In the realm where 3D printing, cloud technology and traditional manufacturing overlap, one needn’t look far to encounter a litany of trendy buzzwords. “Cloud manufacturing”, “digital twins” and “the omnichain” all promise to revolutionize how manufacturers interact with their supply chains and their customers. Manufacturing-as-a-service (MaaS), another buzzword, may not sound quite as exciting (or original), but it still has powerful ramifications for manufacturers, especially when combined with 3D printing technology.

With MaaS, rather than selling a product to a brand, manufacturers instead contract out the use of their production capabilities as an on-demand service. By utilizing cloud network technology and API integrations, manufacturers are able to provide highly customized parts with rapid turnaround times. The addition of 3D printers into this equation allows for greater levels of customization and shorter lead times due to the printers’ ability to transition between complex jobs with little to no downtime. As a result, traditional manufacturers can either treat the service as an extension of their own manufacturing capabilities or as a virtual inventory of replacement parts for their production machinery. For example, Disney recently teamed up with Shapeways, a 3D printer manufacturer, to offer customers the ability to create their own versions of the Star Wars droid R2-D2 through a Shapeways API, which the company then prints and ships.

Although current 3D printers are much slower than traditional manufacturing, several research organizations are working towards increasing print speeds. Researchers at MIT recently announced their fast fused filament fabrication (FastFFF) printing technology. By reimagining how 3D printer printheads move and how fast material can be melted and forced through the printhead nozzle, the researchers promise printers that are 10 times faster than average.

One firm in the market is promising printers that are not only faster, but cost one-tenth as much as previous options. Boston-based Desktop Metal, a company that has raised $212 million from venture capital firms, recently began shipping what it bills as the first office-friendly metal 3D printing system. Soon, the company will begin shipping a $320,000 version of the printer that is expected to be 100 times faster with 20 times cheaper material costs than existing systems. For comparison, according to ProcurementIQ, the average price for a professional grade large-format FFF 3D printer is $6,500. However, prices for 3D printers range widely. Desktop Metal hopes that its new technology will be used to replace selective laser melting (SLM) systems that can cost over $1 million.

Anticipated advances in speed and capabilities may present some drawbacks for manufacturers that wish to obtain in-house 3D printing capabilities. The newest technologies often carry hefty price premiums, and the rapid pace of technological change can quickly render current equipment obsolete. To solve this problem, companies like Materialise and Shapeways have begun offering MaaS business models. Both companies offer APIs that manufacturers can integrate into their own systems to shorten lead times between the design and delivery of 3D printed products. By utilizing their own fleets of 3D printers, Materialise and Shapeways are able to increase their overall efficiency, thereby lowering costs and absorbing the various risks associated with rapid technological evolution and obsolescence. As a result, these companies have an easier time justifying purchases of newer, faster 3D printers, which gives them an additional competitive edge. Manufacturers then contract these companies to produce 3D printed objects that would otherwise be too expensive to print in-house.

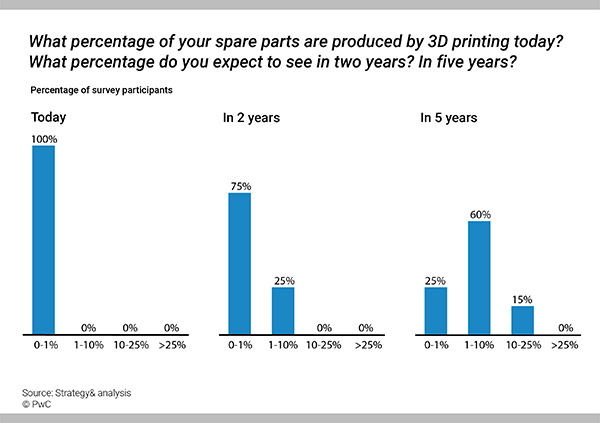

These developments will be a huge boon for traditional manufacturers. With MaaS, manufacturers can keep detailed schematics (“digital twins”) of each machinery part they use, thereby eliminating the need for costly inventory space and long wait times for replacement parts. If a part breaks down or requires replacing, it can quickly be 3D printed on demand by a MaaS provider, shipped and implemented back into the machinery. Thus, a warehouse full of inventory can be shrunk down to the size of a hard drive (or to nothing if the schematics are stored in the cloud), thereby cutting down on inventory space and costs. Manufacturers can also use MaaS to improve the utilization rates of their existing manufacturing lines. Currently, manufacturing utilization in the US sits at about 78%. The other 22% consists of downtime for maintenance or production changeovers. According to a recent PwC report, manufacturers may be able to take advantage of 3D printers’ higher utilization rates and boost their own utilization to upwards of 85% by offloading certain portions of their production (such as for setup-heavy parts with more complex geometries) to 3D printing technology.

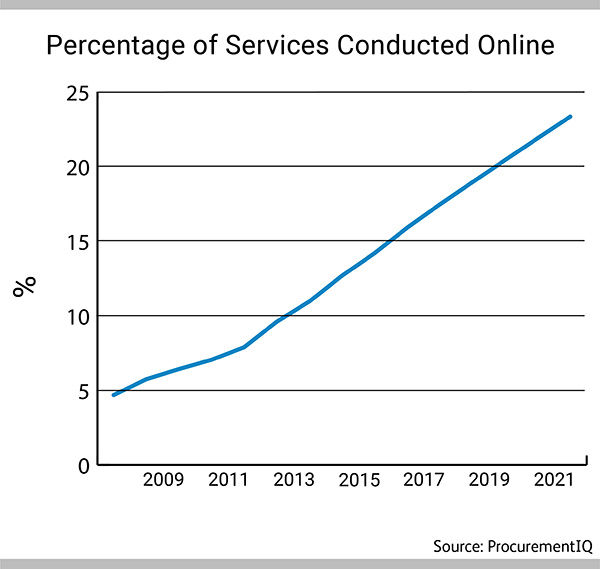

MaaS will not rely solely on 3D printer innovation to reach its full potential. The more that manufacturers are able to collect and communicate real-time insights into the status of their equipment, the more MaaS will make sense from a technological standpoint. To that end, the percentage of services conducted online is an important metric to watch in order to gauge overall progress. ProcurementIQ estimates that over the three years to 2021, the percentage of services conducted online will grow by 4.4 percentage points to 21.9%. As services continue to transition online, manufacturers will become more comfortable using integrated on-demand services to augment their manufacturing capabilities. Furthermore, 3D printer innovation will continue to play a role in facilitating MaaS to ease that transition.

About the Author

About the Author

Ben Kempenich is a business research analyst for ProcurementIQ, formally IBISWorld Procurement, specializing in electronic equipment markets. He holds an MBA in finance from the University of California, Irvine. The research featured in this article can be found at procurementiq.com.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.