It has been said that the definition of insanity is repeating the same behavior time and time again, while expecting a different result. This is true for many of today’s heavy-duty truck transportation fleets that try to extract as much life as possible out of their trucks. This practice is known as “sweating the asset.” Many transportation fleets continue with the same practices year over year, hoping for better results to their financial bottom line.

However, many of these fleets remain challenged with their financial results since this practice prevents them from realizing the significant savings that are returned through the use of more efficient trucking units.

Companies are leveraging data analytics and comprehensive fleet studies that produce a fleet modernization and utilization plan.

Data, analytics and Business Intelligence have evolved significantly over the years, and today all three are being used by leading private fleets and for-hire carriers that find themselves with a considerable competitive advantage over the rest of the transportation industry. Fleets leveraging technology innovations to drive their business operations find that they have newer, more efficient trucks, lower overall costs from reduced fuel and maintenance expenditures, as well as increased safety records and driver retention.

The companies that practice sweating their assets may find they have increased downward pressure on their financial results as they repeatedly have a higher Total Cost of Ownership (TCO).

A long-standing business philosophy affecting organizations today is that some organizations still purchase a hefty order of trucks and drive them for upwards of ten years or more, as a means to squeeze every cent out of the truck’s usage- essentially sweating the asset.

When fleets drive their trucks for as long as possible, they run the trucks to the point of functional obsolescence- making decisions based on the truck’s ability to stay on the road. Over time, costs begin to add up for each aging truck in the fleet, and these costs appear to be masked by the avoidance of the cost of investment to replace each unit, which end up significantly eroding their bottom line.

Instead, today’s leading firms are taking a more distinctive approach to fleet management.

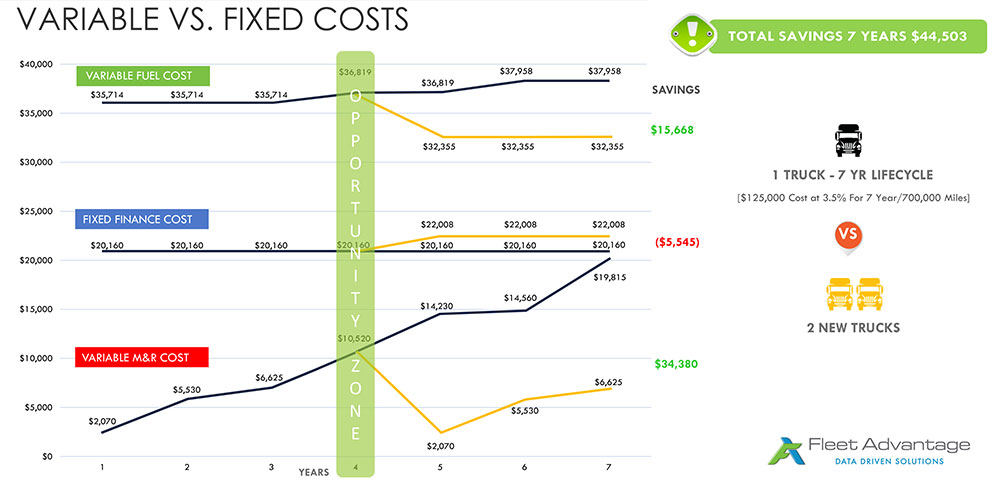

Fleets are now paying closer attention to a truck’s individual TIPPINGPOINT®, the point at which it costs more financially to operate a truck than it does to replace it with a newer model. Elements such as the cost of fuel, utilization, finance costs, maintenance and repair are all factored into arriving at each truck’s unique TIPPINGPOINT®, giving fleet operations personnel and finance departments better insights based on data and analytics into determining and calculating the best time to replace an aging truck. This data illustrates a clear ROI and overall cost savings from utilizing a shorter lifecycle.

In fact, Fleet operators can realize a first-year per-truck savings of $16,928 when upgrading from a 2015 sleeper model-year truck to a 2020 model. For a fleet of 100 trucks, when upgrading to a 2020 model year the savings can reach $1.7 million. These cost savings are only achieved when adopting a shorter asset lifecycle.

This approach not only drives down operating costs but offers flexibility to adjust to changing markets and reinforces a positive corporate image. This approach also helps with driver recruitment and retention efforts by continuously upgrading to newer trucks. It’s no secret that drivers prefer new trucks, just as many car owners might prefer to drive a newer vehicle themselves.

Companies are leveraging data analytics and comprehensive fleet studies that produce a fleet modernization and utilization plan, projecting when aging equipment will need to be replaced. This helps fleets plan their procurement strategies more efficiently, regardless of truck orders in peak or falling demand.

Additionally, changes to the corporate tax rate ad well as new accounting standards have made it more beneficial to lease equipment. In the case of truck acquisition, purchasing equipment remains more expensive than short-term leasing of equipment. Leasing remains the more favorable method for companies regardless if they have a stronger or weaker balance sheet. Also, leasing allows companies to avoid the risk of residual value as well as the cost of remarketing.

By adopting the shorter truck lifecycle approach and monitoring and managing these assets on a profit and loss basis, industry organizations and transportation corporations’ fleets will become further optimized. They will become better equipped at exchanging their aging truck fleets in a more cost-efficient manner in 2019 and beyond.

Katerina Jones is Sr. Director of Business Development at Fleet Advantage, a leading innovator in truck fleet business analytics, equipment financing and lifecycle cost management. For more information visit www.FleetAdvantage.com.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.