Volume 10 | Issue 4

Gas gauges…what’s the big deal? You measure the level of fuel in the tank, send the information to the control panel and…voila! End of story. Or is it? You see, outside of the United States, gas is not what it used to be – at least not in Brazil or in other nations participating in the Kyoto Protocol. Today, Brazil is a world leader in hybrid gas technologies and has made a national commitment to ethanol production (which it derives from sugar cane alcohol) and to its use in flex-fuel vehicles. Flex-fuel technologies are now mandatory in all new vehicles coming off the line in Brazil.

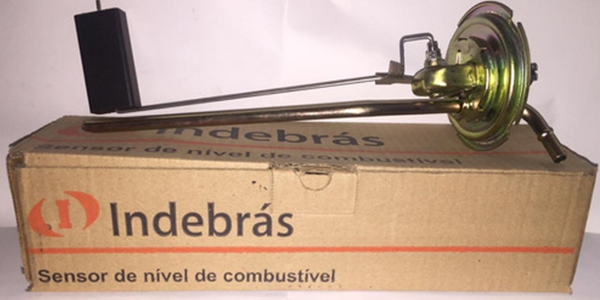

“We have new technologies that we are developing – Brazilian technologies – and we can make a strong play in the market because they help vehicles with climatic problems that affect fuel,” explains Edson Campos, General Director at Indebras. “The world is going to need alternative fuels and our technology can serve all markets.”

Once, a simple measuring device was sufficient for fuel control. Now, advances in fuel composition require that measuring technologies keep up with the times. Fuel gauges from Indebras, for example, measure not only the level, but also the temperature and mixture of the fuel. Today the company manufactures a diverse line of gas sensors and gauges and has become the largest contractor in its segment with 2006 earnings at around $40 million. What’s more, Indebras has more than doubled its revenues over the past four years and boasts a domestic market share of over 75 percent. Campos credits the company’s mixed-fuel measuring technologies for this success. “Our device is more useful and Brazil’s changes in gas have made us indispensable.”

Vehicles of Change

In 1966, when Indebras was founded, the Brazilian auto market looked quite different than it does today. The majority of vehicles assembled in Brazil came in from other countries. Homegrown parts and repair solutions were not always available. This is how Jayme Rodrigues da Silva, a supplier of construction materials, came to design a device that measures gasoline. His rudimentary gas gauge soon became a popular item. As Campos tells it, “The needs kept coming and he kept designing … until he finally started a small business to make these parts.”

Then, in the 1970s, Brazil began using alcohol-powered vehicles because of a national project, called Project Pro-Alcohol. “This migration to alcohol was an important change and now we don’t have any gas-only vehicles in Brazil,” confirms Campos. “There was a change in the entire system of combustion. It was entirely different.” What’s more, Brazilian alcohol is slightly hydrated (contains some water), which makes it highly combustible and “aggressive.” Older fuel gauges no longer worked on this new fuel.

“Our technology is an intelligent device that measures the fuel level and verifies the temperature and mixture of the gas at each moment. This was designed specifically for the Brazilian market because of the flex–fuel vehicles we’ve had since the 1970s and 1980s,” Campos says.

The company’s intelligent measuring device solves some other problems, including problems related to fuel quality. “Our gasoline is already 25 percent ethanol, but the high cost of gas at many stations causes some illegal mixtures to take place. Stations add more ethanol to the regular gasoline or they end up adding other liquids,” laments Campos. “The old system does not know what is being put into the vehicle. First, it burns the fuels and the exhaust system measures the mix and sends this information to the electronic module that can then make an adjustment. This analysis takes more than five minutes. Here in Brazil, you could already be damaging your vehicle by then.” The Indebras technology measures fuel mix factors at the moment of re-fueling, analyzing the mix and the calibration needed to burn it. This makes for better fuel economy and reduced wear and tear, not to mention less pollution.

Alcohol fuels are colder than gasoline and when the engine runs at less than 100 degrees Fahrenheit, the fuel does not work as well and the mixture has to change. To retrofit older vehicles, Indebras invented a system that includes a small gasoline reserve. When sensors measure low engine temperatures, a small amount of gasoline can be injected into the engine to heat it up.

Designing On the Fly

In the early 1990s, another change took place in the Brazilian auto industry. President Fernando Collor opened the doors to international investment, and many foreign companies setup headquarters in Brazil. “We had multinational groups here in Brazil at that time and many of our small, domestic companies were acquired and folded into the large corporations. Some multinationals invested in our competition, so now there are fewer companies in our segment and our competition has more money. But we survived.” Campos credits the company’s design and engineering agility as its most valuable asset. “The big auto makers brought new opportunities too, and we were able to get GM contracts and become the first supplier with a complete module for fuel measurement and delivery. Our technology was able to match the electronics in the vehicles.”

Indebras has always designed new products very much “on the fly,” making quick decisions and innovative developments.

“We designed some things for the big auto makers and some things for ourselves,” he explains. “We helped Ford and GM with the cold fuel system, and we created some new designs for alcohol vehicles that were later used by the big auto makers. We had to adapt, learn new technologies and form new relationships with international partners.”

Suffering more than mere design challenges, Indebras was hit with a scarcity of raw materials, which made it difficult to meet the new requirements. “The big makers brought new vehicles to Brazil in the 1990s. GM brought German-designed vehicles, for example. “We had to re-design our products as if we were in Germany,” remembers Campos. “We needed alternative materials and this was a difficult time for everyone in our industry.” Imported materials were more expensive and took a long time to arrive. As a result, the manufacturers who were more flexible about using domestic alternatives were the most competitive.

Indebras considers itself to be tucked away in the corner of the auto business, and feels it must do more than the others can, and faster. The company’s centralized location in Sao Paulo has helped. All of the company’s engineers and workers are located in the same 20,000-square-foot facility. Operating at about 70 percent of capacity, Indebras still has a little room to grow. “We have an area that we could use more efficiently for future growth, which we plan in 2008,” affirms Campos.

The company plans to grow in other areas besides fuel measuring systems. “Measuring devices are not the only things we make,” says Campos. “We have the technology to develop any products necessary, save glass and tires. Whatever the electronic or electromechanical system, we can design into it.” As an example, Campos cites a fuel system the company designed for Brazilian trucks that heats, measures, and mixes fuels. New laws in Brazil require trucks to include mixed fuel systems (mixed bio-diesel and other fuels). “We designed this for one of our clients, and now we are talking to three companies about it.”

Indebras was also the first to supply Ford with a non-aluminum coolant flow system in 1999. The system, which is made of thermal plastic, has inspired other companies to begin working with this material, following Indebras’ lead. “A lot of companies are leaving aluminum behind and our future growth just might come from this product.”

Design agility comes from its talented engineers and Indebras invests in employee training programs. And not just in engineering. Organization, business relationships, management … the company offers everything that makes its employees more capable and professional. “Some of our employees have been courted by the big companies, but they always choose to stay with us. They are attracted by our variety of projects, and our work efficiency.”

High-Octane Future

Indebras is looking at future growth in a number of new areas. Although the company’s market share decreased from 98 percent in 2005 to 75 percent in 2006, Campos looks toward new international partnerships to fuel growth of its high-tech products. “Brazil produced 2.5 million cars in 2005 and 2.6 million in 2006, so the market is growing slowly, even though our share decreased a bit because of increased competition. Every year cars are cheaper and auto makers are more picky about OEMs. So we are promoting all of our flex-fuel technology internationally. Even in the United States, vehicles are beginning to use flex-fuel technologies.”

The company expects growth of around 8-10 percent in the coming years from exports. But it won’t all be easy. China, for one, poses a great competitive threat. “Recently, China has been consuming all the materials, resins and plastics. They have more capacity to export than we do, so the cost for us is higher than it should be. They are growing quickly and consuming more materials at lower prices. We have to be quick, agile, and inventive because we don’t have the resources that their big companies have.”

Nevertheless, Brazil is in a strong position with its leading ethanol technologies and production. Today, Brazil is nearly 100 percent energy self-sufficient and Ethanol figures greatly into that equation. Brazil is pioneering new Ethanol and mixed-fuel technologies and Indebras is participating with its intelligent fuel measuring devices – technologies that will drive the industry in the coming years.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.