A review of opportunities in aftermarket parts and services.

By Paul Wellener

Revenue from new product sales for manufacturers has stagnated over the past decade. And due to the disruption from the COVID-19 crisis, demand for new industrial equipment may fall as manufacturers’ customers reduce capital spending to manage cash and lessen the pandemic’s business impact. Aftermarket parts and services may help offset these declines as they are typically less impacted by changes in the business environment. In past economic downturns, the aftermarket businesses have been a consistent revenue source and profit stabilizer. Experience shows that manufacturers who focus on parts and services have outperformed their peers and exited past crises stronger than before. This article explores how manufacturers that prioritize and drive aftermarket services can be more resilient during this global economic downturn.

Industry players can stabilize their business by expanding aftermarket parts and services by:

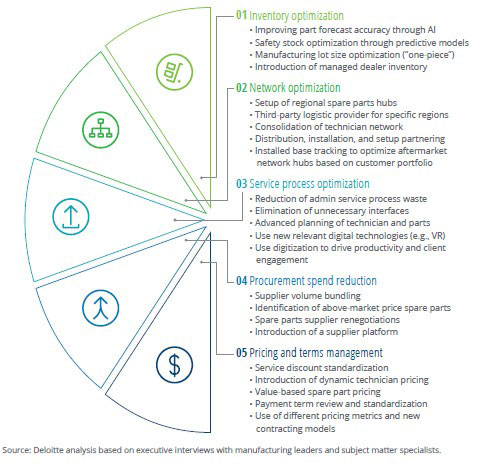

Manufacturers can take advantage of this recent disruption to push through planned changes and innovations around the aftermarket that can impact the nature of their relationship with their customer base and channels. They can do so by focusing on five improvement areas to help boost their aftermarket businesses (figure 1).

Figure 1: Five improvement areas for manufacturers amidst the COVID-19 crisis

However, manufacturers face multiple challenges in scaling and delivering aftermarket services effectively, including increased competition, talent shortage, and entry of new players. To successfully deliver and scale aftermarket services, manufacturers should focus on:

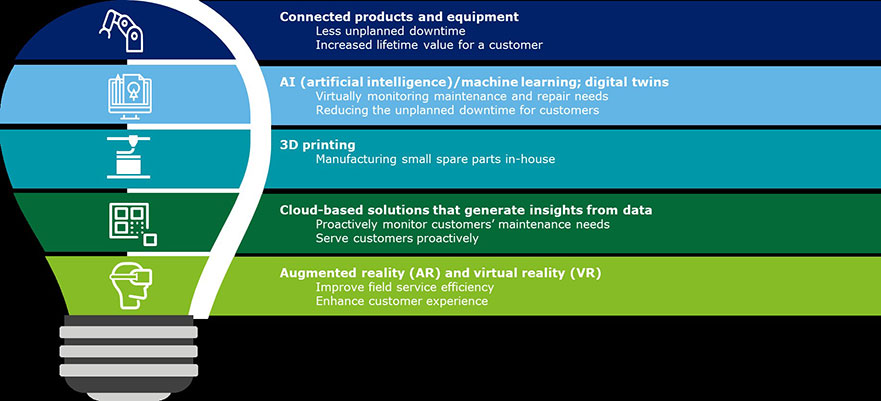

In times of crises such as the one manufacturers are facing with COVID-19 today, where it becomes challenging to dispatch field service technicians to address customers’ critical equipment needs, digital technologies, especially remote assistance capabilities, help ensure business continuity. Leveraging digital capabilities, manufacturers can directly access the equipment and solve many of the problems remotely, quickly, and efficiently. Digital service offerings such as predictive maintenance help manufacturers gain a competitive edge and provide an enhanced customer experience (figure 2).

Figure 2: Key digital technologies and their “value” lever

Source: Deloitte analysis

What may help separate winners and losers will be companies’ ability to leverage technology to help scale and manage their aftermarket parts and services businesses. With their customers facing potential financial pressures, manufacturers who have prioritized their digital transformation to help enhance the aftermarket experience can become those winners in the long run. Leveraging digitalization can help manufacturers gain a competitive edge through improved customer service, better margins, and higher customer loyalty.

For more insights on what companies should consider as they define and execute their aftermarket service strategy, please read the report, Aftermarket Services: Transforming Manufacturing in the Wake of the COVID-19 Pandemic.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the “Deloitte” name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

Paul Wellener

Paul Wellener | pwellener@deloitte.com

Paul is a vice chairman, Deloitte LLP, and the leader of the US Industrial Products & Construction practice with Deloitte Consulting LLP. He has more than three decades of experience in the industrial products and automotive sectors and has focused on helping organizations address major transformations. Paul drives key sector industry initiatives to help companies adapt to an environment of rapid change and uncertainty—globalization, exponential technologies, the skills gap, and the evolution of Industry 4.0. Based in Cleveland, Paul also serves as the managing principal of Northeast Ohio.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.