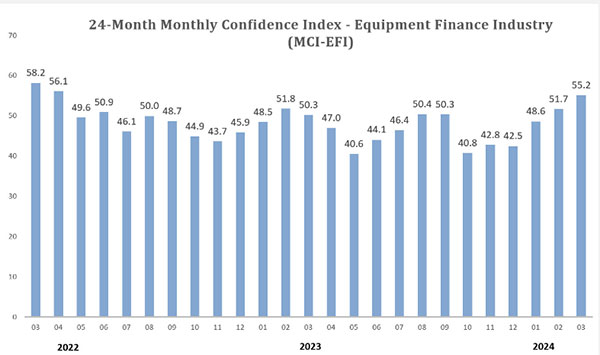

The Foundation’s Monthly Confidence Index for the equipment finance industry is the highest in nearly two years.

Washington, DC – The Equipment Leasing & Finance Foundation (the Foundation) releases the March 2024 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market increased for the third consecutive month to 55.2, up from the February index of 51.7, and the highest level since April 2022.

When asked about the outlook for the future, MCI-EFI survey respondent Keith Smith, President, Equipment & Franchise Finance, Star Hill Financial LLC, said, “Supply chain and demand seemed to have caught up to each other, we are finally seeing equipment ordered and delivered in real time. This has increased the overall activity in the equipment funding space. My biggest concern is the volatility the financial markets, specifically the health of mid-market/regional banks. Historically these institutions have been the backbone of funding in the equipment finance industry, and right now even the deposit-healthy institutions are slowing their lending due to regulatory concerns.”

March 2024 Survey Results:

The overall MCI-EFI is 55.2, an increase from the February index of 51.7.

March 2024 MCI-EFI Survey Comments from Industry Executive Leadership:

Bank, Small Ticket

“The borrowers that have navigated through the uncertain economic conditions and higher rates should emerge even stronger as the economy strengthens.” Charles Jones, Senior Vice President, 1st Equipment Finance, Inc. (FNCB Bank)

“I continue to think that 2024 will be a solid growth year for Wintrust Specialty Finance. The year has started off strong with new business originations at double-digit increases over the same period in 2023. Application volume continues to be strong while approval rates are lower due to lower credit quality we are seeing in the market. Portfolio performance remains heightened from recent years and still performing favorably to historic averages. It is important to remain focused on quality and portfolio performance as we wade our way through the transition in the economy.” David Normandin, President and Chief Executive Officer, Wintrust Specialty Finance

Bank, Middle Ticket

“The normalization of income in the grains and oilseeds sector of production agriculture has the potential to increase demand for financing. It will also increase credit risk, albeit from exceptionally strong levels.” Jason Lueders, President, Farm Credit Leasing

Captive, Small Ticket

“Inventories are returning to pre-COVID levels and end users need to replace older equipment they were forced to keep in service. A stabilizing rate environment and an election coming up could make 2024 a very good year.” Jim DeFrank, EVP and Chief Operating Officer, Isuzu Finance of America, Inc.

Independent, Large Ticket

“I expect conditions to remain stable for the balance of the year due to the upcoming election and the anticipation for interest rates to decrease.” Jonathan Albin, Chief Operating Officer, Nexseer Capital

Independent, Small Ticket

“The net jobs growth is now relatively weak and there are fewer job openings. The Fed may have, or is near, achieving a ‘soft’ landing with the economy.” James D. Jenks, CEO, Global Finance and Leasing Services, LLC

ABOUT THE MCI

Why an MCI-EFI?

Confidence in the U.S. economy and the capital markets is a critical driver to the equipment finance industry. Throughout history, when confidence increases, consumers and businesses are more apt to acquire more consumer goods, equipment, and durables, and invest at prevailing prices. When confidence decreases, spending and risk-taking tend to fall. Investors are said to be confident when the news about the future is good and stock prices are rising.

Who participates in the MCI-EFI?

The respondents are comprised of a wide cross-section of industry executives, including large-ticket, middle-market and small-ticket banks, independents, and captive equipment finance companies. The MCI-EFI uses the same pool of 50 organization leaders to respond monthly to ensure the survey’s integrity. Since the same organizations provide the data from month to month, the results constitute a consistent barometer of the industry’s confidence.

How is the MCI-EFI designed?

The survey consists of seven questions and an area for comments, asking the respondents’ opinions about the following:

How may I access the MCI-EFI?

Survey results are posted on the Foundation website, https://www.leasefoundation.org/industry-resources/monthly-confidence-index/, included in the Foundation Forecast eNewsletter, and included in press releases. Survey respondent demographics and additional information about the MCI are also available at the link above.

JOIN THE CONVERSATION

X: https://twitter.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector—and its people—forward through industry-specific knowledge, intelligence, and student talent development programs that contribute to industry innovation, individual careers, and the advancement of the equipment leasing and finance industry. The Foundation is funded through charitable individual and corporate donations. Learn more at www.leasefoundation.org

Media Contact: Kelli Nienaber, knienaber@leasefoundation.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.