Tax impacts brought on by COVID-19 shutdowns and related COVID-19 stimulus polices makes implementation of changes even more important.

by Ryan Sheehan, Sr. Product Manager Bloomberg Tax & Accounting

For asset-intensive manufacturers, keeping abreast of the latest tax law changes is always critical. However, with a slew of tax impacts brought on by COVID-19 shutdowns and related COVID-19 stimulus polices, the ability to swiftly implement these changes is even more important. As recent market sentiment reveals, increased tech spending suggests that businesses are using automation and advanced technologies to keep pace with workload demands, mitigate COVID-19 impacts and take advantage of stimulus being offered through the CARES Act of 2020, the Bipartisan-Bicameral Omnibus COVID Relief Deal and most recently, The American Rescue Plan Act of 2021.

According to a recent Bloomberg Tax survey, like economic downturns of the past, cash management tops the list of business priorities, followed by workforce changes. Surprisingly, however, Bloomberg Tax found that technology investments – especially in the areas of planning – remain high. A large majority of businesses (91 percent) said they are using or will use tax planning to achieve cash management goals. In addition, 77 percent indicated they will continue to invest in automation technology, and 66 percent will invest in tax software/ERP integration.

During good times, accounting departments may overlook impairment asset testing, but in light of COVID-19, accounting teams should not ignore this important work as it is critical to ensuring the integrity of their company’s balance sheet(s). Examples of potential asset impairments that need to be tested include:

Deferred tax liabilities (DTL) is another area that a typical asset-intensive organization should focus on. Asset-intensive organizations typically have significant deferred tax liabilities resulting from differences in depreciation between generally accepted accounting principles (GAAP) and income tax reporting methods. Consider this common scenario:

Company XYZ has federal tax depreciation of $350 million and GAAP depreciation of $250 million. The difference in depreciation is $100 million. Assuming the tax rate is 21%, the difference in tax is $21 million (21% x $100 million).

Since Section 2307 of the 2020 CARES Act provides a technical correction to the depreciation treatment of qualified improvement property (QIP), this simple calculation is now much more complex. The technical correction assigns a 15-year instead of 39-year recovery period to QIP placed in service after December 31, 2017, making QIP eligible for bonus depreciation.

Assuming Company XYZ has $195 million of QIP.

Post-CARES Act QIP Depreciation: $195,000,000 (100% of $195 million)

Pre-CARES Act QIP Depreciation: $195,000,000 (100% of $195 million)

Depreciation Increase: $195,000,000 (100% of $195 million)

Because of the QIP technical correction, Company XYZ’s $21 million deferred tax liability (DTL) would need to increase to $60.9 million, resulting in a $39.9 million balance sheet increase, and a $39.9 million earnings decrease (i.e. $190 million x 21%). Failing to make this income statement and balance sheet correction could have significant repercussions on financials.

Bloomberg Tax & Accounting’s recent market research suggests that smart tax and accounting teams (especially at asset-intensive manufacturing companies) are turning to advanced technology and automation to stay ahead of pandemic-related tax changes as well as free up staff to focus on key priorities such as DTLs and impairment asset tests. To help these savvy companies with their technology implementation endeavors, we put together a list of our top tips.

In theory, anything can be automated if a decision tree can be mapped out based on criteria within the data. Tasks and processes that have simple decision trees and are frequently repeated are excellent candidates for automation because they reduce the complexity, cost, and risk of failure of an automation project. For example, in the area of fixed assets, asset basis adjustments, capitalization thresholds, asset type mapping, and cost segregation are good starting points for automation.

When you have a long list of tasks to be automated, it can be overwhelming. Try to phrase the tasks as problem statements and prioritize them based on objectives of the business, reduction of risk, and increases in efficiency.

Now that you have a prioritized list of problems to solve, engage with experts on how to solve those problems. There are multiple resources that can help you solve problems, including internal departments such as IT, accounting and finance, and centers of excellence as well as external advisers such as CPA firms and software vendors. Reach out to get estimates of cost and time to automate.

Using a scoring system to assign weights to each problem helps you decide which problem to tackle first. One method of prioritization is called weighted shortest job first (WSJF), which uses benefit/effort to determine what problem/solution mix will give the greatest benefit fastest.

Other prioritization methods besides WSJF exist. There are many resources available on how to think about problem-solving and prioritization. Accountants are used to this way of thinking; however, more focus is often needed on delivering value quickly. Solution providers can help with this.

You have a solid problem that you want to solve, but now you must get buy-in from several stakeholders before proceeding with the implementation. Successful software and automation engagements require multiple departments, such as tax, IT, and accounting, to be aligned. Articulate the objectives of your project by framing the benefits to the business as whole, not just the tax department. Present your roadmap in prioritized order and articulate why it is prioritized in that manner.

During the approval process, it is crucial to set expectations about funding and delivery. If your roadmap is massive, it can be daunting to get budget approval. This is where incremental problem-solving is essential.

Communicate your entire list of problems/solutions to upper management, but seek funding for your highest-priority problem. This reduces the risk of failure to the business and gives you an opportunity to build credibility. “Under promise and overdeliver” is much better than the opposite if you desire future funding.

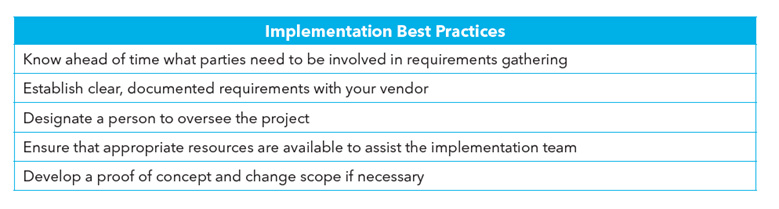

Implementation is very rarely a hands-off process. Communication with your vendors and setting expectations upfront are key to a successful implementation. Proper investment is required, and it is generally not cheap, in time or dollars. Tax departments should consider the following implementation best practices to produce the highest return on their investment.

Establishment of a baseline for measurement should occur during the problem identification stage. Early on, think about how to measure improvement so it can be built into the new process if necessary. Additionally, having metrics of success in place establishes a track record that can be shared with leadership.

Asset-intensive manufacturers have a lot of stake. Covid-related tax changes have only exasperated the cumbersome task of corporate tax compliance, especially in the area fixed asset management. Businesses that take advantage of automation to keep pace with increased workload demands and mitigate COVID-19 impacts are better positioned for a speedy post-Covid recovery. Time saved from task automation means that staff can work on higher-value activities such as optimizing cash tax, scenario modeling, and reducing financial statement and audit risk – all of which are especially important in today’s unpredictable business environment.

Ryan Sheehan, Sr. is Product Manager at Bloomberg Tax & Accounting.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.