarce lithium.

In addition to raw material shortages and how this could potentially hinder the market, the energy storage industry faces additional major challenges, such as battery safety. Lithium-ion batteries suffer from thermal runway issues, resulting in fires and the emission of toxic gasses. These increasing safety concerns bring on more restrictive regulations which can potentially hinder deployment for stationary energy storage. This is where alternative batteries are beneficial because they use a water-based design and are unable to catch fire, which is a significant advantage over lithium-ion batteries, especially as safety is of critical importance to the stationary energy storage industry.

With the Inflation Reduction Act, the U.S. government is shedding its dependance on Chinese supply chains. Lithium-ion batteries that are used in energy storage use a cathode material called lithium iron phosphate (LFP) and China is responsible for producing 99% of the world’s LFP material in addition to 95% of the world’s LFP-based batteries. Therefore, it is important for the U.S. to develop its own domestic supply chain and not be reliant on Chinese supply. This is yet another reason why the adoption of new battery technologies, such as zinc-ion batteries, will be very beneficial. The materials used in zinc-ion batteries are significantly more abundant than the materials used in lithium-ion batteries, offering ESS manufacturers a solution to the industry’s supply chain issues.

To meet these goals, this supply chain will need to match or exceed current lithium-ion production, requiring governments to invest in the development of an energy storage supply chain as aggressively as they have for the EV industry. The solution is for the U.S. to pair its existing zinc supply chain with a continued investment in cell manufacturing to continue rapidly developing a domestic energy storage supply chain.

Rapid growth in the energy storage industry will only be possible with utilities, system operators, investors and policy makers working together. For example, utilities and system operators will need to work with technology developers to address the capacity to control distributed systems. Policy makers will need to change market regulations so that these systems can be compensated for the value they provide. Lastly, investors need to create the financing mechanisms for these projects to achieve a resilient and renewable-power grid – making this a true effort by all.

About the Author:

Ken Rudisuela is the CEO of Salient Energy, a company that produces zinc-ion batteries for applications in the electrical grid. Salient’s batteries are cheaper, safer, and longer-lasting. Prior to Salient Energy, Ken worked as the CTO of IOXUS and then as a Project Manager at Nickel Institute.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.