February 12, 2018

On December 22, 2017, President Donald Trump signed into law the Tax Cuts and Jobs Act of 2017 (TCJA). Called the “biggest tax reform in a generation” by supporters, the TCJA changes the income tax code for individuals and corporations. A goal of this legislation is to accelerate the pace of economic growth in the U.S.

Since this legislation was highly anticipated and its various iterations closely studied by many organizations, some companies managed to implement changes to policy and practice immediately. On January 25, 2018, Institute for Supply Management® (ISM®) opened a special survey that asked members of the Manufacturing and Non-Manufacturing Business Survey Committees to (1) report on their organizations’ familiarity with and activity generated by the law and (2) assess how the new tax code might impact their businesses.

Nearly two-thirds (65 percent) of responding supply executives report that their finance and executive leadership is familiar with the TCJA. They also report that a majority (50 percent) of supply management leadership is familiar with the law. Among respondents with an opinion, those expecting a positive change regarding selected organizational, strategic, and tactical considerations far outnumber those expecting a negative change.

Among the comments from supply executives on what the TCJA means to their businesses:

Manufacturing sector

Non-manufacturing sector

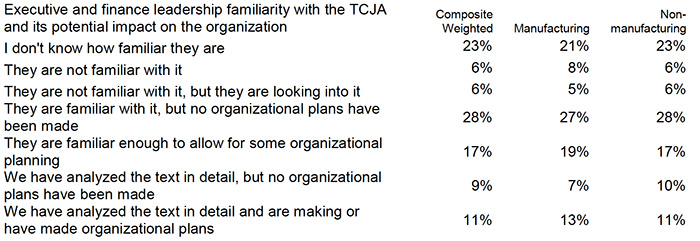

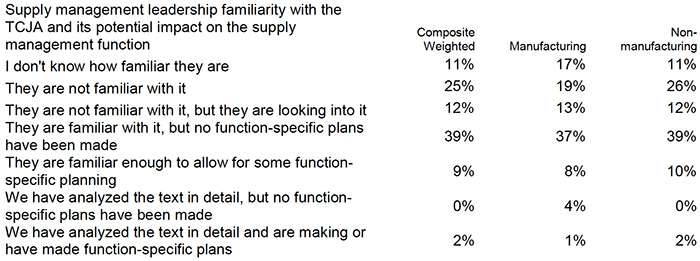

Respondents say that their executive and finance leadership (65 percent) is more familiar with the TCJA than their supply management leadership (50 percent). These proportions do not vary between our manufacturing and non-manufacturing respondents. A slightly higher proportion of manufacturing respondents (32 percent, compared to 28 percent of non-manufacturing) report that organizational planning is underway or has been completed. However, regarding function-specific planning, a slightly higher proportion of non-manufacturing respondents (12 percent, compared to 9 percent of manufacturing) report that function-specific planning is underway or completed.

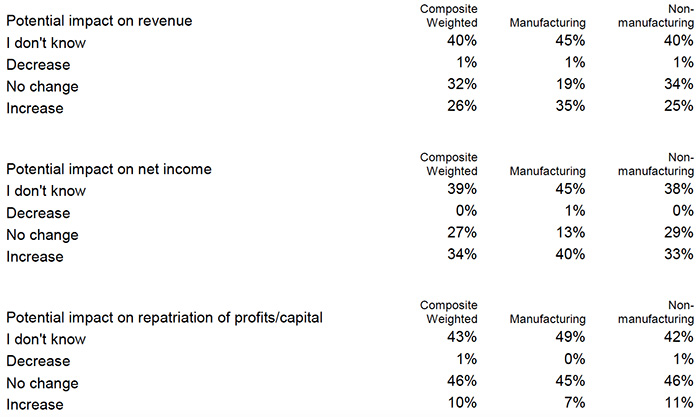

What impact might the TCJA have on key organizational results and behaviors? Supporters of the TCJA believe firms will prosper and be more likely to bring international profits to the U.S. While approximately 40 percent of respondents say they don’t know TCJA’s potential impact regarding these matters, those who believe the new tax code will likely have a positive impact on revenue, net income, and the repatriation of profits far outnumber those who anticipate a negative impact.

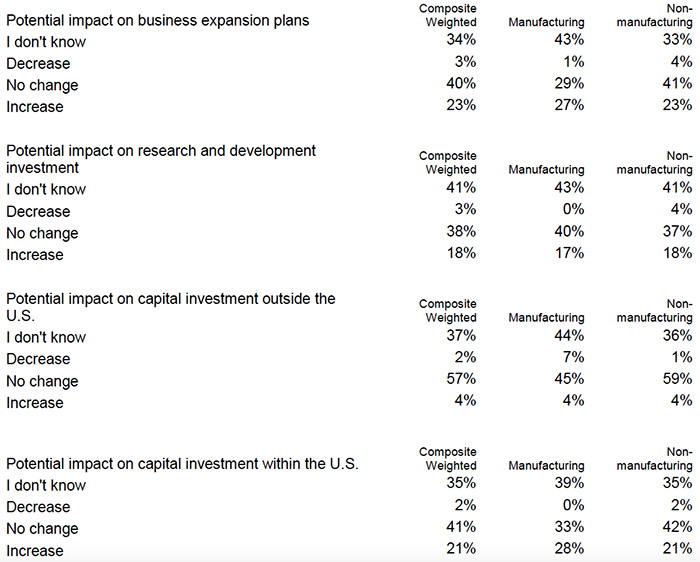

Respondents were asked what impact the TCJA might have on important strategic actions. Might the law induce their firm to expand? What about R&D investment? Would they undertake capital investment within the U.S. or abroad? As with the issues detailed above, 30-40 percent of our respondents say they don’t know the TJCA’s impact on these topics; however, among those expressing an opinion, those who expect the law to likely spur business expansion and R&D investment far outnumber those who believe the law will hinder such activity.

Regarding where capital investment may occur, 7 percent of manufacturing respondents expect non-U.S. capital investment to decrease, while 4 percent believe non-U.S. capital investment will increase. Interestingly, only 1 percent of non-manufacturing respondents expect non-U.S. capital investment to decrease, while 4 percent anticipate non-U.S. capital investment to increase. This may reflect the perception that maximizing non-manufacturing opportunities abroad could necessitate local investment in those markets.

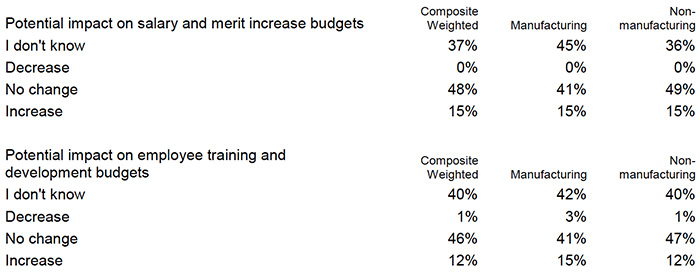

Compensation and training budgets are typically annual exercises, so the tax-reform impact on budgets for (1) salary and merit increases and (2) employee training and development are classified as tactical considerations in this report.

On these issues, 35-45 percent of respondents indicate that they don’t know the TCJA’s potential impact. However, zero respondents expect salary and merit-increase budgets to be negatively impacted, while 15 percent of respondents expect those budgets to increase. A small proportion of respondents (3 percent in manufacturing and 1 percent in non-manufacturing) anticipate employee training and development budgets to decrease due to the TCJA. Fifteen percent of manufacturing respondents and 12 percent of non-manufacturing respondents expect those budgets to increase.

Methodology Data for this study was collected from January 25 through February 6, 2018. Responses from 17 of 18 manufacturing industries and 16 of 18 non-manufacturing industries were included in the above analysis. The “consolidated weighted” results are an average of the manufacturing and non- manufacturing results, weighted 12 percent and 88 percent, respectively. This weighting was imposed to more accurately reflect the current composition of U.S. GDP. Respondent comments have been edited to improve readability and preserve confidentiality, but the spirit of each comment remains intact.

About This Report The data presented herein is obtained from a survey of manufacturing and non- manufacturing supply executives based on information they collected within their respective organizations. ISM® makes no representation, other than that stated within this release, regarding the individual company data-collection procedures. The data should be compared to all other economic data sources when used in decision-making.

Data and Method of Presentation The Manufacturing and Non-Manufacturing ISM® Report On Business® is based on data compiled from purchasing and supply executives nationwide. Membership of the Non-Manufacturing Business Survey Committee is diversified by NAICS, based on each industry’s contribution to gross domestic product (GDP). The Non-Manufacturing Business Survey Committee responses are divided into the following NAICS code categories: Agriculture, Forestry, Fishing & Hunting; Mining; Utilities; Construction; Wholesale Trade; Retail Trade; Transportation & Warehousing; Information; Finance & Insurance; Real Estate, Rental & Leasing; Professional, Scientific & Technical Services; Management of Companies & Support Services; Educational Services; Health Care & Social Assistance; Arts, Entertainment & Recreation; Accommodation & Food Services; Public Administration; and Other Services (services such as Equipment & Machinery Repairing; Promoting or Administering Religious Activities; Grantmaking; Advocacy; and Providing Dry-Cleaning & Laundry Services, Personal Care Services, Death Care Services, Pet Care Services, Photofinishing Services, Temporary Parking Services, and Dating Services). Manufacturing Business Survey Committee responses are divided into the following NAICS code categories: Food, Beverage & Tobacco Products; Textile Mills; Apparel, Leather & Allied Products; Wood Products; Paper Products; Printing & Related Support Activities; Petroleum & Coal Products; Chemical Products; Plastics & Rubber Products; Nonmetallic Mineral Products; Primary Metals; Fabricated Metal Products; Machinery; Computer & Electronic Products; Electrical Equipment, Appliances & Components; Transportation Equipment; Furniture & Related Products; and Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

The ISM® Report On Business® surveys are sent out to Manufacturing and Non-Manufacturing Business Survey Committee respondents the first part of each month. Respondents are asked to ONLY report on information for the current month. ISM® receives survey responses throughout most of any given month, with most respondents generally waiting until late in the month to submit responses to give the most accurate picture of current business activity. ISM® then compiles the report for release on the first and third business day of the following month.

ISM ROB Content The Institute for Supply Management® (“ISM”) Report On Business® (both Manufacturing and Non-Manufacturing) (“ISM ROB”) contains information, text, files, images, video, sounds, musical works, works of authorship, applications, and any other materials or content (collectively, “Content”) of ISM (“ISM ROB Content”). ISM ROB Content is protected by copyright, trademark, trade secret, and other laws, and as between you and ISM, ISM owns and retains all rights in the ISM ROB Content. ISM hereby grants you a limited, revocable, nonsublicensable license to access and display on your individual device the ISM ROB Content (excluding any software code) solely for your personal, non- commercial use. The ISM ROB Content may also contain Content of users and other ISM licensors.

Except as provided herein or as explicitly allowed in writing by ISM, you may not copy, download, stream, capture, reproduce, duplicate, archive, upload, modify, translate, publish, broadcast, transmit, retransmit, distribute, perform, display, sell, or otherwise use any ISM ROB Content.

Except as explicitly and expressly permitted by ISM, you are strictly prohibited from creating works or materials (including but not limited to tables, charts, data streams, timeseries variables, fonts, icons, link buttons, wallpaper, desktop themes, on-line postcards, montages, mash-ups and similar videos, greeting cards, and unlicensed merchandise) that derive from or are based on the ISM ROB Content. This prohibition applies regardless of whether the derivative works or materials are sold, bartered, or given away. You may not either directly or through the use of any device, software, internet site, web-based service, or other means remove, alter, bypass, avoid, interfere with, or circumvent any copyright, trademark, or other proprietary notices marked on the Content or any digital rights management mechanism, device, or other content protection or access control measure associated with the Content including geo-filtering mechanisms. Without prior written authorization from ISM, you may not build a business utilizing the Content, whether or not for profit.

You may not create, recreate, distribute, incorporate in other work, or advertise an index of any portion of the Content unless you receive prior written authorization from ISM. Requests for permission to reproduce or distribute ISM ROB Content can be made by contacting in writing at: ISM Research, Institute for Supply Management, 309 W Elliot Rd, Suite 113, Tempe, AZ 85284, or by emailing kcahill@instituteforsupplymanagement.org, Subject: Content Request.

ISM shall not have any liability, duty, or obligation for or relating to the ISM ROB Content or other information contained herein, any errors, inaccuracies, omissions or delays in providing any ISM ROB Content, or for any actions taken in reliance thereon. In no event shall ISM be liable for any special, incidental, or consequential damages, arising out of the use of the ISM ROB. Report On Business®, PMI®, and NMI® are registered trademarks of Institute for Supply Management®. Institute for Supply Management® and ISM® are registered trademarks of Institute for Supply Management, Inc.

About Institute for Supply Management® Institute for Supply Management® (ISM®) serves supply management professionals in more than 90 countries. Its 50,000 members around the world manage about $1 trillion in corporate and government supply chain procurement annually. Founded in 1915 as the first supply management institute in the world, ISM is committed to advancing the practice of supply management to drive value and competitive advantage for its members, contributing to a prosperous and sustainable world. ISM leads the profession through the ISM Report On Business®, its highly regarded certification programs and the newly launched ISM Mastery Model™. This report has been issued by the association since 1931, except for a four-year interruption during World War II.

Contact: Kristina Cahill

Report On Business® Analyst

ISM®, ROB/Research Manager

Tempe, Arizona

480-752-6276, Ext. 3015

E-mail: kcahill@instituteforsupplymanagement.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.