Boat Trader’s recent survey results show private boat sellers plan to increase their spending in the recreational boating industry.

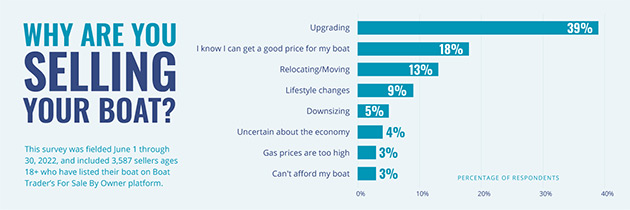

MIAMI, Fla. — Even with surging prices at the pump and inflation rates hitting a 40-year high, private boat sellers are optimistic about the overall boat market and plan to increase their spending in the recreational boating industry. In a new survey conducted by Boat Trader, America’s largest boating marketplace, 39% of sellers on its For Sale By Owner (FSBO) platform reported that they are listing with the intention of a vessel upgrade and 18% stated they expect to sell their boat for a considerable amount. [1]

The turbulent economy has most Americans (82%) worried about rising inflation worsening over the next 12 months, according to a recent study by Allianz Life. [2] Boat dealers have also voiced concern about the current economic environment, the significant increase in vessel prices and how those factors will affect sales, as noted in a Pulse Report survey conducted by Baird Research. [3]

However, Boat Trader’s private seller survey results convey boaters are not necessarily leaving their on-the-water lifestyle and are less unsettled by a looming recession. Only one in 25 respondents (4%) said economic uncertainty was a reason for selling their vessel, while a mere 3% are selling due to high gas prices.

“As we look towards the future and overall health of the boating industry, the number of boat owners expressing their desire to upgrade is a sign that we are successfully retaining boaters after the 2020 surge,” said Courtney Chalmers, Vice President of Marketing, Boat Trader. “Private sellers are very much aware of the current boat market conditions and it’s exciting to see their commitment to a lifestyle on the water has sustained.”

Boat values soared to a record high during the pandemic, with the average global boat value 29% higher than pre-pandemic levels. [4] Despite the higher-than-expected price tag during the boating boom, only 3% of survey respondents reported selling because they could not afford their boat. Of the more than 3,500 private sellers surveyed, 5% said they plan to downsize.

Unexpected lifestyle and health changes were also reasons for sellers to offload their vessels. Respondents also reported relocating or moving factored into their decision to sell.

Boat Trader’s survey also found that among the 434 boat brands listed by private sellers, Bayliner, Boston Whaler, Chaparral, Sea Ray and Yamaha were the most popular, and nearly half of the boats listed were models newer than 10 years. The top five states with the most boats listed for sale by a private seller were California, Florida, Michigan, New York and Texas.

“The pandemic-driven rush to boating pushed the industry to focus on retention,” said Chalmers. “Based on our survey findings and marketplace data, high prices and inventory shortage haven’t deterred boat buyers. More private sellers are also listing their boats for sale as inventory levels begin to normalize, with listings up by 65 percent during the summer boating season compared to last year. We’re heading in the right direction, which is a positive sign for the long-term health of the boating industry.”

About Boat Trader

Boat Trader is the largest online boating marketplace in the United States, creating simple solutions for anyone looking to buy or sell a boat. Founded in 1991, Boat Trader expanded from a weekly classifieds publication found in local markets nationwide to an online marketplace in 1996 and now offers boat dealers and private party sellers comprehensive options for selling their boats online with ease. Boat Trader reaches more than 9 million online boat shoppers and delivers over 170,000 leads each month to its sellers. Boat Trader is based in Miami, FL, and is owned and operated by Boats Group. For more information and to experience the marine industry’s leading classifieds marketplace, visit www.boattrader.com or download the Boat Trader app on the iOS App Store and Google Play.

1 This survey was fielded June 1 through 30, 2022, and included 3,587 sellers ages 18+ who have listed their boat on Boat Trader’s For Sale By Owner platform.

2 2022 2Q Quarterly Market Perceptions Study* from Allianz Life Insurance Company of North America (Allianz Life) and covered by CNBC.

3 Pulse Report survey conducted by Baird Research in conjunction with the Marine Retailers Association of the Americas and Soundings Trade Only.

4 2022 Boats Group Midyear Market Index published August 1, 2022. The 2022 Boats Group Midyear Market Index is a midyear overview of national and international boat For more information, visit www.boatsgroup.com/news.

Media Contact:

Rachael Lobeck | Boats Group | press@boats.com

This release contains disclosures that are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts and can be identified by the use of words such as “may,” “will,” “expect,” “project,” “estimate,” “anticipate,” “plan,” “believe,” “potential,” “should,” “continue” or the negative versions of those words or other comparable words. These forward-looking statements are based upon Boats Group’s current plans or expectations and are subject to a number of uncertainties and risks.

These statements are not guarantees of future performance, and Boats Group has no specific intention to update these statements. As a consequence, current plans, and anticipated actions may differ from those expressed in any forward-looking statements made by Boats Group or on Boats Group’s behalf.

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.