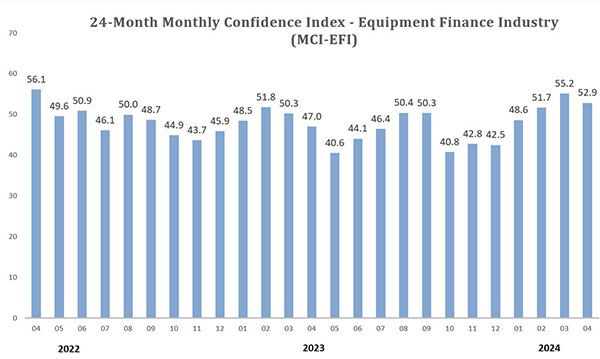

Confidence in the equipment finance market is 52.9 in April, the second highest index in the last two years.

Washington, DC – The Equipment Leasing & Finance Foundation (the Foundation) releases the April 2024 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 52.9, the second highest index in the last two years after last month’s index of 55.2.

When asked about the outlook for the future, MCI-EFI survey respondent Mark Bonanno, President and Chief Operating Officer, North Mill Equipment Finance, said, “Monetary policy has not been as effective in taming inflation that recently came in at an annual rate of 3.2%. The U.S. government as well as the consumer (via credit cards) have unsustainable debt levels, and that will eventually cause cracks in the economy.”

The overall MCI-EFI is 52.9, a decrease from the March index of 55.2.

Bank, Middle Ticket

“Our business is focused on agriculture and rural America. In many cases, ag producer profitability is down or expected to be down compared to the levels of recent years. This situation could make the cash flow and liquidity preservation benefits of a lease more attractive and valuable than they have been. The offset is that credit quality may be more of a challenge, but we expect it to remain quite manageable.” Jason Lueders, President, Farm Credit Leasing

Independent, Small Ticket

“The overspending by the Federal government is contributing greatly to driving up inflation.” James D. Jenks, CEO, Global Finance and Leasing Services, LLC

How may I access the MCI-EFI?

Survey results are posted on the Foundation website, https://www.leasefoundation.org/industry-resources/monthly-confidence-index/. Details about the MCI, including who participates, how it’s designed, and the survey respondent demographics are also available at the link above.

JOIN THE CONVERSATION

X: https://twitter.com/LeaseFoundation

LinkedIn: https://www.linkedin.com/company/10989281/

Vimeo: https://vimeo.com/elffchannel

ABOUT THE FOUNDATION

The Equipment Leasing & Finance Foundation is a 501c3 non-profit organization that propels the equipment finance sector—and its people—forward through industry-specific knowledge, intelligence, and student talent development programs that contribute to industry innovation, individual careers, and the advancement of the equipment leasing and finance industry. The Foundation is funded through charitable individual and corporate donations. Learn more at www.leasefoundation.org

Media Contact: Kelli Nienaber, knienaber@leasefoundation.org

Scott Ellyson, CEO of East West Manufacturing, brings decades of global manufacturing and supply chain leadership to the conversation. In this episode, he shares practical insights on scaling operations, navigating complexity, and building resilient manufacturing networks in an increasingly connected world.