The next industrial revolution isn’t about jobs—it’s about intelligence, and the U.S. must lead in smart manufacturing innovation.

By Tal Elyashiv, Founder & Managing Partner of SPiCE VC

While public discourse continues to focus on tariffs, trade policy, and the return of American manufacturing, the deeper transformation is already underway—quietly but decisively—in research labs, innovation hubs, and smart factories around the world. We are entering what I call The Quantum Revolution—an era defined by the convergence of transformational technologies such as artificial intelligence, blockchain, robotics, and quantum computing. This revolution is not only reshaping our global economy, but also redefining the very nature of how we produce, distribute, and innovate. Manufacturing remains central to this evolution—but the defining question is no longer where we manufacture, but how.

At the heart of this transformation is a truth we don’t talk about enough: the future of manufacturing isn’t about bringing back millions of old jobs—it’s about creating new, smarter ones. And while that shift comes with challenges, it also opens the door to extraordinary opportunity—if we’re bold enough to lead.

Policies like reshoring incentives and tariffs often aim to reduce reliance on low-wage countries. But in practice, they’re doing something else: accelerating investment in automation and intelligent systems. That’s not a sign of decline. It’s evolution.

The World Economic Forum’s (WEF) “Future of Jobs Report 2025 projects that 92 million jobs globally will be displaced by automation, but 170 million new roles will be created by 2030—in areas like data science, robotics, and machine-human collaboration.¹ These aren’t the assembly-line roles of yesterday—they’re higher-skilled, better-paid, and aligned with a rapidly advancing economy.

China understands this. Through its $1.4 trillion “Made in China 2025” initiative, it’s betting big on AI, semiconductors, and smart manufacturing.² the Chinese government has launched a centralized, state-backed fund targeting nearly ¥1 trillion (roughly $138 billion USD) over two decades to advance robotics, AI, and domestic semiconductor manufacturing, according to Bloomberg.²

China has already built over 30,000 smart factories as of early 2025, like AgiBot’s humanoid robot facility, with plans to reach 70,000 by 2030, according to China’s Ministry of Industry and Information Technology.³ These next-generation facilities integrate AI, 5G, IoT, and advanced robotics to optimize every stage of production. They also aren’t focused on hiring—they’re focused on engineering intelligent production at scale.

We in the U.S. must respond—not with nostalgia, but with innovation.

This is the new industrial arms race—not over labor costs, but over who controls the next generation of production intelligence.

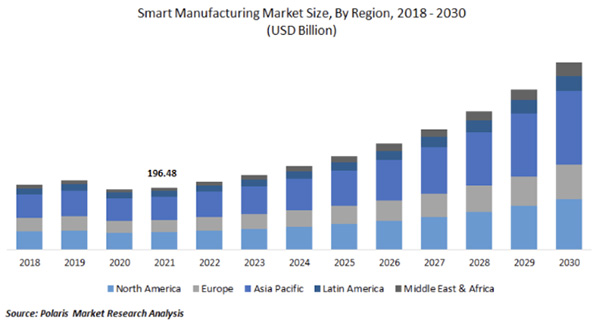

The global smart manufacturing market is expected to hit $727 billion by 2030, growing at a rate of 13.5% annually, according to Fortune Business Insights.⁴ This growth is powered by the integration of AI, real-time data, machine learning, and blockchain technologies into factory environments—resulting in facilities that are not just automated, but adaptive. These systems can learn, self-correct, and optimize in real time, ushering in a new paradigm of industrial productivity.

The U.S. still holds a lead in foundational technologies like cloud computing, AI infrastructure, and advanced chip design. But our edge is narrowing. According to the Center for Security and Emerging Technology (CSET) at Georgetown University, China now produces three times more STEM graduates annually than the U.S. and accounts for more than 60% of global AI patent filings.⁵ If we want to preserve our technological leadership, we’ll need more than breakthrough ideas—we’ll need scale, talent, and cohesive national strategy.

Despite common perceptions, U.S. manufacturing isn’t vanishing. In fact, According to the United Nations Industrial Development Organization, the U.S. is still the second-largest manufacturing country in the world, accounting for over 16% of global output.⁶ And we’ve seen a promising resurgence in domestic production—the U.S. Bureau of Labor Statistics reports that 364,000 manufacturing jobs were added in 2022 alone.⁷

But here’s the nuance: those numbers are plateauing. As companies adopt smart technologies, the types of jobs are changing. Routine labor is being phased out—but new roles are emerging in automation oversight, systems integration, and AI model tuning. And that’s good news.

These are higher-value, higher-paying roles. But they require a new kind of workforce—and a new kind of strategy.

The transition to intelligent manufacturing will be disruptive—but it doesn’t have to be destructive. With smart planning, it can unlock a new era of economic strength.

Research by McKinsey & Company finds that companies that digitize their supply chains experience revenue growth at twice the rate, and achieve margins three times higher than their less-digitized peers.⁸ This shift transcends operational efficiency; it represents a fundamental transformation in organizational resilience—enabling companies to build adaptive, data-driven infrastructures capable of withstanding systemic disruptions and responding dynamically to evolving global market conditions.

In Investing in Revolutions, I explore how these technology waves—from AI to quantum computing—create moments of massive opportunity for both investors and nations. Manufacturing is entering one of those moments right now.

Reshoring alone won’t secure America’s manufacturing future. To lead in the era of intelligent production, the United States needs a coordinated national strategy—one that accelerates public-private R&D, modernizes industrial infrastructure, and builds a workforce ready for automation, robotics, and AI-driven operations.

China is already executing on this vision at scale. Under its “Made in China 2025” initiative, the country has established a central, state-backed venture fund targeting nearly ¥1 trillion (about $138 billion) over 20 years to advance robotics, AI, and semiconductor independence. As of early 2025, China has constructed over 30,000 smart factories, with a goal of reaching 70,000 by 2030, tightly integrating 5G, IoT, and AI into its industrial base.³

By contrast, the U.S. has taken a more decentralized, sector-specific approach. The CHIPS and Science Act allocates $52.7 billion to revitalize domestic semiconductor production, while the Inflation Reduction Act provides tax incentives to boost clean energy manufacturing and reduce industrial emissions.⁹ ¹⁰ Leading private-sector players like GE Aerospace and Carrier are investing heavily in U.S. manufacturing modernization—GE alone has pledged nearly $1 billion in 2025, according to company announcements.¹¹

These are steps in the right direction—but they remain fragmented. To maintain our leadership, we must connect the dots between policy, technology, and workforce development.

We have the innovation. We have the talent. What we need now is alignment—because in this race, momentum matters more than nostalgia.

The question isn’t whether American manufacturing can return—it already has. The question is whether we’re building the right kind of manufacturing—the kind that secures our leadership, fuels our innovation economy, and creates opportunity for generations to come.

Because in this new arms race, the winners won’t be those with the biggest factories. They’ll be the ones who build the smartest ones.

About the Author:

Tal Elyashiv is a venture capitalist, technology founder, and author of Investing in Revolutions: Creating Wealth from Transformational Technology Waves. He is the founder of SPiCE VC, an investment firm focused on emerging technologies that shape tomorrow’s global economy.

Sources:

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.