Manufacturing leaders see serious challenges, from economic and workforce risks to technological disruption, in a shifting global landscape.

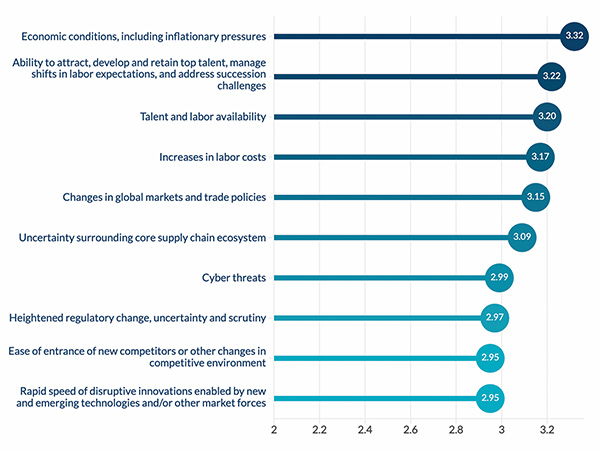

According to the results of a recent global survey of board members and C-suite executives, the manufacturing and distribution industry is grappling with global economic pressures and regulatory uncertainty as well as talent challenges. These issues represent their most pressing risk concerns over the next two to three years.

These are among the more notable findings from the latest Executive Perspectives on Top Risks study conducted by Protiviti and NC State University’s ERM Initiative.

Over the next two to three years, leaders in manufacturing and distribution organizations see a number of issues having a significant impact on their businesses amid broad disruption trends throughout the industry. Here is a rundown, along with some recommendations to address these challenges.

Macroeconomic and regulatory uncertainty

Changing global markets, exacerbated further by the ongoing turmoil surrounding the current tariff environment, increase production costs and complicate long-term planning for businesses reliant on intricate supply chains. Furthermore, inflation continues to strain economies worldwide, dampening growth prospects, and shifts in trade policies are creating pricing pressures, necessitating strategy adjustments.

Companies also are being forced to navigate a dual trend in regulations—heightened oversight in some regions and deregulation in others. This requires strategic leadership to adapt compliance strategies effectively to maintain competitive resilience. The ability to anticipate and adapt to future regulatory obligations is crucial for ongoing success.

A talent crisis

Manufacturers and distributors face a critical talent shortage, as demographic shifts and industry demands outpace labor availability. With a significant portion of the workforce nearing retirement, the industry must compete for a shrinking pool of skilled workers. Consider that by 2030, one in five Americans will be older than 65. Also, Industry 4.0 is escalating the need for highly technical skills, causing a mismatch between available talent and industry needs.

Labor availability has emerged as a top concern with the sector’s unemployment rate notably low. In the United States, manufacturing’s unemployment rate hovers around 3%, with subsectors like machinery manufacturing at around 1%. Recent labor contract negotiations have led to significant wage increases, reflecting workers’ bargaining power. Companies are under greater pressure to focus on automation, reskilling and upskilling to maintain competitiveness.

Proactive workforce strategies to attract, develop and retain employees are essential for addressing this talent crisis.

Technological disruption

Manufacturers and distributors are witnessing technological advancements that both challenge and offer opportunities for the industry. Technologies like AI, digital twins and IoT are transforming operational capabilities and market dynamics. The rise of “dark factories”—fully automated facilities—promises efficiency but requires significant investment.

Disruptive technologies demand investment in automation, AI-driven quality control and predictive analytics to stay competitive. At the same time, these companies face the challenge of balancing investment in innovation with financial stability. Retrofitting existing plants or building new smart factories involves significant capital outlay. However, failing to modernize or manage technical debt may leave firms vulnerable to agile, tech-savvy newcomers.

Companies must strategically plan to leverage these technologies for sustainable growth. This involves adopting a forward-thinking approach to integrate new technologies while managing costs effectively.

Operational vulnerabilities

Manufacturers and distributors face ongoing operational challenges, with supply chain vulnerabilities and cybersecurity risks at the forefront. Despite improvements post-pandemic, supply chain disruptions remain a critical issue, and cyber threats continue to loom large. The interconnected nature of global supply chains leaves manufacturers vulnerable to tariffs, supplier dependencies and infrastructure issues.

Of note, cyber threats, particularly ransomware attacks targeting manufacturing firms, pose significant risks to operational technology networks. In 2024, almost 70% of ransomware attacks targeted manufacturing firms, highlighting the need for robust cybersecurity measures.

Companies must bolster supply chain resilience and secure digital infrastructures to protect operations. Investments in Industry 4.0 and data analytics offer promise for improving supply chain resilience but are not yet widespread. Manufacturers should prioritize strategic investments in technology and infrastructure to mitigate these risks. Furthermore, as automation and IoT integration grow, continuous evaluation of security protocols becomes imperative to safeguard against evolving threats.

Shifting to a view over the next decade, manufacturing and distribution leaders foresee many of these same risk concerns persisting.

In regard to macroeconomic risks, the top issues remain the economy and talent. An aging workforce and shifting immigration policies will continue to shrink the talent pool, intensifying competition for skilled workers. Manufacturers also must compete with other industries for a diminishing pool of skilled labor, making strategic workforce planning essential. Workforce development and increasing automation will continue to be crucial to maintaining productivity amidst these demographic shifts.

In addition, economic challenges, including persistent inflation and trade policy changes, are expected to continue over the next decade. Industry leaders anticipate global supply chains to face continued disruptions as countries reassess trade agreements and tariffs. A number of manufacturers are exploring regionalized supply chains to mitigate these risks, requiring significant investment in infrastructure and logistics adjustments.

Manufacturers and distributors also see several long-term strategic risks, driven by rapid technological advancements and evolving regulatory landscapes. The fast pace of disruptive innovation demands continuous modernization to remain competitive. Advances in automation, AI and smart factories lower barriers to entry, increasing competition from newer, tech-savvy companies. Failure to modernize or manage technical debt can leave companies struggling against “born digital” competitors, risking obsolescence.

Regulatory uncertainty is expected to continue complicating not only compliance efforts, but also strategic planning. Companies must navigate varying regulations across regions, balancing profitability with compliance to maintain market position.

Finally, manufacturers and distributors expect persistent operational risks over the next decade, with supply chain vulnerabilities and cybersecurity threats posing significant challenges. Despite post-pandemic progress, supply chain disruptions remain a critical issue, compounded by geopolitical tensions and supplier dependencies. Investments in predictive analytics, AI-driven forecasting and supply chain diversification are essential steps to help mitigate these vulnerabilities.

Cyber threats also are expected to escalate as automation and IoT integration increase. The ongoing expansion of smart factories and digital systems heightens vulnerability to cyberattacks. Many manufacturers may underestimate these risks, making robust cybersecurity measures imperative to protect against costly disruptions.

Manufacturers and distributors must bolster supply chain resilience and secure digital infrastructures to protect operations. Proactive risk management and strategic investments in technology are crucial for maintaining competitive resilience.

Clearly, manufacturers and distributors see a challenging short- and long-term global risk landscape for their organizations. Strategic technology enablement, talent management and resilience will be among the keys to navigating these waters successfully.

About the Author:

Sharon Lindstrom is a Managing Director with over 35 years of experience in providing risk consulting services to companies primarily in the manufacturing industry. As a founding managing director of Protiviti, she leads the firm’s global Manufacturing and Distribution Industry practice, supporting the industrial products, automotive, materials/chemicals, construction, and distribution/logistics sectors.

Read more from the author:

Sustainability Raises So Many Questions: Here’s an FAQ Guide | The Protiviti View, April 8, 2024

Supply Chain Management’s Upgrade Is Overdue | The Protiviti View, December 11, 2023)

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.