Strategic growth in power equipment manufacturing.

By Beejan Giga, Director | Partner, Carpedia International

And Caleb Emerson, Senior Results Manager, Carpedia International

Growth in the power industry no longer follows a straight path. It’s become a high-stakes chess match, played under time pressure, with unfamiliar pieces. The board keeps shifting. Core materials are unpredictable, supplier prices are climbing, end-users are demanding cuts, and tariffs land like a slap across the face mid-move. Every decision requires sacrifice. Sometimes you need to take two steps sideways before you can take one step forward.

After three decades of relative stability, the industry is grappling with transformation on every front, and there’s no playbook for what comes next.

Transformer manufacturers are under intense pressure to scale production, often by double-digit percentages, in a market where inputs are scarce, prices are rising, and long-term demand is uncertain. But scaling up isn’t just about what’s happening inside the plant. It’s about how well manufacturers understand and plan around their suppliers’ ability to scale with them.

Take a manufacturer that increases annual production from 45 units to 50, then targets 60 the following year. That’s a 33% increase in material demand over two years. Are suppliers prepared for that? More importantly, do they even know it’s coming?

Many companies have spoken of supply chain integration. But what’s emerging now is a deeper form of planning, one that sees business strategy through the lens of the supplier. It’s not just about communicating demand but aligning investment timelines. It takes two to three years to stand up new capacity. You can’t just decide to grow by 15% next year and expect the material to be there when you need it.

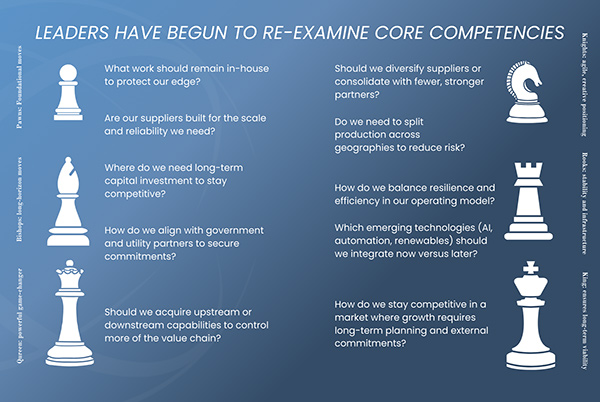

This is pushing CEOs to re-examine core competencies: What work should we keep in-house? What are our suppliers truly built to do? Should we split production between multiple partners? Acquire upstream capabilities? These are no longer fringe strategic questions. They’re central to staying competitive in a market where growth requires long-term capital planning and commitments from government and utility partners.

It’s tempting to meet complexity with headcount.

Some power manufacturers are reacting to the pressure by rapidly expanding their back offices, hoping that increased support staff will stabilize operations. But without a clear understanding of what the workforce actually needs, this can create inefficiency rather than resilience.

At the same time, the industry is wrestling with a genuine shortage of skilled engineering talent. For decades, engineering graduates gravitated toward software and tech. The power sector, then in a period of contraction, was focused on cost containment, not on innovation. It wasn’t as attractive to up-and-coming engineers. Now that demand has roared back, the talent pipeline isn’t keeping up. According to recent IEEE research, as many as four in ten industry leaders expect that the dual pressure of too few workers with the right capabilities and intense competition for those who have them will be one of the toughest obstacles to filling engineering roles in the coming decade (1)

Add in regional challenges, security considerations when sourcing global talent, and questions about interpretation and oversight, and the task becomes even more difficult. There may be thousands of capable engineers worldwide, but if your local teams can’t effectively direct or validate their work, their value can get lost in translation.

The challenge, then, is not just to hire. It’s to understand the capabilities the business actually needs, and where those capabilities need to sit.

There’s another shift happening, one that is less often discussed but just as consequential.

Leadership dynamics in the power industry are evolving. Long governed by long-term relationships and handshake deals, the sector is moving toward a more transactional, performance-driven culture.

A significant portion of North America’s power transformer companies have experienced executive turnover or ownership changes. These shifts are recalibrating expectations around delivery, accountability, and competitive edge.

A wave of generational transitions, acquisitions, and private equity investment is accelerating the shift. Across North America’s broader power industry, mergers and acquisitions were up 113 percent between Q3 2023 and Q3 2024, indicating intense consolidation activity that commonly brings ownership and leadership shifts. (1)

New leaders are taking the helm, and the old “you’re good, so we’ll use you” ethos is giving way to a sharper, more ROI-focused lens, one that sounds more like, “What have you done for me lately?”

This change is exposing a capability gap. Many businesses that have historically succeeded on relationships now find themselves lacking the operational rigor needed to win on performance. It’s about having the systems, people, and processes in place to deliver, consistently and at scale.

There is also a growing awareness both inside and outside the industry of what’s at stake. When a transformer fails, the cost isn’t just measured in repairs. It’s measured in reputational damage, regulatory scrutiny, and public trust.

Extreme weather, aging infrastructure, and surging power demand from EVs and AI-fueled data centers are all straining the grid. These stressors don’t just increase demand for transformers, they shine a spotlight on the companies responsible for producing them.

Some suppliers are concentrating efforts on high-margin data center projects, risking a bifurcation of the market. That work is lucrative now, but the long-term sustainability is unclear. And if transformer providers can’t reliably serve the broader grid, outages will become more frequent, and the industry’s reputation will take the hit.

There’s an urgent need to tighten delivery performance, quality assurance, and strategic alignment across the supply chain. Not just to compete, but to maintain public confidence.

This moment is forcing power industry leaders to ask harder questions: What does growth actually look like for us? What capabilities do we need to own, and which do we need to empower? How do we make our operations not just bigger, but better?

Growth is no longer a binary choice. It’s a spectrum of options, a strategic balancing act that requires clarity, adaptability, and operational strength. It’s not about growing for the sake of growth. It’s about building the ability to deliver, even in uncertain conditions.

And perhaps most critically, it’s about giving your partners — whether suppliers, investors, or employees — a plan they can believe in.

About the Authors:

Beejan Giga is a Director and Partner at Carpedia International, where he leads client engagements that deliver operational and financial improvement across industries such as manufacturing, infrastructure, energy, construction, and transportation. Beejan’s expertise spans improving operational efficiency, strengthening supply chain management, and enhancing capacity planning. He has extensive experience leading complex projects, guiding organizations through post-acquisition integration, and aligning back-office functions to support strategic goals.

Beejan earned his Bachelor of Management and Organizational Studies from Western University and his Master’s in International Business from the Ivey School of Business at Western University.

Caleb Emerson is a Senior Results Manager at Carpedia, a global management consulting firm that helps organizations achieve lasting improvements in performance and profitability. He has led engagements across industries including manufacturing, food production, logistics, and construction, helping leadership teams optimize operations and drive measurable results.

With expertise in business analytics and advanced systems, he also partners with clients exploring integration of AI-enabled tools into their operations. He holds a BA in Business Administration and an MSc in Business Analytics from the Ivey Business School, as well as an MSc in Economics and Business Administration from the Norwegian School of Economics.

Read more:

Resilience Redefined | April 2024

Manufacturing Agility: Adapting to Market Disruptions | March 2024

This article is sponsored by Carpedia.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.