As fleets continue to face parts and labor shortages as recessionary pressure mounts, here’s what teams can expect in the new year.

In 2022, we saw the transportation industry in flux. Staffing needs are continually challenged by a tight labor market. High fuel costs are forcing searches for new sources of efficiency. On top of that, Americas Commercial Transportation (ACT) Research has forecasted a recession in 2023, meaning less funds will be available to allocate toward maintenance.

It’s no secret – as these issues come head-to-head in 2023, fleet maintenance teams are about to feel increased pressure to keep their current fleets healthy with limited resources. Here are three trends we’re likely to see in the new year as maintenance teams adapt to the pressure.

Preventative Maintenance (PM) Cycles Will Get Tighter. Most fleets have extended their trade cycles to combat the challenges facing the industry. According to this year’s Benchmark Report by the National Private Trucking Council, private fleets report being forced to extend these cycles due to supply chain issues delaying new parts and vehicles. While this situation may improve in 2023, budgets are tightening in response to mounting recessionary concerns and many fleets won’t be able to afford to replace old trucks. It will be up to maintenance teams to keep aging vehicles on the road.

As trucks are leveraged beyond prime years, the standard PM cycles suggested by OEMs, or even those more personalized intervals that worked in years prior, aren’t going to cut it. Fleet managers should use the remainder of 2022 to assess their current fleet assets and plan accordingly. Maintenance may need to be performed more regularly than on new vehicles to effectively prevent roadside breakdowns. Seasonal- and mileage-based parameters likely need to shift as well to ensure assets are optimized and ready for duty.

Once fleets make the appropriate adjustments to their PM cycles and understand they can save money and time with a more proactive strategy, it’s likely we’ll see shorter PM cycles become commonplace — even when parts become readily available and the economy balances out.

Mergers & Acquisitions Will Become More Frequent. Given the rough economic environment, the strong will get stronger—and the weak are vulnerable. Companies with the available financial resources will look to overcome their own lack of vehicles by gaining them through acquisition.

Several secondary issues will arise due to this trend. First, acquired companies and their employees will have to prove themselves under new ownership; they will have to quickly adapt to new systems and new ways of working. Second will be the challenge of integrating technologies, as acquisition inevitably creates a lack of cohesion between existing and new fleets.

While merging technologies is major task, workflows, standards and personnel are also affected during an acquisition. Quick alignment of data and support systems will be critical to success.

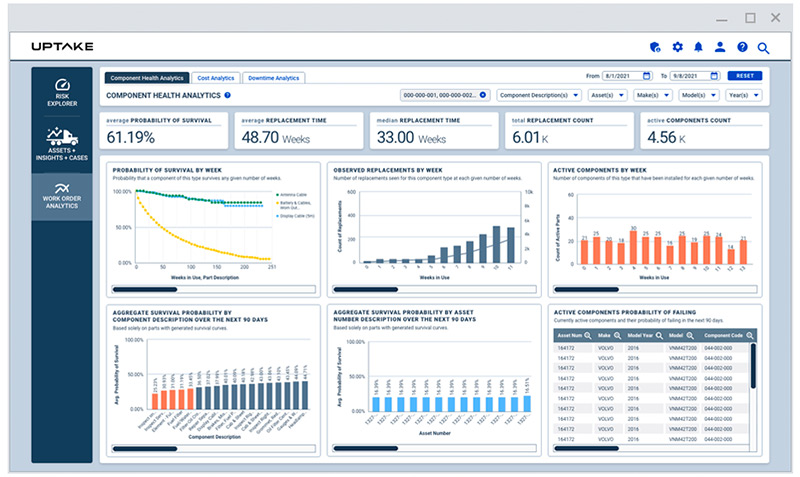

Data and Analytics Will Move To The Front Lines. With all the data immediately available to fleet technicians, schedulers, and managers, the time has come to embrace it. Too many organizations allow their data to sit idle– and while many employees don’t know how to easily generate insights, this will soon change.

By leveraging work order analytics, for example, frontline managers can make their jobs easier and more effective in new ways. It gives maintenance teams a historical view of their fleet’s work orders to help identify trends – like the time of year they see more unplanned maintenance in their fleet due to inclement weather – and plan accordingly. Likewise, if fleet managers look at their work order analytics and notice their aging fleet is seeing an uptick in unplanned shop visits, they can shorten their preventative maintenance cycles to catch catastrophic failures before they occur.

In the past, work order analytics seemed too time-consuming and nebulous for front-line maintenance organizations. Competitive and economic pressures, however, will compel maintenance to finally embrace these analytics platforms. What they will find is that the systems are faster, easier to use, and far more valuable than they expected.

Leveraging both human and informational assets will be vital to fleets’ success in the coming year. The lesson here is to not be afraid of embracing the unknown. Maintenance teams can often be set in their ways—but this is no time for timidness. With the right mindset, fleet managers, technicians, and drivers can tackle the trends coming in 2023 head on.

Jim Rice is Vice President of Transportation for Uptake, a leader in industrial intelligence.

In this episode, I sat down with Beejan Giga, Director | Partner and Caleb Emerson, Senior Results Manager at Carpedia International. We discussed the insights behind their recent Industry Today article, “Thinking Three Moves Ahead” and together we explored how manufacturers can plan more strategically, align with their suppliers, and build the operational discipline needed to support intentional, sustainable growth. It was a conversation packed with practical perspectives on navigating a fast-changing industry landscape.