Russia’s invasion of Ukraine has accelerated the push for energy independence as a measure of national security.

By Jeffrey Whittle, Womble Bond Dickinson (US) LLP

If the past three years have taught us anything, it is that the world is interconnected at a level few of us truly realized before the COVID-19 pandemic. A relatively minor event in one market can have ripple effects halfway around the world. And a major international event—such as the ongoing war in Ukraine—can drastically reshape global economies.

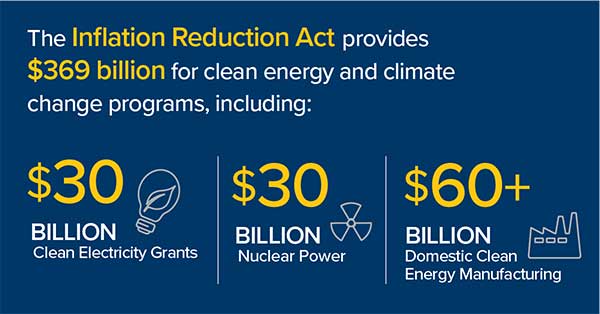

Even before the war began in February 2022, the U.S. and most other Western nations had made climate change and clean energy a priority. The Inflation Reduction Act, signed into law in August 2022, provides $369 billion across a wide range of programs designed to promote clean energy and reduce carbon emissions. But the war, disrupted supply chains and forced European nations that previously relied on Russia for fossil fuels to seek alternative sources of oil and gas

Combined, these and other market factors are accelerating a global shift to clean, renewable forms of energy.

When Russia invaded neighboring Ukraine, many observers believed that would be just a matter of weeks or even days before Russia conquered its much smaller neighbor. Instead, the Ukrainian military, armed with inspiring courage and significant material support from the West, have more than held their own, inflicting enormous losses on the invading army and retaking much of the land initially seized by the Russians.

Still, the war’s end remains sadly distant. The Russians still have hundreds of thousands of troops in the field and have entrenched themselves in the Ukraine’s eastern and southern regions. Completely ousting the invading force may not be possible, at least in the short term. The bloody conflict seems likely to drag on for many more months to come.

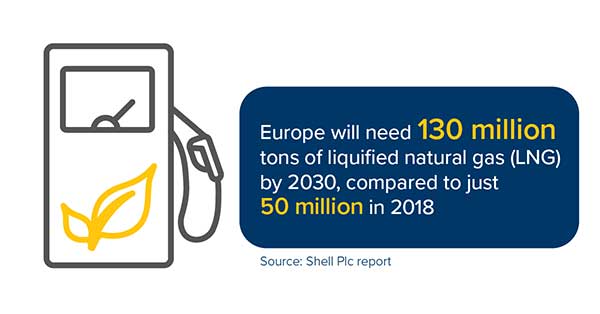

It has become obvious that a return to the pre-Feb. 2022 normal, in which Russia supplied nearly 40 percent of Europe’s natural gas, is not going to happen. Liquefied natural gas (LNG) has become a particularly desirable commodity in part because of necessity. It does burn cleaner than traditional fossil fuels. It also fills the gap left by the lack of Russian supply. It can be shipped great distances and across oceans far more easily than any alternative.

Europe’s demand for LNG has spiked in the year since the war began. A new report by Shell Plc estimates that Europe will need 130 million tons of LNG by 2030, compared to just 50 million in 2018.

Both Europe and the U.S. also continue to invest in and develop green energy resources, such as solar and offshore wind, as well as carbon capture technology. But LNG offers a short- and medium-term solution as an immediate transition fuel source for economies wanting to reduce their carbon footprint while still providing consumers with ample energy.

Germany currently is having an intense public debate about the future of three nuclear power plants. The plants initially had been scheduled to close at the end of 2022. But that deadline was extended until mid-April 2023 due to energy concerns related to the Russia-Ukraine war.

The conflict has had an impact on energy markets outside of Europe as well. In Nov. 2022, China negotiated a massive, 27-year agreement for Qatar to supply LNG to China. Chinese officials realized that global forces were driving demand for LNG and wisely locked in a long-term supply chain.

The war in Ukraine came at a time when the U.S. federal government already had ambitious plans for clean energy adoption and greenhouse gas emissions reductions.

The 2022 Inflation Reduction Act represents the largest federal investment in clean energy in U.S. history. The Act’s key provisions include:

The last provision indicates the philosophical shift in decision-making circles. Previously, the transition to clean energy was seen as a global concern to combat the threat of climate change. But the war in Ukraine has driven home that energy stability and secure supply lines are matters of national security.

Leaders in Washington now see the transition to clean, renewable energy as part of the equation (along with domestic oil and gas production) needed to reduce dependence on foreign energy. It is a lesson European nations could have learned painfully this winter had the weather been not been relatively warm. Clean energy already a national trend—the war in Ukraine has accelerated it as a priority.

Jeffrey Whittle has more than 30 years of experience guiding energy sector clients in complex IP and licensing transactions. He is Head of Womble Bond Dickinson’s Global Energy and Natural Resources Industry Sector Team and Managing Partner of the firm’s Houston office.

In this episode, I sat down with Beejan Giga, Director | Partner and Caleb Emerson, Senior Results Manager at Carpedia International. We discussed the insights behind their recent Industry Today article, “Thinking Three Moves Ahead” and together we explored how manufacturers can plan more strategically, align with their suppliers, and build the operational discipline needed to support intentional, sustainable growth. It was a conversation packed with practical perspectives on navigating a fast-changing industry landscape.