Deloitte provides an outlook on what to expect for the manufacturing industry in the year ahead.

By John Coykendall, UUS Industrial Products & Construction Leader, Deloitte

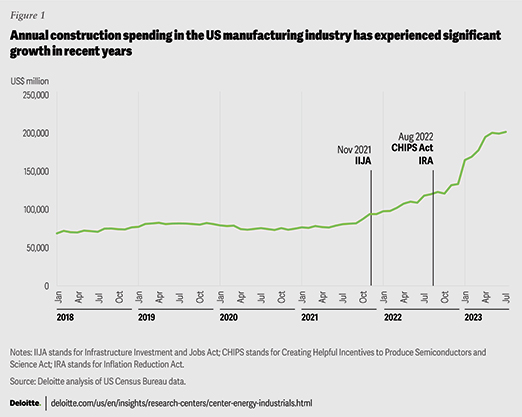

In 2023, the US manufacturing industry capitalized on the momentum generated by three significant pieces of legislation that were signed into law in 2021 and 2022—the Infrastructure Investment and Jobs Act (IIJA), the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, and the Inflation Reduction Act (IRA). By introducing an infusion of funds and tax incentives into US manufacturing across various sectors—including semiconductors, clean energy components, electric vehicles, batteries, and the constituent parts and raw materials of these products—the IIJA, CHIPS, and IRA have already spurred record private sector investment in the manufacturing industry.i

For example, the investments in semiconductor and clean technology manufacturing are nearly double the commitments made for these sectors throughout 2021, and nearly 20 times the amount allocated in 2019.ii Since passage of the IRA, over 220 new clean technology manufacturing facilities have been announced—representing US$100B in investment—which are expected to create nearly 90,000 new jobs.iii There has been a significant increase in construction spending in manufacturing industry after the passage of the IIJA, CHIPS Act, and IRA (figure 1). As of July 2023, annual construction spending in manufacturing stands at US$201 billion, representing a 70% year-over-year increase and setting the stage for further industry growth in 2024.iv

In 2024, manufacturers are expected to face economic uncertainty, the ongoing shortage of skilled labor, lingering and targeted supply chain disruptions, and new challenges spurred by the need for product innovation to meet company-set net-zero emissions goals.

In a recent survey conducted by the National Association of Manufacturers (NAM), almost three-quarters of surveyed manufacturing executives feel that attracting and retaining a quality workforce is their primary business challenge.v

According to Deloitte’s analysis of PMI data over the past year, the average delivery times for production materials peaked at an all-time high of 100 days in July 2022 but have since steadily improved, reaching 79 days in November 2023.vi However, they have not returned to prepandemic levels.

As companies move forward on their journey to electrifying and decarbonizing their product portfolios, new challenges emerge. These challenges include the need to address technical readiness, high initial costs of transitioning production processes, as well as new and complex supply chains for batteries and their crucial rare earth metals.

Technology is poised to play a significant role in supporting manufacturers in taking on the challenges they may face in 2024. A recent Deloitte study indicated that a striking 86% of surveyed manufacturing executives believe that smart factory solutions will be the primary drivers of competitiveness in the next five years.vii

According to the 2023 Deloitte and MLC industrial metaverse study,viii 92% of surveyed manufacturers are already experimenting with or implementing at least one metaverse-related use case. Executives surveyed anticipate an increase of 12% or more in several key performance indicators, including sales, quality, throughput, and labor productivity because of industrial metaverse initiatives. Nearly one-third of respondents are already implementing or experimenting with virtual aftermarket servicesix which can create new and enhanced offerings, such as remote troubleshooting assistance using augmented reality, as well as virtual operation manuals.

Companies are investigating the use of digital tools, such as artificial intelligence, to help to sense the local labor market and generate approaches for marketing jobs to potential employees. Generative AI (GenAI), in particular, is expected to hold immense potential in areas such as product design, aftermarket services, and supply chain management. It could lead to reduced costs across manufacturing organizations and could serve as another tool for navigating a challenging labor market.

Significant investment and growth in the US manufacturing industry is expected to continue in 2024. So, what strategies should manufacturers consider in order to tackle these ongoing challenges, help scale up production, improve competitiveness, and capture the full potential of the record influx of capital into the industry? To help companies begin to answer this question, Deloitte’s 2024 Manufacturing Industry Outlook enumerates on five key trends to consider in the year ahead (Figure 2).

John Coykendall is a vice chair, Deloitte LLP, and the leader of the US Industrial Products & Construction practice. John has more than 25 years of consulting experience focusing on global companies with highly-engineered products in the A&D, Industrial Products and Automotive industries.

John advises senior executives on driving impactful and sustained performance improvement, through both top-line growth and margin improvement initiatives. He has led large-scale transformation efforts to help businesses with strategic cost transformation and operations/supply chain initiatives.

John has an undergraduate degree from Lafayette College in Business & Economics and Government & Law and an MBA from Duke University.

i John Keilman, “America is back in the factory business,” Wall Street Journal, April 8, 2023.

ii Amanda Chu and Oliver Roeder, “US manufacturing commitments double after Biden subsidies launched,” Financial Times, April 16, 2023.

iii Environmental Entrepreneurs, “Clean economy works: Tracking new clean energy projects across United States,” accessed December 13, 2023.

iv Deloitte analysis of US Census Bureau data.

v National Association of Manufacturers (NAM), “NAMs’ outlook survey second quarter 2023,” June 7, 2023.

vi Deloitte analysis of PMI reports.

vii Wellener, Shepley, Dollar, Laaper, Ashton, and Beckoff, “Driving value with smart factory technologies,” Deloitte Insights, September 16, 2019.

viii Wellener, Coykendall, Hardin, Morehouse, and Brousell, “Exploring the industrial metaverse,” Deloitte Insights, September 14, 2023.

ix Ibid.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.